July transaction volume 2,571 cases... 279 cases ↓ compared to June

Price increase after quick sale depletion, impact of financial volatility

Experts "Too early to predict trend change... Need to monitor developments"

The increasing trend in apartment sales volume in Seoul has been broken after 9 months. It is interpreted that the buying momentum has slowed down due to a significant rise in asking prices after the depletion of urgent sale listings and growing financial uncertainties. However, since summer is a seasonal off-season and transaction volumes are increasing in some areas, some analysts say it is too early to see this as a signal of a housing price decline.

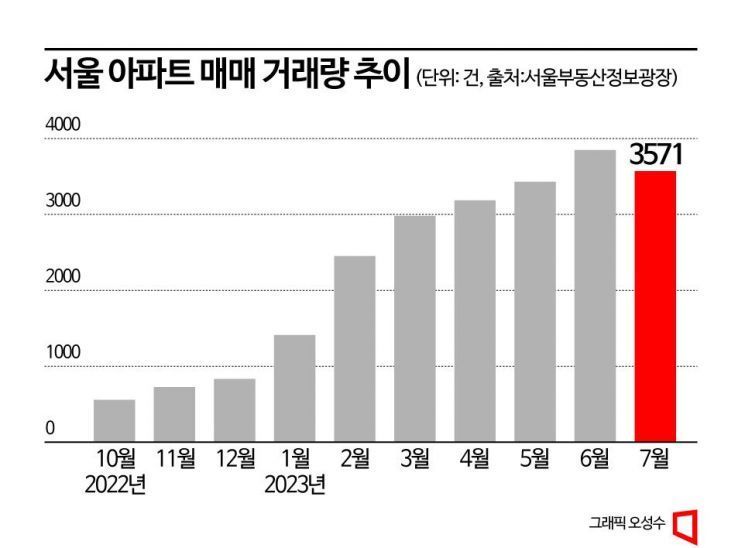

According to the Seoul Real Estate Information Plaza on the 31st, the total apartment sales volume in Seoul in July was 3,571 cases, down 279 cases (7.25%) from June (3,850 cases). This is the first time in 9 months that the transaction volume has decreased compared to the previous month. Since the apartment transaction reporting deadline of the 30th has passed, there is little chance that the transaction volume will change.

The volume of apartment transactions in Seoul has continued to increase since October last year (559 cases), when it experienced a severe transaction cliff due to the US-originated interest rate hikes. After the announcement of large-scale real estate regulation easing in January this year, the volume exceeded 1,000 cases, and in February it surpassed 2,000 cases. In April, it entered the 3,000 range, exceeded 3,800 cases in June, and the achievement of 4,000 cases in July was expected, but it failed to surpass the previous month and slightly declined. Some areas such as Mapo-gu, Seongdong-gu, and Seodaemun-gu continued the upward trend, but the transaction volume in mid-to-low-priced apartment-dense areas with relatively insufficient infrastructure or development prospects, such as Jungnang-gu, Gangbuk-gu, and Gangseo-gu, saw a significant decrease.

The slowdown in Seoul's transaction volume increase seems to be due to the rapid rise in asking prices after the depletion of high-quality urgent sale listings. The sharply increased asking prices can be confirmed through recent actual transaction price trends of representative large complexes. For example, the Helio City in Garak-dong, Songpa-gu, Seoul, with an exclusive area of 84.98㎡, fell to 1.66 billion KRW in November last year but rose to 2.04 billion KRW last month, which is 380 million KRW higher. The Mapo Raemian Prugio in Ahyeon-dong, Mapo-gu, Seoul, with an area of 84.89㎡, jumped from 1.62 billion KRW in December last year to 1.85 billion KRW in August this year, an increase of 230 million KRW in half a year. The actual transaction price of the Dream Forest Harrington Place in Mia-dong, Gangbuk-gu, Seoul, with an area of 84.67㎡, rose from 730 million KRW in March to 879 million KRW in August, which is 149 million KRW higher.

Financial instability, with mortgage interest rates rising again after a quiet period, is also one of the factors causing buyers to hesitate. As of the 28th, the variable mortgage interest rates of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?range from 4.05% to 6.956%, with the upper limit approaching the 7% range. Ham Young-jin, head of the Zigbang Big Data Lab, explained, "It seems that the depletion of urgent sale listings, expanded price burdens, and increased uncertainty about interest rate fluctuations have led to a slowdown in transactions."

However, he pointed out that it is too early to say that the trend of the real estate market, which had been warming up with July's transaction volume, has changed or that a housing price decline is expected. Ham said, "Since summer is a seasonal off-season and even though the transaction volume in July this year decreased compared to the previous month, it is still more than five times that of a year ago (644 cases), so we need to watch the trend in autumn."

He also saw the sharply decreasing supply of new housing as a variable. Ham added, "Since the supply of new housing next year is 15,000 units, which is half of this year's, the possibility of a drop in jeonse prices that support housing prices is low," and added, "There is a possibility that housing prices will rise or remain firm, especially centered on the Gangnam area, which led the market recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.