Only Card Company Showing Net Profit Growth Amid Recession

Lower Loan Loss Costs Due to Fewer Financial Product Sales

Hyundai Card reported increases in sales, operating profit, and net profit in the first half of the year compared to the same period last year. This contrasts with most card companies, whose performance declined due to worsening market conditions.

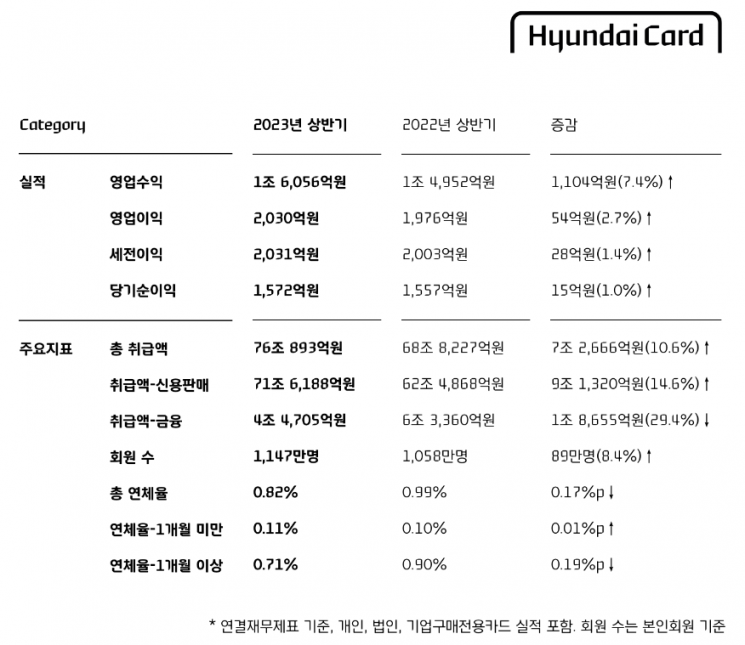

Hyundai Card announced on the 14th that it recorded a net profit of 157.2 billion KRW in the first half of this year, a 1.0% increase compared to the same period last year. Sales reached 1.6056 trillion KRW, and operating profit was 203 billion KRW, both up 7.4% and 2.7% respectively from the previous year.

Among the seven major full-service card companies?Shinhan, KB Kookmin, Samsung, Hyundai, Lotte, Hana, and Woori?only Hyundai Card and Lotte Card saw an increase in net profit in the first half compared to the same period last year. Shinhan Card (-23.2%), KB Kookmin Card (-21.5%), Samsung Card (-8%), Woori Card (-38.7%), and Hana Card (-23.7%) experienced declines ranging from 8% to nearly 40%. Although Lotte Card’s net profit rose 72.7% to 306 billion KRW due to gains from the sale of a subsidiary, excluding this, Lotte Card’s net profit actually decreased by 39.1% to 107.9 billion KRW compared to the previous year.

Hyundai Card’s strong performance is attributed to managing financial products with a focus on soundness and reducing bad debt expenses through risk management. In the first half, Hyundai Card’s total transaction volume was 76.0893 trillion KRW, a 10.6% increase from the same period last year. Of this, credit sales volume was 71.6188 trillion KRW, up 14.6%, while the financial sector transaction volume decreased by 29.4% to 4.4705 trillion KRW during the same period.

In particular, the decline in sales of credit products such as card loans and cash services is believed to have contributed to the reduction in bad debt expenses. Hyundai Card’s bad debt write-off expenses in the first half were 37 billion KRW, down 18.4%. The total delinquency rate also fell by 0.13 percentage points from the previous quarter to 0.82%, marking two consecutive quarters with delinquency rates below 1%.

Meanwhile, Hyundai Commercial reported a net profit of 94.1 billion KRW for the first half. Excluding one-time gains from acquiring Hyundai Card shares in the first half of last year, this represents an 18.5% increase compared to the same period last year. Hyundai Commercial explained, "Since the second half of last year, we have proactively reduced high-risk assets such as real estate project financing (PF) and increased cash holdings by selling loan receivables."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)