"Insurance Policy Loans as 'Urgent Funds' Increase the Most

Delinquency and Non-Performing Loan Ratios Also Rise

Mortgage Loans, Non-Mortgage Loans, and SMEs All Increase"

[Image source=Yonhap News]

[Image source=Yonhap News]

The delinquency rate on household loans by insurance companies in the first half of the year nearly doubled compared to the same period last year. The ratio of non-performing loans (loans classified as substandard or below) in corporate loans more than doubled. Given the ongoing economic uncertainty, there is an analysis that stronger efforts are needed to manage soundness.

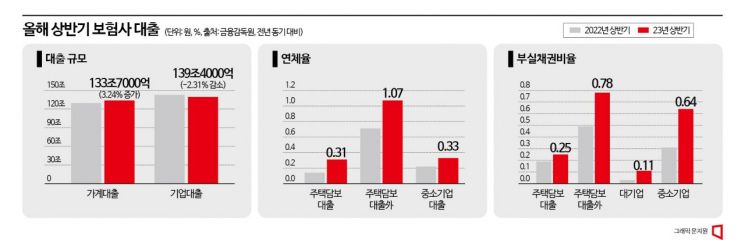

According to the "Status of Insurance Company Loan Claims as of the End of June 2023" released by the Financial Supervisory Service on the 6th, the balance of insurance company loan claims at the end of the first half of this year was KRW 273.1 trillion, an increase of 0.26% (about KRW 700 billion) compared to the same period last year. Specifically, household loans increased by 3.24% (KRW 4.2 trillion) to KRW 133.7 trillion compared to the same period last year. This contrasts with corporate loan balances, which decreased by 2.31% (about KRW 3.3 trillion).

Among household loans, insurance policy loans, considered a 'quick cash' means, increased the most. As of the end of the first half, the balance was KRW 68.9 trillion, up 4.87% (about KRW 3.2 trillion) compared to the same period last year. This accounts for 76% of the increase in household loans by insurance companies compared to the same period last year. Insurance policy loans are loans raised using the premiums paid so far as collateral. There is no separate screening, and even if interest payments are overdue, it does not affect credit ratings. They are also not subject to the Debt Service Ratio (DSR) calculation. They are mainly used as 'quick cash' for those with low credit scores who face restrictions in using bank loans or whose cash flow is unstable.

The delinquency rate also increased. As of the first half, the delinquency rate on insurance company loan claims was 0.30%, up 0.12 percentage points from the same period last year. The increase in the delinquency rate for household loans was steeper. It rose by 0.21 percentage points to 0.46%, more than doubling in one year. It also increased by 0.03 percentage points compared to the end of the first quarter. The delinquency rate on corporate loans also rose. It was 0.22%, up 0.07 percentage points from the first half of last year. While there were no delinquencies in large corporate loans, the delinquency rate for small and medium-sized enterprises rose by 0.11 percentage points to 0.33% compared to the same period last year. This appears to be due to the combined effect of a worsening economy and rising interest rates on past loans.

Another notable point is the increase in the ratio of non-performing loans, that is, the ratio of loans classified as substandard or below that are overdue for more than three months. The non-performing loan ratio for all insurance company loans was 0.43% at the end of the first half, double the 0.22% recorded in the first half of last year. It also rose by 0.15 percentage points compared to the end of the first quarter.

Specifically, the non-performing loan ratio for household loans rose from 0.25% in the first half of last year to 0.35% in the first half of this year. In particular, non-performing loans increased in loans other than mortgage loans. The non-performing loan ratio for mortgage loans rose from 0.19% in the first half of last year to 0.25% in the first half of this year, but the non-performing loan ratio for loans excluding mortgage loans was 0.78%, up 0.29% during the same period. A representative from an insurance company explained, "It seems that the demand for quick cash, which was blocked at banks, has extended beyond credit card companies and other credit finance companies to insurance companies," adding, "As loans increased, the delinquency rate naturally increased as well."

The non-performing loan ratio for corporate loans rose even more sharply. It was 0.47% in the first half of this year, up 0.26 percentage points from 0.21% in the first half of last year. Both large corporations (0.03% → 0.11%) and small and medium-sized enterprises (0.31% → 0.64%) saw increases.

A Financial Supervisory Service official said, "We will continuously monitor the soundness indicators of insurance companies in preparation for increased economic volatility such as rising interest rates," and added, "We plan to enhance loss absorption capacity through sufficient provisioning (including reserves) and induce early normalization of non-performing assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.