Need for Funds to Expand New Businesses like Cloud and AI

Naver Strives to Divest Stakes in Promising Startups like Bucketplace, Futureplay, and Ballan

Kakao Undergoes Organizational Restructuring and Non-Core Business Reorganization Amid Performance Decline

Leading national companies Naver and Kakao are actively securing cash needed for investment in new businesses. Both companies require large-scale investments to expand their cloud and artificial intelligence (AI) ventures but are struggling due to economic downturns and poor subsidiary performance.

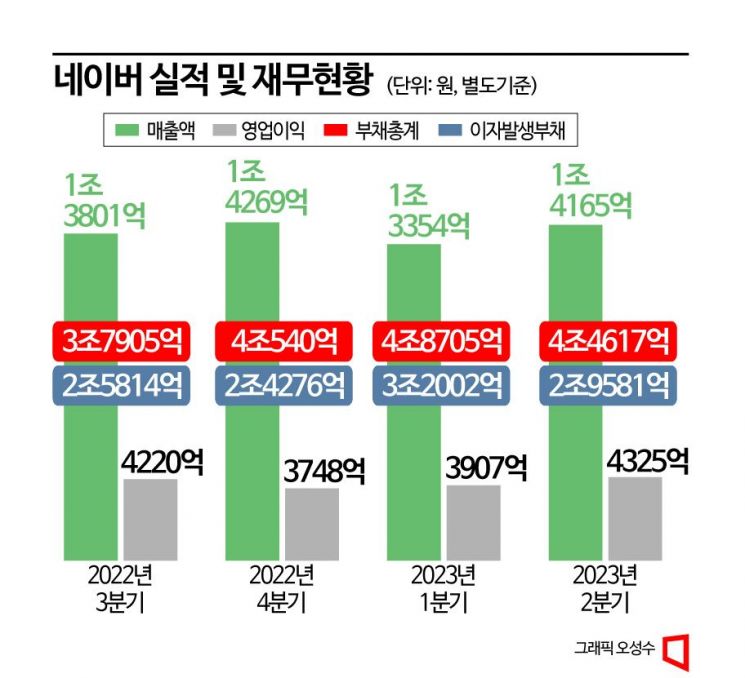

According to the investment banking (IB) industry, Naver's borrowings stood at approximately KRW 4.4 trillion as of the end of Q2 this year. A significant portion of this debt is foreign currency loans for overseas business expansion, along with substantial funding needs for mergers and acquisitions (M&A). In January this year, Naver invested about KRW 1.9 trillion to acquire the U.S. commerce company 'Poshmark.' Of this amount, around KRW 400 billion was financed through internal resources, with the remainder relying on borrowings.

With urgent cash needs, Naver is attempting to secure funds by selling stakes in startups it previously invested in, such as Bucketplace, Futureplay, and Balan. Known as a major player in the venture industry, Naver anticipates that the current IPO market downturn will make it difficult for its invested companies to go public in the short term. Therefore, it is expected to proceed with sequential sales focusing on startups that have demonstrated some growth potential.

Among the individual startups Naver has invested in, Bucketplace, the operator of the popular platform 'Ohouse,' is attracting the most market attention. Despite accumulating losses of up to KRW 100 billion since its founding, Bucketplace maintains a debt-free management structure. Bucketplace has received a total of KRW 313 billion in cash through four rounds of series investments from investors such as IMM Investment, Mirae Asset Venture Investment, and SoftBank. In the most recent Series D round, Bucketplace was valued at KRW 2 trillion. According to the half-year report this year, Naver holds an 11.17% stake in Bucketplace. Simply put, selling 10% of its stake could secure about KRW 200 billion in cash based on the recent valuation.

The luxury goods trading platform Balan was valued at KRW 300 billion during its Series C funding round last year. As of this year's half-year report, Naver holds a 7.98% stake, worth approximately KRW 24 billion.

Startup accelerator Futureplay was valued at KRW 200 billion last year during a pre-IPO equity investment round. Naver owns a 2.02% stake, valued at about KRW 4 billion. An IB industry insider commented, "Naver recently unveiled its generative AI, HyperCLOVA X, but there are concerns that this could shrink the search advertising market, and sustaining growth with existing revenue models may be difficult. Naver is at a stage where it needs to carefully consider its next steps."

Kakao is also making strenuous efforts to raise funds for new business ventures. To secure capital, Kakao is pushing to sell its stake in Starship Entertainment, a subsidiary of Kakao Entertainment. Kakao reportedly seeks a valuation of KRW 1 trillion for Starship Entertainment, applying about 50 times its net income of KRW 19.7 billion last year. Kakao plans to raise up to KRW 100 billion through this stake sale. Due to deteriorating performance of key affiliates such as Kakao Entertainment and Kakao Pay, the company is undergoing restructuring processes including divestment of non-core businesses and organizational reorganization.

Earlier, Kakao Enterprise lent KRW 100 billion as operating funds for severance and consolation payments related to restructuring aimed at shifting to a cloud-centric business, and it is reported that a significant portion of these funds has been used. Although additional funding is needed, Kakao has reportedly failed to secure further investments since the second half of last year.

Kakao has grown through years of mergers and acquisitions (M&A). However, worsening market conditions and losses from subsidiaries have begun to erode the parent company’s performance. Kakao Enterprise recorded an operating loss of KRW 140.6 billion last year, an increase of KRW 50 billion compared to the previous year. Kakao Entertainment also returned to the red after seven years, posting an operating loss of KRW 13.8 billion last year. Hyunyong Kim, a researcher at Yuanta Securities, said, "In the U.S. business where losses deepened in webtoons, marketing efficiency improvements and restructuring have been underway since the end of last year."

At the beginning of the year, Kakao Entertainment secured KRW 1.2 trillion in investments from sovereign wealth funds in Saudi Arabia and Singapore, but spent the entire amount on acquiring SM Entertainment in March. It has sold stakes in subsidiaries Legend Rise and Soundist Entertainment and liquidated Tapas Entertainment’s Korean branch and the Indian webtoon platform Crosscomics. It is expected to further streamline subsidiaries with large deficits. Kakao Entertainment plans to replenish funds through various means such as commercial paper (CP) and corporate bond issuance, external investments, and even an initial public offering (IPO). At the time of investment in January, Kakao Entertainment was valued at about KRW 11 trillion. Along with its parent company Kakao, it is estimated that its valuation has increased further as it became the largest shareholder of SM, which is expected to reach annual sales of KRW 1 trillion this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)