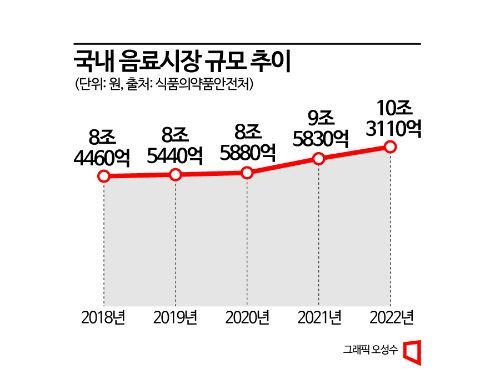

Last Year's Sales 10.311 Trillion Won... Up 7.6% YoY

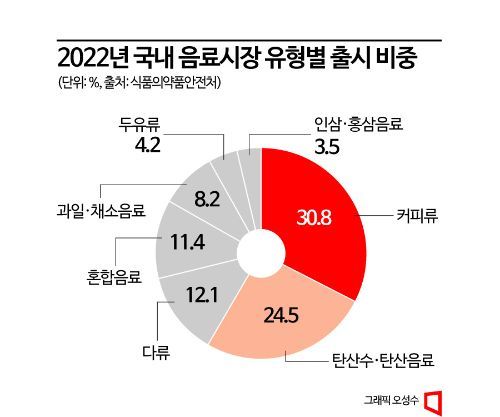

Coffee Products Account for Highest Share at 30%

Growth Expected to Continue Centered on Sugar-Free and Low-Calorie Products

Last year, the domestic beverage market size surpassed 10 trillion won for the first time. This growth is attributed to the rising consumer trend prioritizing health, with low-calorie and zero-sugar carbonated drinks and coffee emerging as new growth drivers in the market.

Zero Trend Grows 20% in 3 Years

According to the Ministry of Food and Drug Safety's '2022 Food Production Performance' report released on the 30th, the domestic beverage market size recorded sales of 10.311 trillion won last year, marking a 7.6% increase compared to the previous year (9.583 trillion won). This is the first time the domestic beverage market, which has shown continuous growth every year, has surpassed 10 trillion won. Compared to 8.544 trillion won in 2019, the market has grown by more than 20% over three years.

By category, coffee accounted for the largest share of domestic sales at 30.8%. While roasted coffee sales declined, sales of instant coffee, blended coffee, and liquid coffee increased. Among coffee types, liquid coffee holds the highest sales share, with Lotte Chilsung Beverage capturing 25.3% of the retail distribution channel market share in 2021, followed by Dongseo Food (16.6%), Maeil Dairies (15.6%), and Coca-Cola Beverage (10.9%).

Following coffee, carbonated drinks accounted for 24.5%, tea (da-ryu) 12.1%, mixed beverages 11.4%, fruit and vegetable drinks 8.2%, soy milk 4.2%, and ginseng and red ginseng drinks 3.5%. Sales of carbonated drinks, black tea, red ginseng, fermented beverages, and coffee drinks increased compared to the previous year. In particular, tea varieties such as green and black tea, which contain relatively less caffeine and fewer calories compared to coffee drinks, have seen gradual sales growth due to the expansion of ready-to-drink (RTD) products that can be consumed as water substitutes. On the other hand, fruit and vegetable juice sales declined due to health concerns over their relatively high sugar content.

Last year, beverage exports reached $947.59 million (approximately 1.2554 trillion won), up 4.5% from the previous year, continuing a steady growth trend. The main export countries were led by China at 22.8%, followed by the United States (12.2%), Vietnam (8.0%), Cambodia (7.9%), Japan (4.7%), Russia (4.7%), and Israel (3.7%). China mainly imported infant character beverages and plant-based drinks, the U.S. imported aloe beverages, and Vietnam and Cambodia imported grain-processed drinks and energy drinks as major export items. Meanwhile, beverage imports amounted to $588.63 million (approximately 779.2 billion won), increasing by 4.7% over four years since 2018.

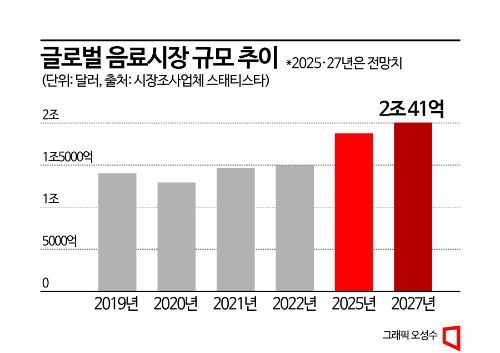

Growth Continues Riding 'Health and Sustainability' Trends

Globally, 'health' and 'sustainability' have become established trends in the beverage market, and the global beverage market, including Korea, is expected to continue growing centered on sugar-free, low-calorie, and organic products. According to global market research firm Statista, the global beverage market size was $1.4971 trillion (approximately 1981 trillion won) last year, up about 2% from the previous year ($1.4657 trillion). The global beverage market, which shrank significantly due to reduced outdoor activities and plummeting beverage consumption amid COVID-19, has been recovering since 2021 with an average annual growth rate of 7.7%, and is projected to reach $2.0041 trillion (approximately 2650 trillion won) by 2027.

Among products, zero-sugar beverages show the most remarkable growth as consumer interest in health rises. Zero-sugar drinks, which use alternative sweeteners instead of fructose, are rapidly increasing in consumption due to the perception that they cause less weight gain. Recently launched zero-sugar beverages closely mimic the taste of existing products, capturing consumers' palates, and their application has expanded from carbonated drinks to coffee, ion beverages, and energy drinks.

Along with the zero-sugar trend, demand and launches of tea beverages and plant-based alternative drinks are expected to increase. A representative example is kombucha, a fermented health drink, with various companies such as Tizen and Maeil Dairies recently entering the domestic market. According to global research firm Polaris, the global kombucha market size is expected to grow from $2.5 billion in 2021 to $11.4 billion by 2030, and the domestic plant-based alternative beverage market is also expected to exceed 1 trillion won by 2025, up from 800 billion won last year.

Additionally, products emphasizing various functionalities such as stress relief and sleep aid are expected to contribute to the growth of the beverage market. Musca launched 'Sleeping Bottle,' a natural sleep beverage recognized for its functionality by the Korean Intellectual Property Office, and hy recently released 'Sleep Care Shim,' a functional product that helps with sleep health, following 'Stress Care Shim' earlier this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.