Domestic Fruit and Vegetable Juice Market Shows Clear Annual Decline

High Sugar Content Juice Demand Drops Amid Health Focus

Responding with Sugar-Free and Organic Premium Products

As the domestic beverage market is being reorganized around products emphasizing health by reducing sugar and calories, the stagnant fruit juice market is also seeking a breakthrough by promoting premium products such as sugar-free and organic options.

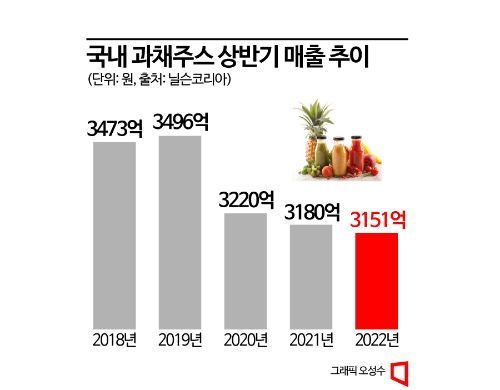

According to market research firm Nielsen Korea on the 29th, the sales of domestic fruit and vegetable juices in the first half of last year amounted to 315.1 billion KRW, a 0.9% decrease compared to the same period the previous year. The domestic fruit and vegetable juice market, which was around 349.6 billion KRW in the first half of 2019, has seen a gradual decline in sales volume each year, decreasing by about 10% over the past three years.

As juice sales shrink, its share in the overall beverage market is also contracting. According to the Ministry of Food and Drug Safety’s ‘2022 Food Production Performance,’ fruit and vegetable juices accounted for 8.1% of domestic beverage sales last year. This is lower than coffee (30.8%), carbonated drinks (25.5%), and tea beverages such as green and black tea (12.5%). The market share of fruit and vegetable juices was 10.2% in 2018 but dropped to single digits at 9.6% the following year, then continued to decline to 9.2% in 2020 and 8.6% in 2021.

The sluggishness of the juice market is due to the growing consumer preference for health, which has rapidly reduced the number of consumers seeking fruit juices that contain relatively high sugar content. In the past, fruit juice was regarded as a symbol of premium beverages, but as interest in health increased, high-calorie fruit juices gained an unhealthy image, leading to a decline in consumption. Additionally, the increase in substitutes such as coffee, carbonated drinks, probiotic beverages, and tea drinks has also contributed to the contraction of the juice market.

The fruit juice industry is aiming for a rebound by responding to the market with premium products such as sugar-free and organic options. Since the recent beverage market, including carbonated drinks and coffee, is being reorganized around products that reduce sugar and calories, fruit juice is also following this mega trend.

A representative from Woongjin Foods said, “It is realistically difficult for the fruit juice market to regain its former heyday,” adding, “We plan to find a breakthrough through various attempts such as zero sugar, high concentration, and premium cold-pressed juices.”

Woongjin Foods launched the zero-calorie dried fruit beverage ‘Jayeoneun Deomallin’ in February as a breakthrough. As of mid-this month, six months after its launch, Deomallin has achieved cumulative sales of 13 million bottles and sales revenue of 32.5 billion KRW, showing strong performance. Pulmuone also responded to the demand for premium fruit juices by launching ‘I’m Real Organic’ on the 9th, which uses 100% organic ingredients. I’m Real Organic is a cold-pressed product made without adding purified water or sugar, producing fruit juice 100% without heating, minimizing nutrient loss from the raw materials.

A Pulmuone representative said, “Consumer interest in premium beverages is increasing,” and added, “We plan to continuously introduce products that reflect consumer needs in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.