Analysis of 260 Listed Companies with Estimates from 3+ Firms

Operating Profit Up Only 1.7% Compared to Q3 Last Year

Prolonged Recession Causes Lower-Than-Expected Outlook... Gloomy Forecast for Next Year Too

Domestic major listed companies' earnings in the third quarter of this year are expected to remain at levels similar to last year. Initially, the securities industry anticipated a full-scale earnings rebound starting in the third quarter, but the economic downturn in China and prolonged semiconductor industry sluggishness have delayed the turnaround period. With first-half earnings already halved compared to last year, rather than a 'low in the first half and high in the second half' pattern, there are bleak forecasts that the corporate recession could extend into next year.

Growing Concerns Over Economic Downturn Triggered by China's Real Estate

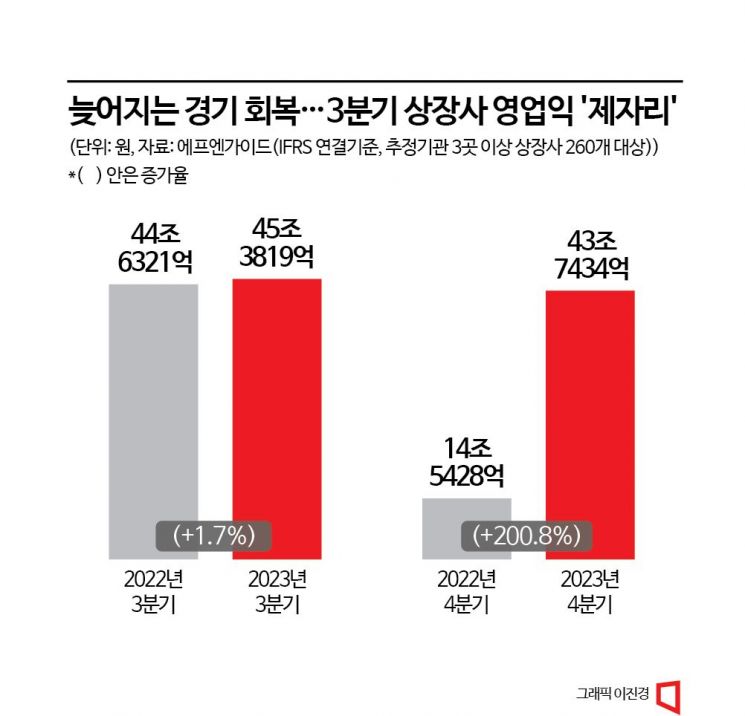

On the 6th, financial information firm FnGuide compiled third-quarter operating profit estimates for 260 listed companies with forecasts from three or more institutions, totaling 45.3819 trillion KRW. Compared to their combined operating profit in the third quarter of last year (44.6321 trillion KRW), this represents only a 1.7% increase, effectively indicating a 'standstill.'

The reasons domestic major companies are struggling to achieve an earnings rebound include China's economic downturn, sluggish exports, and the prolonged semiconductor slump driven by weak IT demand. After China resumed economic activities following a long lockdown due to the COVID-19 pandemic, domestic export companies were hopeful, but the effect was minimal. Recently, concerns over an economic downturn triggered by China's real estate sector have intensified, further expanding external uncertainties. Additionally, politically, as cooperation among South Korea, the U.S., and Japan strengthens, South Korea-China relations have cooled relatively, creating challenging conditions for companies with a high export ratio to China.

According to the Bank of Korea's 'June Balance of Payments (provisional)' released on the 8th, the export volume to China in the first half of this year was $60.18 billion (cumulative), down 26.1% from $81.38 billion in the same period last year. Given the significant risk of China falling into deflation, this trend is expected to continue for the time being. Lee Seung-min, Research Director at Samsung Securities Research Center, explained, "In the mid to long term, China's growth rate is inevitably expected to decline to around 3-4% due to the resolution of excessive debt and oversupply of housing," adding, "The Chinese government is still focusing on 'economic structural reform,' so it remains reluctant to implement stimulus measures to boost the economy."

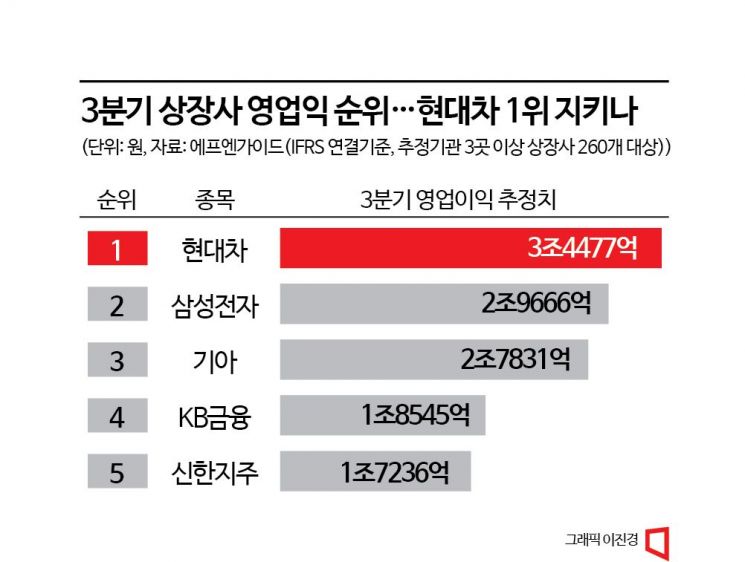

Hyundai Motor Likely to Maintain No.1 Operating Profit Among Listed Companies for Three Consecutive Quarters

The slower-than-expected depletion of semiconductor inventory due to weak IT demand also negatively impacted listed companies' earnings. The third-quarter earnings of major domestic semiconductor giants such as Samsung Electronics and SK Hynix are expected to fall short of initial expectations. At the beginning of the year, Samsung Electronics' third-quarter operating profit was forecasted to exceed 5 trillion KRW. However, according to FnGuide, the latest securities firms' estimates for Samsung Electronics' third-quarter operating profit stand at only 2.9666 trillion KRW. KB Securities initially projected 5.8 trillion KRW in January but lowered it to 2.3 trillion KRW in a mid-month report. Meritz Securities also revised its January forecast from 5.5 trillion KRW down to 1.9 trillion KRW recently.

Despite the global semiconductor market stirring due to strong performance by U.S. company Nvidia, Samsung Electronics' earnings remain sluggish because traditional IT demand for mobile and PC has not recovered. Nvidia dominates the high-performance graphics processing unit (GPU) market primarily used for artificial intelligence (AI), whereas domestic semiconductor companies have a large proportion of memory semiconductors centered on DRAM. According to data released last month by market research firm TrendForce, this year's DRAM bit growth rate is 6.4%, down from the previous forecast of 7.0%. Kim Young-geon, a researcher at Mirae Asset Securities, said, "A rebound in existing demand for mobile, PC, and data centers is still distant," adding, "Due to continued weak smartphone demand in China, a meaningful global demand rebound is delayed." He further noted, "For mobile and PC, the improvement in set (finished product) demand is crucial, and for server DRAM, inventory adjustments in data centers are expected to continue until the end of the year."

Ultimately, due to China's economic downturn and slow recovery in global IT demand, the recovery of Samsung Electronics' semiconductor division earnings is also delayed. Contrary to early-year forecasts, Samsung Electronics' third-quarter earnings are expected to remain in the 2 trillion KRW range, leading to expectations that Hyundai Motor will maintain its 'No.1 operating profit' title once again. According to FnGuide estimates, Hyundai Motor's third-quarter operating profit is 3.4477 trillion KRW, higher than Samsung Electronics. Hyundai Motor recorded the highest operating profit among all domestic listed companies for the first and second quarters consecutively. SK Hynix is estimated to post a loss of 1.7507 trillion KRW in the third quarter, ranking last among all listed companies included in this survey.

Recovery Expected in Q4 vs. Optimistic Outlook Only

However, securities firms foresee a turnaround in the fourth quarter. The estimated operating profit for Q4 is 43.7434 trillion KRW, three times that of the same period last year (14.5428 trillion KRW). The semiconductor industry is expected to have the greatest impact again. Samsung Electronics' fourth-quarter operating profit estimate is 4.396 trillion KRW, surpassing Hyundai Motor's 3.4558 trillion KRW, likely reclaiming the top spot. SK Hynix is also expected to post a loss of 759 billion KRW in Q4, but the deficit is projected to shrink significantly compared to the previous quarter. Im Hye-yoon, a researcher at Hanwha Investment & Securities, said, "Semiconductor prices and volumes have improved for two consecutive months, reflecting a recovery in the semiconductor industry," adding, "The export economy passed its bottom in Q2 and is expected to turn positive year-on-year in Q4."

Nevertheless, concerns remain that this may only be an optimistic outlook from the securities industry. According to a recent report titled 'Recent Trends in the Chinese Economy and the Impact on Our Companies' published by the Korea Chamber of Commerce and Industry, 79% of companies forecast that China's economic downturn will persist. Kim Hyun-soo, head of the Economic Policy Team at the Korea Chamber of Commerce and Industry, suggested, "There is an observation that the recent economic slowdown in China is part of a long-term structural adjustment process such as deleveraging, so it is necessary to consider countermeasures with a long-term perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.