"Buffett Always Increases Cash During Stock Market Crashes"

"Burry's Portfolio Also Bets on Market Decline"

Steve Hanke, an economist who served as an economic advisor to former U.S. President Ronald Reagan and a professor at Johns Hopkins University, described the investment positions of 'investment genius' Warren Buffett and Michael Burry, the real-life protagonist of 'The Big Short,' as a "good move." Professor Hanke believes that both have bet on a future decline in U.S. stock prices.

On the 28th (local time), Professor Hanke told the U.S. media outlet Business Insider in an interview, "The recently disclosed portfolios of Buffett and Burry both suggest the possibility of a stock market downturn."

Professor Hanke explained, "Buffett's position seems as if he is preparing for a recession," adding, "He appears to judge that the U.S. stock market is overvalued."

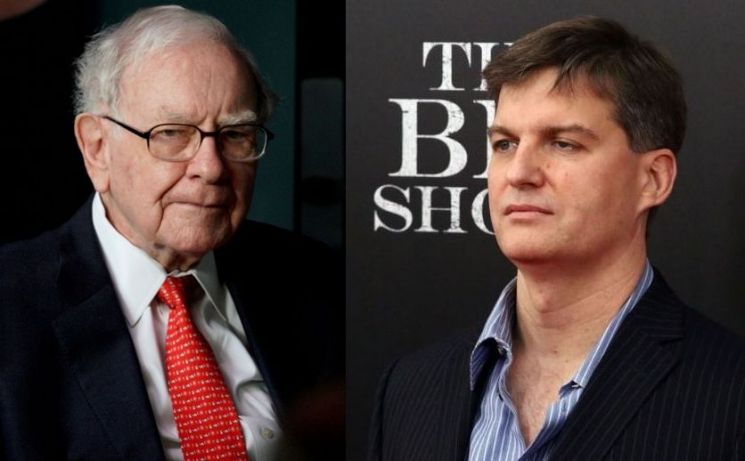

Warren Buffett, founder of Berkshire Hathaway (left), and investor Michael Burry [Image source=Reuters Yonhap News, Twitter]

Warren Buffett, founder of Berkshire Hathaway (left), and investor Michael Burry [Image source=Reuters Yonhap News, Twitter]

He pointed out that Buffett has historically increased his cash holdings whenever a stock market crash was anticipated. Professor Hanke said, "During the 2008 global financial crisis, Buffett used massive cash reserves to rescue companies on the brink of bankruptcy and generated profits."

In fact, Berkshire Hathaway, the investment company led by Buffett, has recently increased its cash holdings. According to data released by the U.S. Securities and Exchange Commission (SEC), Berkshire Hathaway sold approximately $8 billion worth of stocks net in the second quarter and delayed share buybacks. As a result, its cash and bond holdings increased to nearly $147 billion, reaching an all-time high.

Professor Hanke also viewed investor Michael Burry, known as the real-life model for the movie 'The Big Short,' as taking a position similar to Buffett's. He said, "Michael Burry bet most of his portfolio funds on a decline in the U.S. stock market in the second quarter," and evaluated it as "a very good choice considering economic uncertainties."

Burry is the figure who, just before the 2008 U.S. subprime mortgage crisis, anticipated a crisis in the U.S. real estate market and bet against mortgage bonds, earning a huge profit. His story inspired the movie 'The Big Short.'

Professor Hanke expects the U.S. economy to enter a recession in the first half of next year. He said, "This is due to the effects of the Federal Reserve's (Fed) aggressive tightening," and pointed out, "Stocks are currently trading at a premium compared to bonds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.