Rapid Decline in Private Bond Issuance Limit Amid Consecutive Losses

Concerns Over Increased Financial Burden Due to Shortened Debt Structure

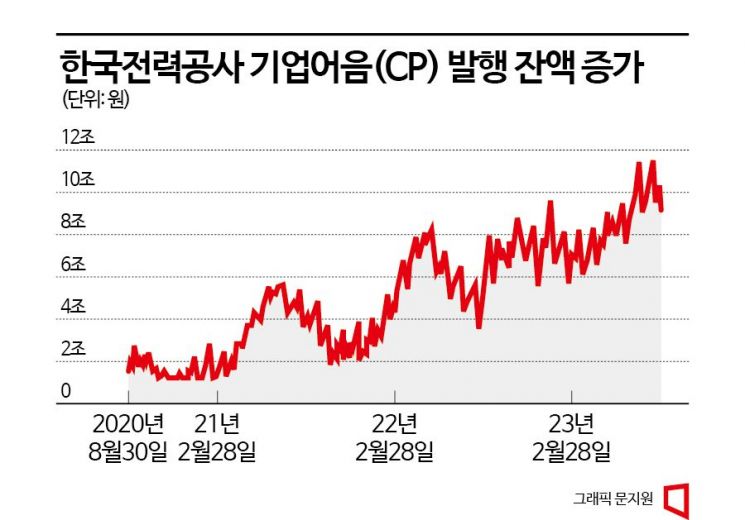

Korea Electric Power Corporation (KEPCO) is rapidly increasing the outstanding balance of commercial paper (CP, including electronic short-term bonds). This is because large-scale KEPCO bond issuance is restricted, leading to CP being used as an alternative funding source. Concerns have been raised that large-scale short-term financing by public enterprises could cause issues such as shortening of the borrowing structure.

According to the bond market on the 31st, KEPCO's outstanding CP balance as of the end of August reached 9.47 trillion won. It steadily increased from the 2 to 3 trillion won level in 2021, surpassing 11 trillion won at one point this year. Although the CP balance fluctuated due to repeated issuance and redemption, the recent average balance has risen to around 10 trillion won.

Despite the increase in the bond issuance limit, there are still many restrictions on bond issuance, which is interpreted as leading to the increase in CP issuance. Following the revision of the Korea Electric Power Corporation Act last year, KEPCO can issue bonds up to five times the sum of its capital and reserves, and up to six times in emergencies, until 2027.

According to KEPCO, the sum of capital and reserves fell from 42.7 trillion won at the end of last year to 17.7 trillion won in the first half of this year. Considering this, the bond issuance limit is 104.5 trillion won. Given that the outstanding bond issuance balance was about 70 trillion won at the end of the first half of this year, there is still room within the limit.

However, due to continuous deficits reducing reserves, KEPCO cannot recklessly increase bond issuance. KEPCO's equity capital (based on separate financial statements), which is linked to reserves, decreased from 53.3 trillion won in 2020 to 22.1 trillion won at the end of last year, and further to 15.9 trillion won in the first half of this year. For this reason, it is analyzed that KEPCO is increasing CP issuance, which is not included in the bond issuance limit.

A bond market official explained, "Due to continuous deficits, KEPCO's bond issuance limit keeps decreasing," adding, "Simply put, a deficit of 1 trillion won reduces the bond issuance limit by 5 to 6 trillion won." The official also said, "Even without additional bond issuance, if the deficit continues, the bond issuance limit can be fully used," and "As long as the deficit structure persists, KEPCO cannot recklessly increase bond issuance."

Concerns that large-scale public bond issuance could negatively impact the bond market are also acting as a constraint on KEPCO bond issuance. There have been ongoing worries that if the issuance volume of public bonds and bank bonds increases, liquidity in the bond market could concentrate on public bonds, causing a sharp rise in funding costs for corporate bonds with relatively lower credit ratings.

There are voices expressing concern about the shortening of the borrowing structure due to the increase in KEPCO's CP issuance. A bond market official said, "CP usually has a maturity of less than three months, so KEPCO has to respond to CP maturities of about 3 to 4 trillion won every month," adding, "If the shortening of the borrowing structure intensifies, it will become another financial burden for KEPCO." The official pointed out, "It is not considered a desirable financial strategy to recklessly increase CP issuance just because it is not included in the bond issuance limit."

There are also concerns that this could negatively affect the short-term funding market. A bond manager at an asset management company said, "Recently, money market fund (MMF) funds, which mainly invest in CP, have increased, so there is no immediate difficulty in absorbing public enterprise CP such as KEPCO's," but warned, "If a liquidity crunch in the short-term funding market recurs as it did last year, public enterprise CP could become a problem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)