More than one in three accounting, finance, and audit professionals at domestic companies responded that there is a possibility of embezzlement or fraud occurring within their own companies.

Global accounting and consulting firm EY Hanyoung announced the results of the "2023 EY Hanyoung Future of Audit Survey" reflecting this on the 16th. A total of 708 employees from accounting, finance, and audit departments of domestic companies participated in the survey.

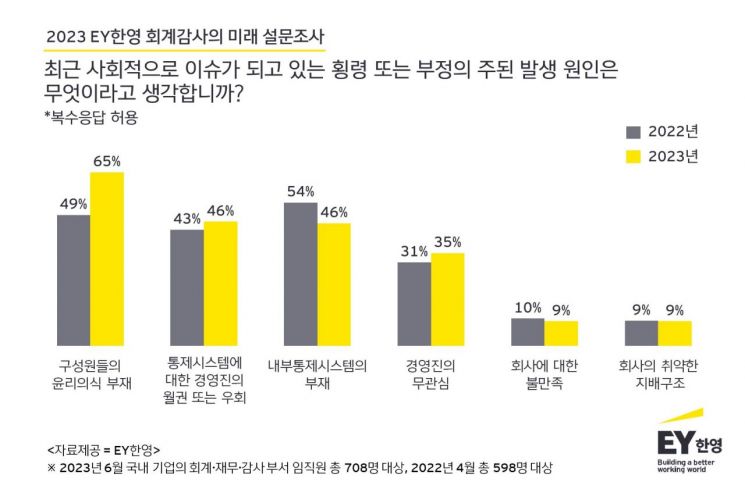

Thirty-eight percent of all respondents answered that there is a possibility of embezzlement or fraud occurring in their companies. Respondents cited the main cause of embezzlement or fraud as "lack of ethical awareness among members (65%)." This figure increased by 16 percentage points from 49% in last year's response to the same question. The ranking of this response also rose from second place last year to first place, highlighting the need to enhance ethical awareness among organizational members.

Additionally, "absence of internal control systems," which was the top response last year (54%), dropped to third place (46%) in this year's survey. This was interpreted as a result of companies strengthening internal control systems as safeguards to prevent accounting fraud following a series of large-scale embezzlement incidents last year. The second most common reason for embezzlement or fraud was "management's overreach or circumvention of control systems."

Digital auditing emerged as an alternative to detect false financial information or embezzlement of funds. Fifty-seven percent of respondents answered that digital auditing is useful in detecting false reporting of financial information.

In addition, respondents indicated that digital auditing helps detect embezzlement or fraud such as ▲fabricated or excessive payment transactions related to inventory, tangible asset purchases, and expense accounts (31%), ▲embezzlement of collected receivables through sales and accounts receivable accounts (28%), and ▲misappropriation or embezzlement of held cash deposits (25%).

Regarding the advantages of digital auditing, the highest response rate (58%) pointed to the ability to identify fraud and errors through large-scale data analysis. In fact, digital auditing helps detect early signs of anomalies in company ledgers through large-scale data analysis. By analyzing entire datasets rather than partial data, it can precisely diagnose high-risk areas by analyzing financial data trends and hidden patterns within companies. EY Hanyoung has introduced EY Helix, a large-scale data analysis tool, into audit operations to perform detailed and in-depth analyses.

Lee Kwang-yeol, Head of Audit at EY Hanyoung, explained, "When embezzlement occurs within a company, it negatively affects the company's investment trust and reputation, so it is important to proactively block fraud risks." He added, "It is also necessary to raise ethical awareness among members through establishing and regularly updating internal control devices, introducing job rotation systems, and strengthening ethics education for employees."

He emphasized, "Considering that embezzlement and accounting fraud issues are becoming increasingly sophisticated, utilizing digital auditing that can quickly inspect vast amounts of data can help detect and prevent potential risks early."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.