UBI Research Publishes 3rd Quarter OLED Market Track

Market research firm UBI Research announced on the 28th that the shipment volume of organic light-emitting diode (OLED) panels for smartphones (including foldable phones) in China is expected to surpass that of Korea by 2025.

On the same day, UBI Research released forecast figures for the shipment volume and revenue share of smartphone OLEDs in Korea and China through the Q3 OLED Market Track report.

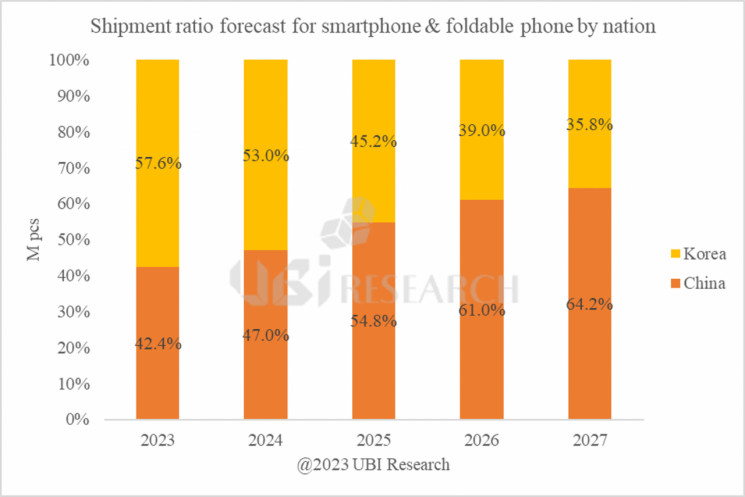

As of this year, the shipment volume share is 57.6% for Korea and 42.4% for China. Korea’s share is expected to decrease to 53% next year, 45.2% in 2025, 39% in 2026, and 35.8% in 2027, while China’s share is projected to rise to 47% next year, 54.8% in 2025, 61% in 2026, and 64.2% in 2027.

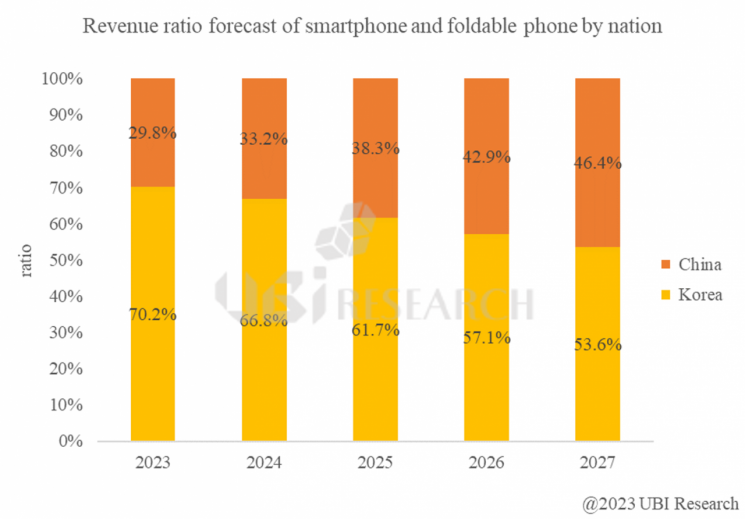

UBI Research expects Korea to maintain a lead in revenue share until 2027 because Chinese products are cheaper than Korean products.

The survey results show that this year’s revenue share is 70.2% for Korea and 29.8% for China. Korea’s share is expected to be 66.8% next year, 61.7% in 2025, 57.1% in 2026, and 53.6% in 2027. China’s share is forecasted to increase to 33.2% next year, 38.3% in 2025, 42.9% in 2026, and 46.4% in 2027.

It was explained that the quality of OLED products from Chinese display companies is also steadily improving, so revenue cannot be taken for granted. Chinese companies are growing based on a huge domestic market and government support.

UBI Research stated, "(Chinese companies) are targeting the market with cost-effectiveness (performance relative to price)," adding, "After 2028, Korea could be overtaken by China in revenue as well."

UBI Research advised that for Korea to maintain its leadership position in the display industry, it should seek to expand the IT (information technology) and TV OLED markets, where Chinese companies still find it difficult to enter. It also emphasized the need to accelerate the transition to the microdisplay industry for the new XR (extended reality) market.

UBI Research said, "Although China invests more in microdisplays than Korea, this field requires precision processes similar to semiconductors, making it an area where Korean companies can easily establish a foothold for catching up."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.