Commercial Banks Assess Housing Market Recovery

Household Surplus Funds Expected to Flow In

View of apartments in Seobu Ichon-dong from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

View of apartments in Seobu Ichon-dong from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

"Housing transaction volume is recovering centered on actual demand. The government’s regulatory easing has shifted the trend to a soft landing. A gradual recovery is expected for the time being."

(KB Financial Group Management Research Institute Housing Market Review on the 25th)

Commercial banks are increasingly issuing assessments that the housing market is showing signs of recovery. In July, nationwide housing sale prices fell by 0.19% (compared to the previous month), continuing a year-long downward trend. However, the rate of decline has been narrowing for seven consecutive months since the beginning of the year. In particular, the price change rate of the top 50 apartments by total market value has expanded its increase for three consecutive months since May (May 0.10% → June 0.82% → July 1.00%).

In June, the nationwide housing sales volume reached 53,000 units, exceeding 50,000 units for two consecutive months. This represents a 34% increase compared to last year’s average transaction volume. The Real Estate Research Team at KB Financial Group Management Research Institute diagnosed, "The expectation of housing market recovery is relatively strong in the Seoul metropolitan area, which is showing a rapid recovery speed."

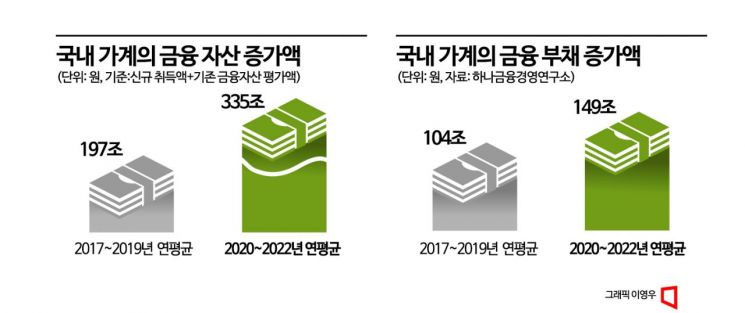

Increase in Household Financial Assets, Annual Average of 335 Trillion Won

Riding this momentum, there is also a forecast that household surplus funds will flow into the housing market, increasing demand for apartment purchases in the Seoul metropolitan area. Hana Financial Management Research Institute, in its report titled 'Impact of Increased Household Liquidity on the Housing Market,' analyzed, "Recently, financial assets including deposit currency have significantly increased, and domestic households hold a considerable amount of surplus funds," adding, "With the housing market recovery trend, some of the household liquidity may flow into the housing market."

From 2020 to 2022, after the pandemic, the annual average increase in domestic household financial assets (new acquisitions + valuation of existing financial assets) reached 335 trillion won, greatly exceeding the previous three years’ 197 trillion won. During the same period, the increase in financial liabilities averaged 149 trillion won annually, about 2.2 times less.

In particular, deposit currency, which corresponds to surplus funds, increased by an annual average of 169 trillion won between 2020 and 2022. The report stated, "The increase in the first quarter of this year compared to the previous quarter was 62 trillion won, similar to the 63 trillion won increase during the same period last year, maintaining a steady upward trend." It continued, "With rising interest rates and strengthened Debt Service Ratio (DSR) regulations, households have been repaying loans this year, and the difference between deposit currency balances and loans reached 218 trillion won in the first quarter, marking the highest level since the pandemic," adding, "This is six times the average difference of 36 trillion won between 2010 and 2022."

Currently, the scale of liquidity held by households is large, and additional funds can be secured through policy mortgages such as special BoGeumJari loans, so housing market transactions are expected to increase further depending on changes in homebuyer sentiment. The housing sales market consumer sentiment index surveyed by the Korea Research Institute for Human Settlements rose from 90.1 in September last year to 114.1 in June this year.

High Possibility of Inflow into Seoul Metropolitan Area Apartments

When funds flow in, they are expected to concentrate first on apartments in the Seoul metropolitan area, which are highly preferred by buyers. As seen in the recent overheating of subscription competition rates for major apartment sales in Seoul, investment recovery is clear in products with high buyer preference based on the recovery of buying sentiment. In Seoul, the competition rate was 6.5 to 1 in December last year but soared to 120 to 1 last month.

The report stated, "If household liquidity flows additionally into the housing market, transactions of apartments in major areas of the Seoul metropolitan area with less oversupply pressure and high latent demand, as well as areas undergoing reconstruction and redevelopment, are expected to increase further," adding, "On the other hand, housing markets in less preferred non-metropolitan areas of the Seoul metropolitan area and local regions, where demand is thin and unsold inventory is high, will require interest rates to fall and accumulated inventory to be cleared before a full market recovery can occur."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.