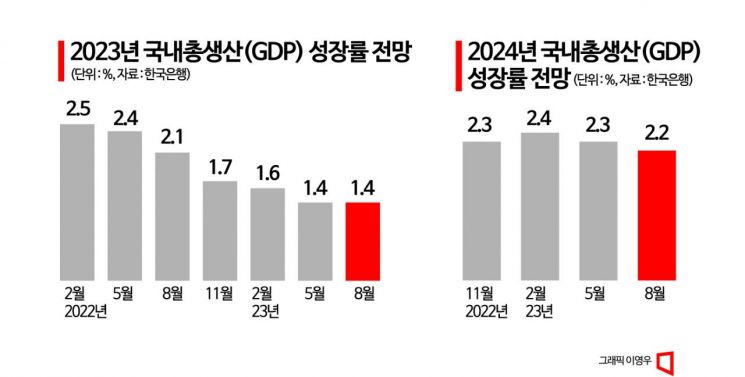

Maintaining this year's growth rate at 1.4%

Lowered to 2.2% by 0.1%p next year

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 24th, striking the gavel. / Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 24th, striking the gavel. / Photo by Joint Press Corps

On the 24th, the Bank of Korea's Monetary Policy Committee decided to keep the base interest rate steady at 3.5% per annum for the fifth consecutive time and maintained this year's real Gross Domestic Product (GDP) growth forecast at 1.4%, unchanged from the projection made in May. Despite the growing risks originating from China, which have cast a red light on export prospects for the second half of the year given South Korea's high dependence on trade with China, the impact remains limited for now. Moreover, uncertainty over further tightening by the United States has increased the need to maintain a wait-and-see stance.

With the likelihood of a rapid recovery in the Chinese economy diminishing, next year's growth forecast was revised downward by 0.1 percentage points to 2.2%. Since China plays a significant role in the global economy, concerns have emerged that a slowdown in China could spread into a global recession, potentially shaking the government's 'low in the first half, high in the second half' growth outlook and leading to pressure for interest rate cuts.

At the monetary policy meeting held that day, the Bank of Korea's Monetary Policy Committee unanimously decided to keep the base interest rate at 3.50% per annum. The committee had halted its rate hike cycle in February after 18 months of consecutive increases since August 2021, and this marks the fifth consecutive month of rate freezes following last month. With the Bank of Korea's decision to hold rates steady, the interest rate gap with the United States (5.25?5.50%) remains at a record high upper bound of 2.00 percentage points.

Unanimous Decision to Keep Rates Steady... Korea-US Interest Rate Gap Maintained at 2.00%p

The Bank of Korea's rationale for freezing rates this month is that although inflationary pressures are easing, there remain concerns about a potential resurgence. Additionally, the recent emergence of risks from China is expected to impact the economy negatively, warranting a cautious approach for the time being. While the consumer price inflation rate slowed to 2.3% in July, recent rises in international oil prices suggest inflation may increase this month. With the direction of U.S. monetary tightening still uncertain, the Bank opted to hold rates steady and monitor future inflation trends.

Governor Lee Chang-yong stated, "The domestic economy is gradually improving, but inflation is expected to exceed the target level for a considerable period, and policy uncertainties remain high. We will focus on price stability and maintain a tightening stance for a significant period while assessing the need for further rate hikes."

In the revised economic outlook released that day, the Bank of Korea maintained its consumer price inflation forecast at 3.5% for this year. Governor Lee, during a parliamentary hearing on the 22nd, noted, "The consumer price inflation rate was 2.3% in July, with core inflation at 3.3%. There is a possibility that inflation will return to the 3% range in August and September, then gradually decline to below the mid-2% range by the second half of next year."

The growth forecast for this year was also maintained at 1.4%. Although the government expects exports to turn positive in the second half and show an upward trend, the effect of China's reopening has been weaker than anticipated, and the recovery in the semiconductor sector, a key export industry, has been delayed, pushing back the timing of economic rebound.

Kim Jeong-sik, Professor Emeritus of Economics at Yonsei University, commented, "Despite factors such as rising household debt and a higher won-dollar exchange rate that support rate hikes, the recent spread of risks from China's real estate sector has destabilized the economy, which appears to be the reason for the rate freeze. The Bank of Korea will likely decide on further rate hikes after assessing the direction of additional tightening from U.S. Federal Reserve Chair Jerome Powell's speech at the Jackson Hole symposium on the 25th (local time)."

Next Year's Growth Forecast Revised Down from 2.3% to 2.2%

The Bank of Korea's decision to lower next year's growth forecast from 2.3% to 2.2% reflects the assessment that the recent slowdown in China's economy is more severe than expected, and uncertainties such as additional U.S. tightening and rising international oil prices make economic recovery challenging. Since the growth rate in the first half of this year was 0.9% compared to the same period last year, achieving the Bank's forecast requires 1.7% growth in the second half, a difficult target considering recent export and economic conditions.

The slowdown in China's economy is identified as the biggest issue. Kang Sam-mo, Professor of Economics at Dongguk University, said, "South Korea's economy is highly dependent on trade, and China, which accounts for the largest share of export markets, is crucial. Even if China's economy partially recovers, many believe it will not return to previous levels, which could negatively affect our economy."

Kang In-su, Professor of Economics at Sookmyung Women's University, also noted, "Although China's share in exports has decreased, the absolute amount remains large, so the U.S. export market cannot offset the decline in exports to China in the second half. Despite China's government implementing stimulus measures, their effects are limited, and the risk of real estate company collapses is emerging, making a recovery in China's economy in the second half unlikely."

Governor Lee explained the reason for the downward revision of next year's growth forecast as "the low possibility of a rapid recovery in China's economy." However, he added, "I am aware that attention is focused on changes in China's real estate market, foreign exchange market, and stock prices, but the current growth forecast for China is not different from what was expected before July." He further stated, "Uncertainties have increased, raising the possibility of a recession, but this does not mean China's economic growth rate for this year has significantly declined, so we need to observe further."

Governor Lee emphasized that although the 1.4% growth forecast for this year is low, it is not unique to South Korea. He said, "If asked whether low growth rates in the short term can be supplemented by interest rate or fiscal policy, I would say no. Trying to raise growth by 0.1 percentage points through interest rate or fiscal measures could hinder structural adjustment."

China's Economic Slowdown, U.S. Tightening... Greater Economic Uncertainty Next Year

Both the Bank of Korea and the government continue to expect the domestic economy to follow a 'low in the first half, high in the second half' pattern. However, growing instability in China's real estate market and the onset of deflation could delay China's export recovery and extend the ripple effects to domestic financial and foreign exchange markets. Since Chinese capital holds a significant share in the domestic bond market, any future capital outflow from China could impact interest rates and the stock market.

In particular, if the U.S. Federal Reserve raises interest rates further within the year due to stronger-than-expected domestic employment and consumption, risks of capital outflows and exchange rate volatility could increase. Cho Kyung-yeop, Head of Economic Research at the Korea Economic Research Institute, said, "Although there are no signs of capital outflows yet despite the Korea-U.S. interest rate gap widening to 2 percentage points, it is uncertain what will happen if the gap widens further. The Bank of Korea must be deeply concerned."

The Bank of Korea's decision to hold rates steady could backfire after Fed Chair Jerome Powell's speech at the Jackson Hole symposium on the 25th. Last August, Powell's hawkish remarks shocked global markets. If he signals further rate hikes this time, the won-dollar exchange rate could surge, and foreign investors might withdraw funds. This would be the worst-case scenario for the Bank of Korea after freezing rates. The Bank's 0.1 percentage point downward revision of next year's growth forecast appears to reflect such economic uncertainties.

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 24th at the Bank of Korea in Jung-gu, Seoul. / Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 24th at the Bank of Korea in Jung-gu, Seoul. / Photo by Joint Press Corps

Inflation Concerns Persist... Watchful of International Oil Price Rebound

Although consumer price inflation has recently stabilized, it is still too early to be complacent. In the revised economic outlook, the Bank of Korea projected consumer price inflation at 3.5% this year and 2.4% next year, unchanged from May. Governor Lee previously remarked in parliament on the 22nd, "Among advanced countries, we are the only one with inflation below 3%."

However, this forecast assumes that international oil and commodity prices will stabilize downward as initially expected. Major oil-producing countries like Saudi Arabia continue production cuts to raise oil prices, pushing Brent crude, the global benchmark, into the mid-$80 range. Although concerns over China's economic slowdown have recently caused some price hesitation, Saudi Arabia is likely to maintain cuts through October, leaving room for further price increases by year-end.

Professor Ha Jun-kyung of Hanyang University's Department of Economics explained, "The rapid decline in inflation so far has been largely due to falling international oil prices, but the base effect is ending, and core inflation is not yet under control. If food service and service prices continue to rise in the second half, wage pressures will increase, and the rising oil price trend could also contribute to inflation."

Governor Lee Chang-yong: Household Loan Increase Driven by Beliefs in Housing Price Bottom and Interest Rate Cuts

At a press conference following the monetary policy meeting, Governor Lee explained the rise in household loans by saying, "The increase in real estate-related loans is because many people expect interest rates to stabilize and fall. This expectation, along with the belief that housing prices have bottomed out, underpins the willingness to borrow." He expressed concern over the spread of the housing price bottom theory, stating, "What worries me is that people invest thinking interest rates will fall due to this perception. Interest rates have been very low for over a decade, and younger generations who have not experienced inflation may be buying homes expecting a return to low rates, which calls for caution."

Governor Lee also mentioned that six Monetary Policy Committee members believe it is necessary to keep open the possibility of raising the base interest rate to 3.75% in response to the increase in household loans and uncertainties in the U.S. Federal Reserve's monetary policy. He said, "When the household debt-to-GDP ratio exceeds 80%, it can constrain economic growth and financial stability. Currently, this ratio is over 100%, and the goal is to gradually reduce it to 80% via 90% as an intermediate target. However, the recent rise in household loans will first be addressed through microprudential policies such as regulations, with macroprudential policies considered afterward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.