Starting October Next Year, Electric Vehicle Parts Production in the US

Expected Sales of 314 Billion KRW in 2025... Concerns Over Increased Interest Expenses Due to Large-Scale Borrowing

EcoPlastic is investing a large amount of capital to build an electric vehicle (EV) parts factory dedicated to EVs in Georgia, USA. The company plans to raise the necessary funds through loans and capital increases. Once the US factory begins full-scale operations in October next year, it is estimated that the annual sales of the US subsidiary will exceed 300 billion KRW by 2025.

According to the Financial Supervisory Service's electronic disclosure system, EcoPlastic will issue 7 million new shares through a rights offering followed by a general public offering of forfeited shares. The planned issue price per share is 3,890 KRW, raising a total of 27.2 billion KRW. For every one existing share, 0.21 new shares will be allocated. The largest shareholder, Seojin Automotive, plans to subscribe to 100% of the allocated shares using bank loans or its own funds.

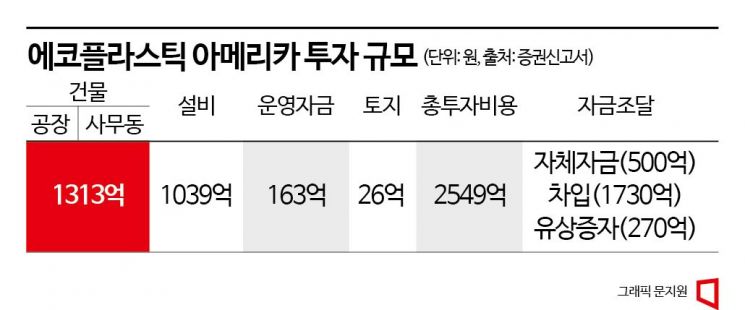

All the raised funds will be invested in 'EcoPlastic America.' The company explained that in line with the US government's strong EV industry promotion policies, it will build an EV parts factory in Georgia with an annual capacity of 300,000 units. The total expected investment amount is 254.9 billion KRW. Of this, 173 billion KRW will be raised through loans, and the remainder will be invested using internal funds and the capital raised through the stock issuance.

Hyundai Motor Company, EcoPlastic's largest customer, has set a goal to complete its dedicated EV factory in the US by 2025. Hyundai has selected EcoPlastic as its partner for entering the US EV market. EcoPlastic supplies 60% of Hyundai's plastic bumpers for the domestic market. Hyundai accounted for 68% of EcoPlastic's sales in the first half of this year.

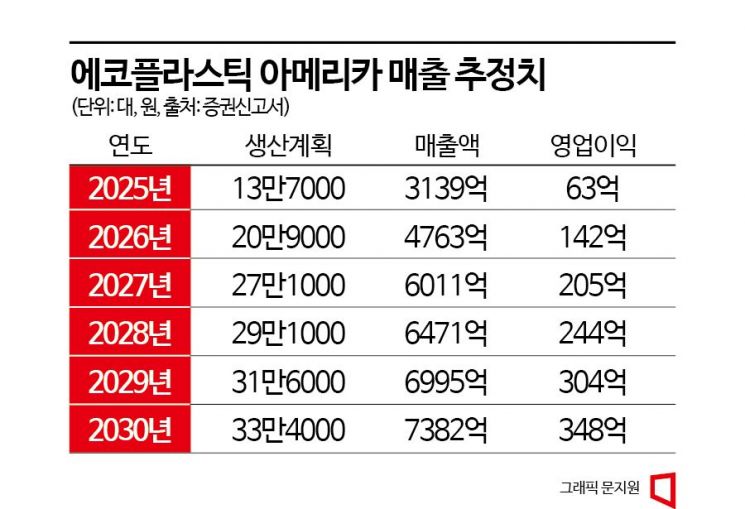

If EcoPlastic completes its investment in the US subsidiary as planned, sales are expected to surge from 2025. The projected sales of the US subsidiary are 313.9 billion KRW in 2025, 476.3 billion KRW, and 601.1 billion KRW thereafter, with expectations to grow into a major affiliate. On a consolidated basis, EcoPlastic recorded sales of 1.0173 trillion KRW in the first half of this year, an 18.2% increase compared to the same period last year. Once EV parts production begins in the US, the sales growth rate is expected to accelerate further.

However, EcoPlastic's large-scale borrowing for investment is considered a risk factor. As of the first half of this year, EcoPlastic's debt ratio reached 407.5%. Total borrowings amount to 280 billion KRW and have steadily increased since 2020. Interest expenses have also been rising, from 8.7 billion KRW in 2020, 8.8 billion KRW in 2021, to 11.1 billion KRW in 2022. Due to the impact of interest rate hikes, interest expenses exceeded 7 billion KRW in the first half of this year. Considering the operating profit of 38.5 billion KRW recorded last year, the interest expense is not insignificant.

EcoPlastic's operating profit margin has been increasing, from 1.0% in 2021, 2.1% in 2022, to 3.5% in the first half of this year. During the same period, the cost of goods sold ratio decreased from 95.8% to 93.4%. Due to the large sales volume, profitability improvements lead to significant profit increases. However, due to the nature of parts manufacturers, it is difficult for profit margins to improve dramatically.

Considering EcoPlastic's profit scale, the risks associated with large-scale borrowing and rising interest expenses are not negligible. However, if Hyundai produces and sells EVs locally in the US as planned, sales and profits will increase, enabling stable growth. EcoPlastic has signed standby underwriting agreements with KB Securities, Shinhan Investment Corp., and others to ensure there are no disruptions in raising investment funds. If forfeited shares occur after the general public offering, a forfeiture fee of 7.0% may be incurred.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)