The business performance of South Korea's leading semiconductor companies in the first half of this year was found to be poor compared to major U.S. companies. In contrast, the automotive and pharmaceutical/bio sectors achieved better results than companies in the U.S. or Japan.

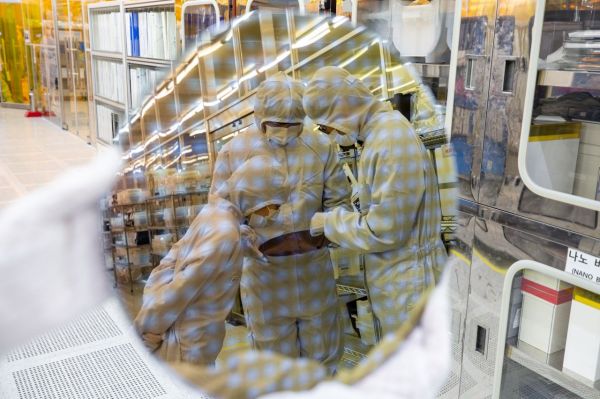

Researchers are conducting semiconductor material and component development research in the 12-inch semiconductor testbed cleanroom at the Daejeon Nano Convergence Technology Institute. It is projected that the global semiconductor shortage will continue until mid-next year. As the local industry in the region, which is implementing strategies to advance the semiconductor ecosystem, faces potential impacts from this trend, attention is focused on the situation, while countries around the world are also rolling out their countermeasures one after another. Our government is accelerating efforts to advance the semiconductor ecosystem. Through the 'K-Semiconductor Strategy Report,' the government envisions a leap to becoming a comprehensive semiconductor powerhouse by 2030 and plans to complete semiconductor localization through massive investments and tax benefits. Having achieved K-quarantine through COVID-19, South Korea is expected to proudly showcase the success of K-Semiconductor in the global semiconductor hegemony competition. /Daejeon=Photo by Kang Jin-hyung aymsdream@

Researchers are conducting semiconductor material and component development research in the 12-inch semiconductor testbed cleanroom at the Daejeon Nano Convergence Technology Institute. It is projected that the global semiconductor shortage will continue until mid-next year. As the local industry in the region, which is implementing strategies to advance the semiconductor ecosystem, faces potential impacts from this trend, attention is focused on the situation, while countries around the world are also rolling out their countermeasures one after another. Our government is accelerating efforts to advance the semiconductor ecosystem. Through the 'K-Semiconductor Strategy Report,' the government envisions a leap to becoming a comprehensive semiconductor powerhouse by 2030 and plans to complete semiconductor localization through massive investments and tax benefits. Having achieved K-quarantine through COVID-19, South Korea is expected to proudly showcase the success of K-Semiconductor in the global semiconductor hegemony competition. /Daejeon=Photo by Kang Jin-hyung aymsdream@

On the 3rd, the Korea Employers Federation revealed this in a report titled 'Comparison of Business Performance of Leading Companies by Industry in Korea, the U.S., and Japan.'

The report compared the first half business performance of Korean semiconductor companies Samsung Electronics and SK Hynix with U.S. companies Intel and Qualcomm. The average sales growth rate of the two Korean companies compared to the same period last year was -36.2%, while the two U.S. companies recorded -23.3%. The average operating profit margin was also negative at -24.8% for Korea, whereas the U.S. recorded 6.0%.

In the case of Taiwan's TSMC, another semiconductor powerhouse, the sales growth rate in the first half of this year was only -3.5%, but the operating profit margin was an impressive 43.8%.

Average Revenue Growth Rate and Operating Profit Margin (%) of Representative Companies by Industry in Korea, the US, and Japan in the First Half of 2023 [Source=Korea Employers Federation]

Average Revenue Growth Rate and Operating Profit Margin (%) of Representative Companies by Industry in Korea, the US, and Japan in the First Half of 2023 [Source=Korea Employers Federation]

The sectors where Korean companies showed strong performance in the first half of this year were automotive, pharmaceutical/bio, and internet services.

The average sales growth rate of Korean automotive companies was 22.4%, higher than the U.S. (16.9%) and Japan (19.4%). The average operating profit margin in Korea was 11.2%, reaching double digits, while the U.S. (5.8%) and Japan (6.8%) remained in single digits. The automotive companies analyzed were Hyundai Motor and Kia for Korea; Ford and General Motors for the U.S.; and Toyota and Honda for Japan, two companies each.

In the pharmaceutical/bio sector, Korea recorded an average sales growth rate of 18%, while the U.S. had -18% and Japan 7.8%. The average operating profit margin was 30.3% for Korea, 19.8% for the U.S., and 6.2% for Japan. The pharmaceutical/bio companies analyzed were Samsung Biologics and Celltrion for Korea; Johnson & Johnson and Pfizer for the U.S.; and Takeda Pharmaceutical and Astellas Pharma for Japan, two companies each.

Ha Sang-woo, head of the Economic Research Department at the Korea Employers Federation, emphasized, "Amid ongoing difficulties due to high interest rates and global supply chain restructuring issues, and growing concerns about low growth, it is necessary to ease regulations that hinder investment and innovation and to further strengthen tax and export support to improve the performance of our companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)