23~27 Years Public Institutions Mid-to-Long-Term Financial Management Plan

Additional 5.1%P Reduction in Debt Ratio of Financial Risk Institutions

The government plans to reduce debt by 42 trillion won by 2026 to secure the financial soundness of 14 public institutions with financial risks, including Korea Electric Power Corporation and Korea Land and Housing Corporation (LH). Through this, the debt ratio of financially risky institutions, which was expected to be 385% this year, is planned to be lowered to 305% by 2026.

On the 1st, the Ministry of Economy and Finance announced that it reported to the National Assembly the "2023-2027 Mid- to Long-term Financial Management Plan for Public Institutions" and the "2023 Revised Plan for Financial Soundness of Financially Risky Institutions," which contain such details.

In June last year, the Ministry designated 14 public institutions as financially risky at the 8th Public Institution Management Committee. The government designated LH, KEPCO, the five power generation companies (Namdong Power, Nambu Power, Dongseo Power, Seobu Power, Jungbu Power), Korea Hydro & Nuclear Power, and Korea District Heating Corporation as institutions showing signs of deteriorating business profitability. Additionally, Korea Gas Corporation, Korea National Oil Corporation, Korea Mine Reclamation Corporation, Korea Coal Corporation, and Korea Railroad Corporation were designated as institutions with overall weak financial structures.

The government will promote financial soundness worth 42.2 trillion won over the next five years (2022-2026) for the 14 financially risky institutions. This figure adds 8.1 trillion won of last year's financial soundness achievements to the previously established target of 34.1 trillion won. Specifically, it plans to pursue △asset sales of 7.5 trillion won △business adjustments of 15.7 trillion won △management efficiency improvements of 6.8 trillion won △revenue expansion of 1.4 trillion won △capital expansion of 10.7 trillion won.

The government projected that the debt ratio of the 14 financially risky institutions will decrease from 310.2% in 2026 to 305.1%, a further reduction of 5.1 percentage points through this year's revised financial soundness plan. In particular, excluding KEPCO and Korea Gas Corporation, which accounted for 38.9% (245 trillion won) of the total debt last year due to the sharp rise in energy prices, the debt ratio is expected to be stably managed at around 151.1% in 2027.

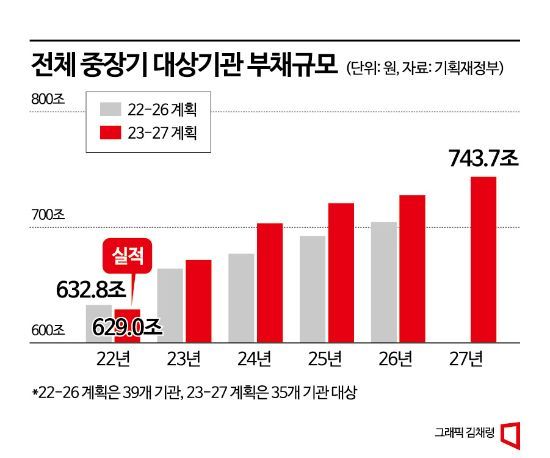

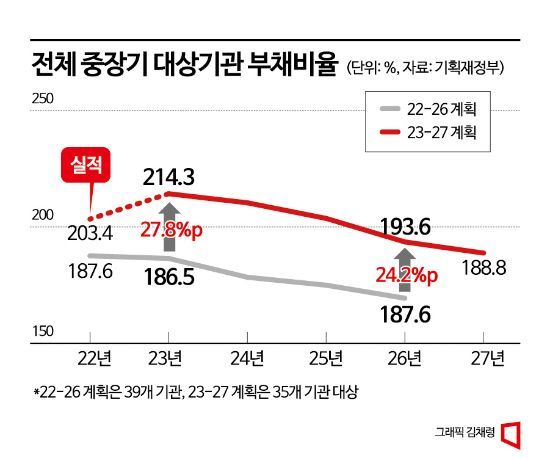

Between 2023 and 2027, the assets of 35 public institutions subject to mid- to long-term financial management are estimated to increase by 152.6 trillion won to 1,137.7 trillion won. It is expected that assets will increase by 79.5 trillion won mainly due to expanded public (rental) housing supply centered on LH and the Korea Expressway Corporation, and by 25.8 trillion won due to expansion of transmission and distribution facilities and nuclear power plant construction. Although debt is expected to increase by 72 trillion won to 743.7 trillion won in 2027, the debt ratio is projected to fall by 25.5 percentage points from 214.3% this year to 188.8% in 2027 due to the revised financial soundness plan.

By sector, in social overhead capital (SOC), due to the expansion of public housing supply and other factors, the debt scale in 2027 is expected to increase by 47.1 trillion won to 304 trillion won compared to this year, while the debt ratio is expected to decrease by 6.0 percentage points to 171.9%. In the energy sector, due to KEPCO's accumulated deficits and Korea Gas Corporation's recovery of overdue receivables, the debt scale is expected to be 288.6 trillion won (-9 billion won), and the debt ratio is expected to decrease by 259.7 percentage points to 414.1% during the same period. In the financial sector, due to the expansion of new policy finance, the debt scale is expected to increase by 23 trillion won to 132.5 trillion won, and the debt ratio is expected to increase by 3.1 percentage points to 100.3%.

The net income of these public institutions is expected to record a deficit of 3.1 trillion won this year, an improvement of 9.4 trillion won compared to the previous year, and then achieve an average annual surplus of 8.3 trillion won over the next four years (2024-2027). The interest coverage ratio, which indicates debt repayment ability, is expected to gradually improve from 0.2 times this year to 1.7 times in 2027.

The Ministry of Economy and Finance stated that it will monitor the implementation performance of the financial soundness plans for financially risky institutions semiannually and report the annual performance to the Public Institution Management Committee for continuous management. For institutions other than financially risky ones, it will also periodically check whether self-help efforts are being implemented according to innovation plans and mid- to long-term financial management plans, and especially ensure that essential investments for each institution are carried out without delay by managing monthly investment plans and execution results through investment execution monitoring meetings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)