Ethereum Withdrawal Enabled After Shapella Upgrade

Domestic Exchanges: "Participation Increases as Unstaking Becomes Possible"

Investor interest in Ethereum staking remains strong. In particular, there are responses indicating that participation in Ethereum staking has been increasing since the Shapella upgrade.

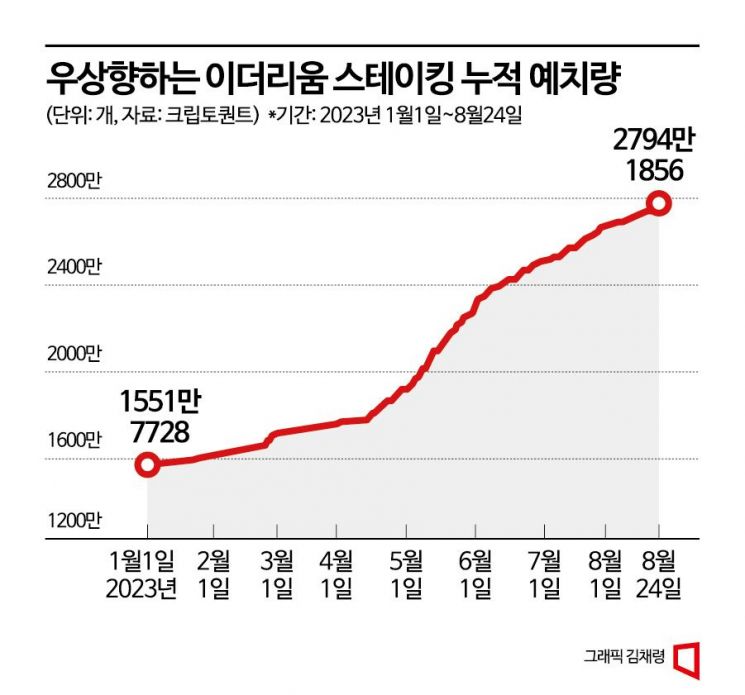

According to cryptocurrency data provider CryptoQuant, as of the 24th of this month, the total amount of Ethereum deposited for staking was recorded at 27,941,856. Staking refers to entrusting cryptocurrency to a blockchain network that uses the Proof of Stake (PoS) method, participating in blockchain operation and verification, and receiving coins as a reward. At the beginning of this year, the amount of Ethereum deposited was 15,517,728, which means it has increased by 80.06%.

Domestic cryptocurrency exchanges have evaluated that staking has increased since the Ethereum Shapella upgrade in April this year. The Shapella upgrade primarily enables unstaking, allowing users to withdraw their staked Ethereum, unlike before when only staking was possible. Previously, withdrawal functionality was not implemented, making it impossible to retrieve staked Ethereum until the Shapella upgrade was completed.

Korbit provided Ethereum 2.0 staking services 48 times from April 2021 to March this year. Ethereum 2.0 staking was a service before the Shapella upgrade. After the service ended, Korbit started a new Ethereum staking recruitment in May. As a result, 66.8% of the total amount that had been staked and returned during the Ethereum 2.0 staking period applied for the service in the single recruitment held in May. In terms of amount, the deposited funds were estimated at approximately 33.5 billion KRW. This figure is more than 20 times higher than the first round of Ethereum 2.0 staking.

A Korbit official explained, "The risk of non-withdrawal has been resolved through the Shapella upgrade, leading investors to be more active in staking," adding, "The fact that there are many services and uses such as DApps (decentralized applications) operating based on the Ethereum blockchain also contributes to increased participation."

Although Ethereum staking has been available since November 2020, unstaking was not possible until the Shapella upgrade was completed, raising concerns about a potential mass withdrawal event. However, these worries were alleviated thanks to safeguards such as controlling the number of validators allowed to withdraw at once to limit the number of validators leaving the network. Additionally, the ability to freely stake and withdraw Ethereum lowered the entry barrier, leading to increased participation. According to CryptoQuant statistics, the cumulative amount of Ethereum staked increased by 29.71%, from 17,573,376 to 22,793,760, during the two months from April 1 to May 31 this year. The growth rate from January 1 to February 28 was only 9.45%.

Upbit offers staking services for cryptocurrencies including Ethereum, Cosmos, Cardano, and Solana. For Ethereum, staking can be applied for starting from a minimum of 0.02 ETH, with an estimated annual reward rate of 4.4%. An Upbit official stated, "Investor interest in Ethereum staking has grown following the successful Ethereum Shapella upgrade."

It is also explained that the ability to receive rewards without having to sell cryptocurrency can be attractive to investors. Even in a bear market, if investors expect price appreciation, they can earn additional rewards without selling their holdings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)