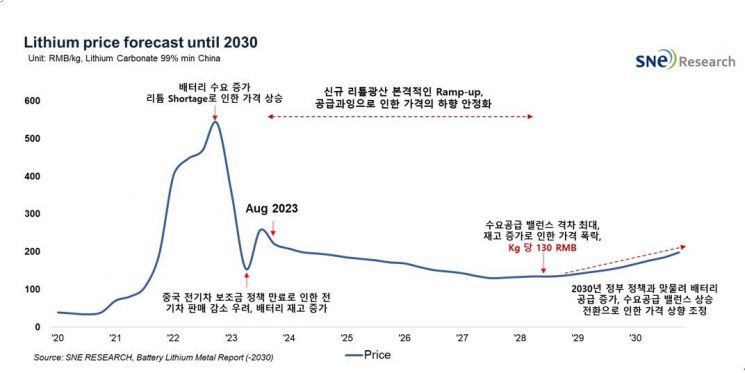

SNE Research "Will Rise Again After 2028"

There is a forecast that the price of lithium, a key mineral in electric vehicle batteries, will show a long-term downward stabilization trend.

Energy market research firm SNE Research stated in a report on the 28th, "Due to an oversupply of lithium, a continuous price decline of lithium carbonate is expected," adding, "Prices will rise again after 2028."

Lithium carbonate is a key mineral in lithium-ion batteries used in electric vehicles. At the beginning of 2022, due to a shortage of lithium raw materials, the price soared to 580,000 yuan per ton (approximately 110 million KRW). However, from the end of 2022, issues such as the termination of electric vehicle subsidies in China and increased battery inventories by battery manufacturers caused the price to drop to 160,000 yuan per ton (approximately 30 million KRW) within five months.

The price of lithium carbonate is expected to continue its downward stabilization trend until 2028. The main reason for the decline is the increase in supply volume due to the full-scale operation of new lithium mining projects. SNE Research predicted, "An imbalance between supply and demand will occur due to oversupply," and "In 2027, the largest drop will be recorded, with lithium prices falling to 130,000 yuan per ton (approximately 28 million KRW) in 2028."

The decline in lithium prices is expected to pose a burden on demand, supply, mining, and refining companies. SNE Research forecasted, "Global mining companies with relatively high margins will survive the competition."

SNE Research expects global mining companies' lithium production to increase from 950,000 tons in 2023 to 3.33 million tons in 2030, recording an average annual growth rate of 19.6%. Lithium demand is projected to grow from 790,000 tons annually in 2023 to 2.53 million tons in 2030, with an average annual growth rate of 18.1%. This relatively lower growth rate compared to supply is expected to result in an oversupply of 790,000 tons in 2030.

New lithium mining countries are expected to expand from a few existing countries such as South America and Australia to North America, Europe, and Africa. The emergence of new mining countries is expected to positively impact supply chain diversification and price stability in securing key minerals.

With the implementation of the U.S. Inflation Reduction Act (IRA), to receive tax credits in the U.S., at least 40% of battery minerals must be sourced from the U.S. or countries that have free trade agreements (FTA) with the U.S. SNE Research forecasted, "As the number of countries capable of lithium mining increases, opportunities to supply lithium raw materials that meet IRA conditions will also increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.