Broadcast Revenue Share Declines Annually

Last Year Fell Below Half at 49.4%

Meanwhile, Transmission Fees Rise 8% Annually

Broadcast-Mobile 'Cross Broadcasting' Introduced

Recent Moves to Strengthen Mobile Channels

The TV home shopping industry’s recent notification to cease program broadcasts through paid broadcasting operators is analyzed to reflect a strategy of strengthening mobile broadcasting and business restructuring. This is because there is no need to maintain existing operations by paying high transmission fees amid a situation where the proportion of broadcasting sales is decreasing year by year.

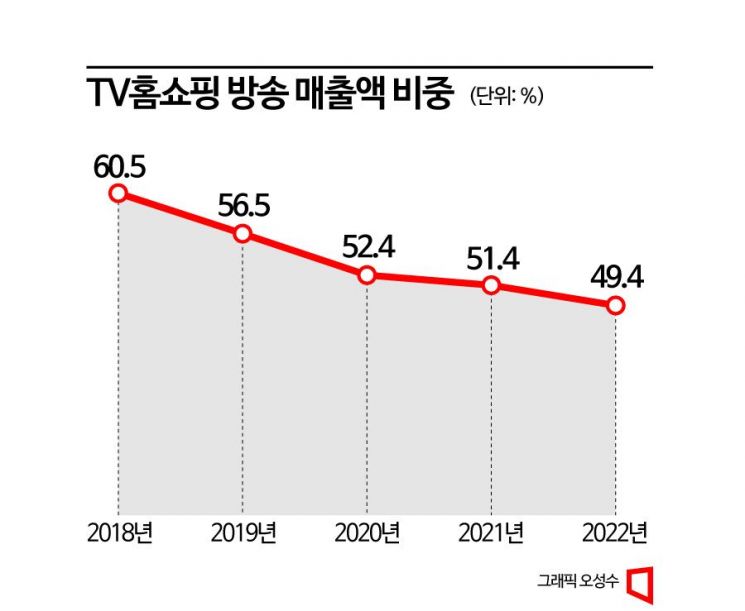

According to the industry on the 29th, as of last year, the proportion of broadcasting sales in TV home shopping fell below 50% for the first time, standing at 49.4%. The proportion of broadcasting sales in TV home shopping has continuously declined from 60.5% in 2018, 56.5% in 2019, 52.4% in 2020, to 51.4% in 2021. The sales amount of TV home shopping companies is calculated by summing direct purchase product sales and sales commission revenue received from partners. This is distinguished from the total transaction amount (handling volume) which sums the value of all products sold through TV home shopping.

Broadcast scene of CJ OnStyle's sales broadcast, which notified LG HelloVision of the suspension of broadcasting transmission on the 28th.

Broadcast scene of CJ OnStyle's sales broadcast, which notified LG HelloVision of the suspension of broadcasting transmission on the 28th. [Photo by Asia Economy DB]

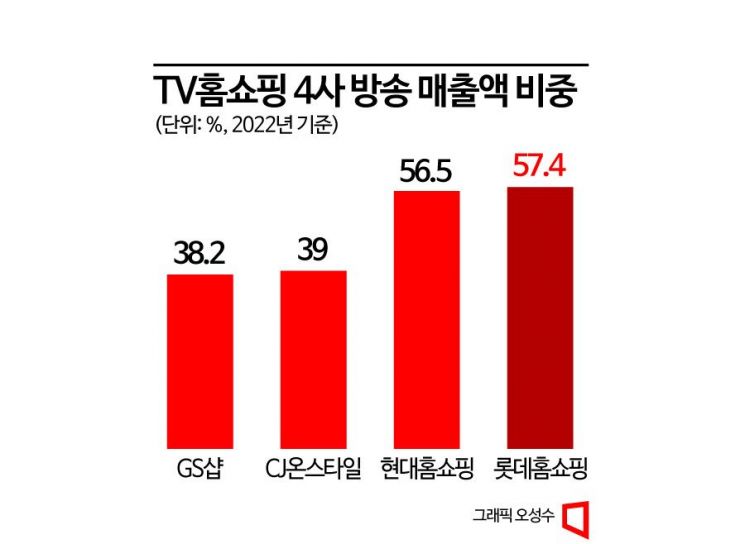

The downward trend in the proportion of broadcasting sales is also confirmed among major businesses. Comparing figures from 2018 and 2022, GS Shop’s proportion decreased from 51.1% to 38.2%, and CJ OnStyle’s dropped from 54.0% to 39.0%. Lotte Home Shopping, which has a relatively high proportion of broadcasting sales, fell from 64.9% to 57.4%, and Hyundai Home Shopping decreased from 68.5% to 56.5%. If this trend continues, it is predicted that these two companies will also see their broadcasting sales proportion fall below 50% within 2 to 3 years at the earliest.

In fact, the decline in TV viewership has had a significant impact on the TV home shopping industry. According to the Broadcasting and Communications Commission’s survey on media usage behavior, even the main age groups watching TV home shopping have shown a trend of moving away from TV viewing. Between 2018 and 2022, the percentage of people who considered TV as an “essential daily medium” sharply decreased by age group: from 72.8% to 52.5% for those in their 60s, from 50.2% to 31.8% for those in their 50s, and from 23.8% to 9.2% for those in their 40s. Conversely, the proportion who regarded smartphones as an essential medium rose by about 20% during the same period, reaching 46.6%, 65.8%, and 89.2% respectively. The introduction of ‘cross broadcasting’ that spans TV broadcasting and mobile by companies is also due to these reasons.

Meanwhile, TV home shopping companies pay annual transmission fees to paid broadcasting operators such as cable, satellite, and IPTV in exchange for channel allocation. These transmission fees have increased significantly year by year. Last year, the transmission fee amounted to 1.9065 trillion KRW, a 33.3% increase compared to 1.4304 trillion KRW in 2018. The average annual growth rate reached 8%. Despite the proportion of broadcasting sales decreasing every year, transmission fees have risen annually. The decision by CJ OnStyle, following Lotte Home Shopping and Hyundai Home Shopping, to suspend broadcasting transmission is also a result influenced by this background.

The industry has shown a movement to reduce dependence on TV, whose sales proportion has declined, and strengthen mobile channels with increasing user numbers as an essential survival strategy. Therefore, this transmission suspension incident is interpreted as a move to accelerate such a trend. However, since broadcasting, which TV home shopping companies are based on, still plays an important role, a complete blackout across all companies is realistically expected to be difficult. The fact that so far CJ OnStyle and others have limited their transmission suspension declarations to cable companies also supports this outlook.

Although IPTV is operated by the three major telecommunications companies (SK, KT, LG), it was found to have received the largest amount of home shopping transmission fees last year. Meanwhile, about ten cable companies received roughly half the transmission fees of IPTV. Due to its scale, IPTV is likely difficult for TV home shopping companies to respond to easily, but adjusting a single cable company seems possible. An industry insider said, “The IPTV market currently appears more stable, but the cable TV market is slowing down. From the cable TV companies’ perspective, while IPTV transmission fees are rising, they will seek more revenue, but negotiations must proceed considering actual business feasibility.”

To prevent the spread of TV home shopping blackouts, cooperation and response efforts across companies are essential. For this, the role of the TV Home Shopping Industry Association is very important. However, concerns have recently arisen due to the appointment of a new chairman of the TV Home Shopping Industry Association. The appointment of Lee Sang-rok, former spokesperson for President Yoon Seok-yeol’s presidential campaign, as chairman has raised many concerns within the industry. An industry insider observed, “This appointee lacks experience in the home shopping industry, so it will be difficult to carry out practical work.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)