The Bank of Korea Publishes Domestic Manufacturing Map

Visualization of Production, Export, and Import by 11 Major Industries

Analysis suggests that if a semiconductor supply chain disruption occurs, it will have ripple effects on the regional economy centered around the Seoul metropolitan area in South Korea.

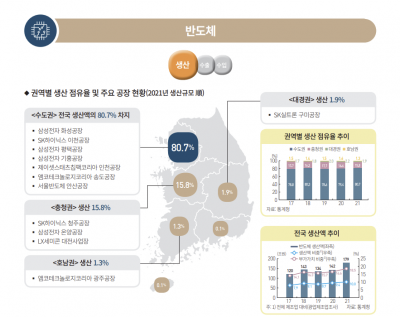

The Regional Research Support Team of the Regional Economy Department at the Bank of Korea (BOK) stated on the 25th through the "Map of Major Manufacturing Production and Supply Chains in South Korea" that domestic semiconductor production by South Korean companies is concentrated in the Seoul metropolitan area.

According to BOK, the domestic semiconductor production share is 80.7% in the Seoul metropolitan area and 15.8% in the Chungcheong region, totaling 96.5% when combined. BOK explained, "The main production plants of major companies such as Samsung Electronics (Hwaseong, Pyeongtaek, Giheung) and SK Hynix (Icheon) are located in Gyeonggi Province," adding, "If global demand and supply shocks occur, the semiconductor production routes in the Seoul metropolitan area will transmit the impact to the regional economy."

South Korea's semiconductor exports last year amounted to $142.7 billion in total exports, with exports to China reaching $75.8 billion, accounting for 53.1%. If the intensifying US-China conflict affects South Korea's semiconductor exports to China, production will inevitably be impacted.

Regarding imports, materials and components necessary for semiconductor production rely on China (23.1% import share) and Japan (21.4%), while manufacturing equipment dependence is high on the United States (23.3%), Japan (23.3%), and the Netherlands (22.8%). Items such as super capacitors (China, 91.5%), polyimide film (Japan, 89.9%), and wafer coating agents (Japan, 89.4%) show a dependence on specific countries at around 90%, and there are multiple manufacturing equipment items with over 90% dependence on Japan.

BOK stated, "Domestic semiconductor production is inevitably sensitive to the economic conditions of countries with high trade dependence, as well as changes in trade and industrial policies," adding, "The domestic semiconductor industry will be greatly influenced by the recovery pattern of China's economy, which accounts for a high export share. Additionally, international affairs such as US-China conflicts, Korea-Japan economic cooperation, geopolitical risks, and abnormal climate phenomena may cause disruptions in the supply of materials, components, and equipment."

The booklet also includes regional production status, exports by country and product, and imports of materials, components, and equipment for 11 major manufacturing industries in South Korea, including automobiles. The data is visualized by sector, divided into production, export, and import categories.

In the automobile industry, South Korean companies rank third globally in vehicle sales, with domestic production (3.76 million units in 2022) and overseas production (3.57 million units) being of similar scale. Domestic automobile manufacturing plants are evenly distributed across regions nationwide.

Complete vehicle exports in 2022 amounted to $54.1 billion (2.22 million units), significantly exceeding domestic sales (1.17 million units). The export share was led by the United States (41.1%), followed by Canada (6.1%), Australia (6%), the United Kingdom (4.1%), and Germany (3.2%).

BOK noted, "Domestic automobile production is expected to be mainly influenced by economic fluctuations and resulting demand changes in Western advanced countries with high export shares, such as the United States. Attention should also be paid to supply disruptions of parts originating from China due to changes in production conditions within China and the development of US-China conflicts."

Regarding secondary batteries, production and exports are rapidly growing centered on three domestic companies (LG Energy Solution, SK On, Samsung SDI). However, due to the rapid improvement in competitiveness of Chinese companies, the global market share of domestic companies has been declining since 2020. BOK pointed out, "The dependence on China for secondary battery materials and components/manufacturing equipment is 63.7% and 36%, respectively, exposing the industry to global supply chain risks, making proactive management across the entire industry important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)