Life Insurers' Net Profit Up 75% YoY

Accounting Standard Changes Cause Significant 'Optical Illusion'

Non-life Insurers' Net Profit Increases by 55.6%

Insurance companies recorded a net profit exceeding 9 trillion won in the first half of this year. Although this represents an increase of more than 3.5 trillion won compared to the first half of last year, it is difficult to view this as genuine performance growth. This is largely attributed to a significant accounting standard change effect causing an optical illusion.

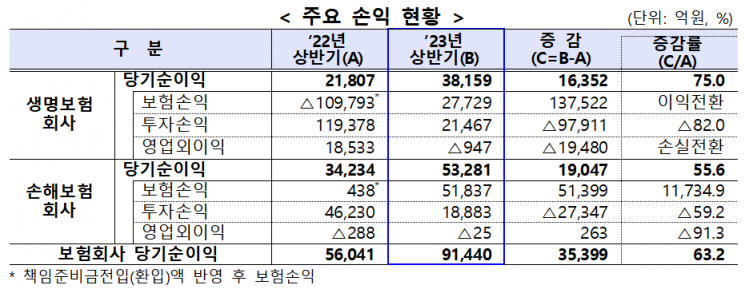

According to the Financial Supervisory Service on the 30th, the net profit of insurance companies (22 life insurers and 31 non-life insurers) in the first half of this year was 9.144 trillion won, an increase of 63.2% (3.5399 trillion won) compared to the same period last year.

The net profit growth rate of life insurers, which had been sluggish, was steeper. It reached 3.8159 trillion won in the first half of this year, up 75.0% (1.6352 trillion won) from the first half of last year. However, both the net profit scale and the increase amount were higher for non-life insurers. Non-life insurers posted a net profit of 5.3281 trillion won, up 55.6% (1.9047 trillion won) from the same period last year.

The Financial Supervisory Service analyzed that the accounting system changes played a major role in the performance growth. First, with the application of IFRS 9, the number of securities whose valuation gains and losses are recognized in current profit and loss increased, leading to higher financial product valuation gains. Additionally, with the introduction of IFRS 17, the deferral period for new contract acquisition costs (expense recognition) was extended (from 7 years to the insurance period), reducing current expenses. Interest expenses on insurance contracts also shifted from insurance profit and loss to investment profit and loss, resulting in increased insurance profit and loss and decreased investment profit and loss. Furthermore, the increase in sales of protection-type insurance favorable to the newly introduced profitability indicator, Contractual Service Margin (CSM), under IFRS 17 also had an impact.

Insurance companies’ revenue equivalent, the earned premium, was recorded at 111.3362 trillion won for the first half of the year. This represents a 7.7% increase compared to the same period last year, driven by increased sales of protection-type insurance.

It also became evident that the improvement in life insurers’ performance is close to an 'optical illusion.' Life insurers’ earned premiums amounted to 52.6266 trillion won, a 4.0% (2.0133 trillion won) increase compared to the same period last year. This is significantly lower than both the increase in life insurers’ net profit and the growth in non-life insurers’ earned premiums. Non-life insurers collected 58.7096 trillion won in premiums in the first half of this year, growing 11.2% (5.9068 trillion won) compared to the same period last year.

Specifically, life insurers saw increases compared to the same period last year in protection-type insurance by 3.4% (806.9 billion won), savings-type insurance by 4.3% (623.3 billion won), and retirement pensions by 33.5% (1.9436 trillion won). However, variable insurance decreased by 20.0% (1.3605 trillion won) due to financial market instability and other factors.

Non-life insurers experienced increases across the board compared to the same period last year: long-term insurance by 3.3% (1.042 trillion won), automobile insurance by 2.5% (265.4 billion won), and general insurance by 8.9% (599.7 billion won). In the case of retirement pensions, the number of people canceling existing contracts and re-enrolling with changed interest rates increased, resulting in a 100.3% (3.9997 trillion won) rise compared to the same period last year.

Meanwhile, as of the first half of this year, insurance companies’ total assets and equity capital were identified as 1,169 trillion won and 167 trillion won, respectively. Total assets decreased by 10.8% (141.1 trillion won) compared to the end of last year, while equity capital increased by 87.9% (167 trillion won). This is believed to be the result of accounting system changes reflecting insurance contract loans, unamortized new contract acquisition costs, and insurance receivables?previously asset items?in the evaluation of insurance liabilities. As a result, assets decreased, but liabilities decreased even more due to market value evaluation of insurance liabilities, leading to an increase in equity capital.

Additionally, the return on assets (ROA) was recorded at 1.56%, and the return on equity (ROE) at 10.95%. These figures represent increases of 0.72 percentage points and 1.14 percentage points, respectively, compared to the same period last year.

A Financial Supervisory Service official stated, "Guidelines for applying the new accounting standards will be fully implemented in the second half of the year, and there will be impacts on profit and loss and financials due to increased market volatility such as interest rates and exchange rates. We will continue to supervise key assumptions in insurance supervisory accounting and thoroughly monitor major risk factors such as insurance operations, alternative investments, and real estate project financing loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.