Related Stocks Surge Following Announcement of Contaminated Water Discharge Plan

Volatility in June Warns of Herd Trading Risks

When the Japanese government announced plans to discharge contaminated water from the Fukushima nuclear power plant into the sea starting on the 24th, stocks of salt and fisheries-related listed companies surged in the domestic stock market. However, since there was a precedent in June where related stocks surged and then plummeted, caution is advised for investors caught up in short-term themes.

On the 7th, interest in sea salt surged and hoarding movements appeared following Japan's plan to discharge contaminated water from its nuclear power plant, as salt is being sold at a large supermarket in Seoul. Photo by Kang Jin-hyung aymsdream@

On the 7th, interest in sea salt surged and hoarding movements appeared following Japan's plan to discharge contaminated water from its nuclear power plant, as salt is being sold at a large supermarket in Seoul. Photo by Kang Jin-hyung aymsdream@

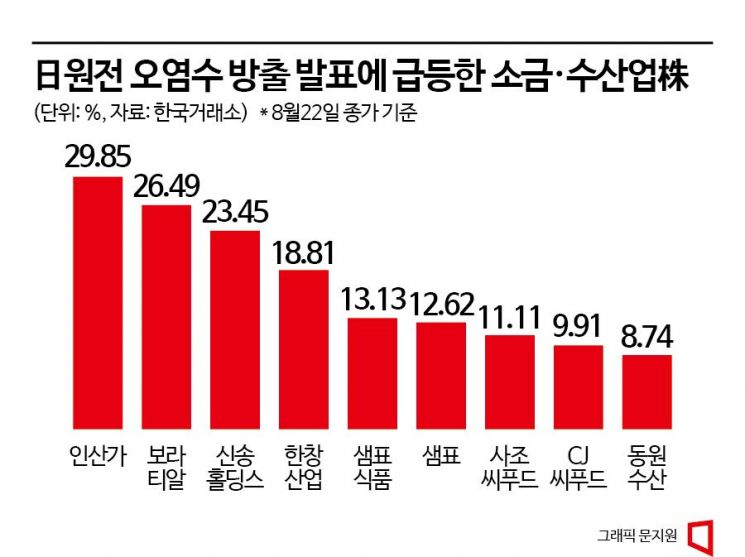

According to the Korea Exchange, on the 23rd, the stock price of Insanga, a KOSDAQ-listed company, closed at 3,480 won, hitting the daily price limit increase of 30% compared to the previous trading day. The stock price soared to the upper limit immediately after the announcement by Japanese Prime Minister Fumio Kishida in the morning and closed at that level. Insanga is a company that produces bamboo salt and related food products. When news of Japan’s contaminated water discharge surfaced in mid-June, the stock price, which was in the high 1,000 won range, surged to 4,300 won in a short period. Then, it plunged to the 1,900 won range at the end of last month before rising sharply again.

Other companies such as Boratial, which sells edible sea salt (26.49%), and Sinsong Holdings, which produces and sells sea salt through its subsidiary-owned salt farms (23.45%), also surged. Stocks of fisheries-related companies including Hanchang Industry (18.81%), Sempio Foods (13.13%), Sempio (12.62%), Sajo Seafood (11.11%), CJ Seafood (9.91%), and Dongwon Fisheries (8.74%) also soared.

The reason these companies’ stock prices jumped following Japan’s announcement of the nuclear wastewater discharge plan is the expectation that prices of salt and various processed products using salt will rise. In mid-June, a short-term “salt hoarding” phenomenon occurred due to increased anxiety. However, this phenomenon did not last long, and the government has been releasing a stockpile of 400 tons of sea salt since the 10th of last month.

Since such external issues do not directly translate into improved performance for individual companies, and given the precedent of sharp rises and falls in June, caution is advised for investors. In June, when stocks like Insanga and Sinsong Holdings showed extreme volatility, the Korea Exchange designated them as investment warning stocks. On the same day, Daesang Holdings, classified as a salt-related theme stock, recorded a sharp jump to 8,730 won?about 26% higher than the closing price of 6,930 won on the 21st?before plunging immediately to 7,100 won, showing wild price swings within a single day.

Joon-ki Cho, a researcher at SK Securities, said, “The rotation speed of supply and demand among themes is very fast, and stock price volatility is also very high. Since the stock prices strongly react to expectations and issues by rising and falling, it is necessary to be cautious about the accompanying high volatility during this process.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.