A new powerhouse in the eco-friendly ship market, 'Methanol,' is emerging as the trend. It is establishing itself as a new alternative, with orders even surpassing those for LNG (liquefied natural gas) powered ships, which had been spotlighted in the carbon-neutral era.

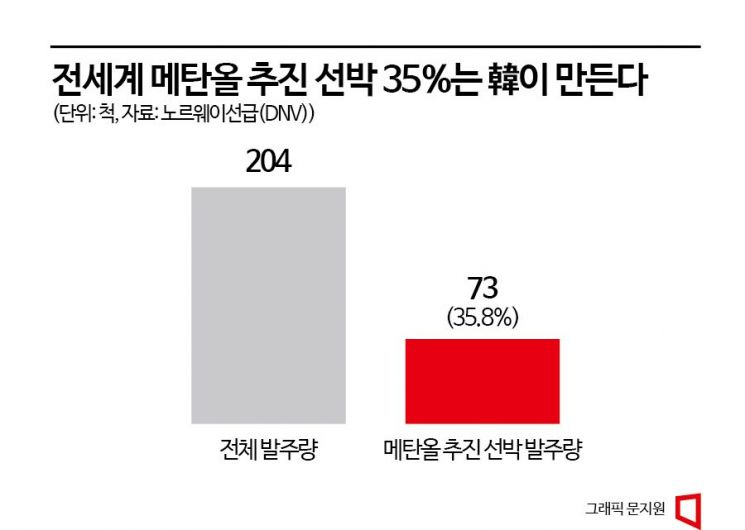

As of July this year, the cumulative global orders for methanol ships (including conversions) stand at 204 vessels. Among these, domestic shipbuilders have secured 73 vessels, accounting for 35.8%. Currently, 27 vessels are operational, and the remaining 177 are scheduled to be delivered to shipowners and commence operation by 2028. By ship type, 143 vessels, or 70.1% of the total, are container ships. When limited to container ships, South Korea’s order share expands to 42.7%. (Source: Norwegian Classification Society (DNV) AFI (Alternative Fuel Insight)) British shipbuilding and shipping market analysis firm Clarkson Research reported that among the 128 dual-fuel ships ordered worldwide in the first half of this year, 80% are capable of using methanol.

The reason methanol-powered ships are gaining attention following LNG is due to the increasingly stringent environmental regulations imposed by the International Maritime Organization (IMO). From this year, all ships over 400 tons must comply with the Energy Efficiency Design Index (EEDI) set by the IMO. EEDI is an index quantifying the amount of carbon dioxide emitted when transporting 1 ton of cargo over 1 nautical mile (1.852 km). Ships that do not meet the IMO’s EEDI allowable values cannot operate. These standards become stricter year by year, and the EEDI Phase 5 regulation, to be implemented from 2050, requires reducing total ship exhaust emissions by more than 50% compared to 2008 levels. Orders for eco-friendly ships are directly linked to the survival of shipping companies.

In particular, shipping companies highly value methanol’s carbon reduction effects. Compared to conventional marine fuels, methanol can reduce sulfur oxides (SOx) by 99%, nitrogen oxides (NOx) by 80%, and greenhouse gases by up to 25%, making it a promising eco-friendly marine fuel following LNG. Until now, methanol faced limitations as a marine fuel due to high production costs and high nitrogen oxide emissions, but with the development of fuel injection technology that reduces nitrogen oxide emissions, it has emerged as the next-generation marine fuel. Unlike LNG, which requires high pressure and cryogenic conditions for storage, methanol can be stored and transported easily at room temperature and normal atmospheric pressure, which is also considered an advantage. Additionally, if released into the ocean, methanol dissolves quickly in water and biodegrades, preventing marine pollution. John MacDonald, Vice President of the U.S. nonprofit classification society ABS, said, "Methanol is a promising solution with many advantages, including ease of storage and handling and the ability to reduce carbon emissions." However, a downside is that ports capable of supplying methanol fuel are still limited. Establishing methanol infrastructure at global hub ports is considered important.

Korean shipbuilders leading the eco-friendly ship market are also significantly increasing their orders for methanol-powered ships. HD Hyundai Heavy Industries secured a total of 43 methanol-powered container ships last year and this year alone, bringing their cumulative methanol-powered ship orders to 55 vessels. Samsung Heavy Industries recently secured 16 methanol-powered container ships of 10,000 TEU (one 20-foot container) capacity for 3.9 trillion KRW, and HJ Heavy Industries also recorded orders for two vessels.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.