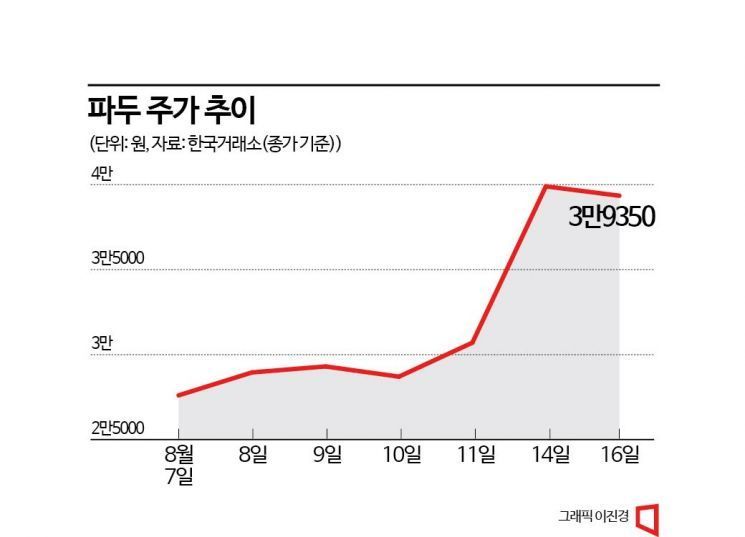

Surpassing 40,000 KRW Intraday Just 7 Trading Days After Listing

Producing Controllers for Data Storage Devices Specialized for Data Centers

Breaking Samsung Electronics' Monopoly Gains Attention... Individual Investors Lead 'Buy' Trend

On the day of its listing, the semiconductor design (fabless) company Pado, which had lost face by recording an opening price and closing price below the public offering price, has risen to just under 40,000 won within 7 trading days of entering the KOSDAQ. Individual investors led the buying momentum, supported by foreign investors, quickly pushing the stock price above the public offering price. However, the prevailing analysis is that it remains to be seen whether the upward trend in the stock price will continue. While the company's growth potential is recognized, profitability and supply-demand dynamics are key factors.

According to the Korea Exchange on the 17th, Pado closed at 39,350 won, down 1.38% from the previous day. Although the stock price rose to 46,850 won during the day, it ended lower as foreign investors turned to selling. From a supply-demand perspective, institutions have been continuously selling, and foreign investors have shown a tendency for short-term trading.

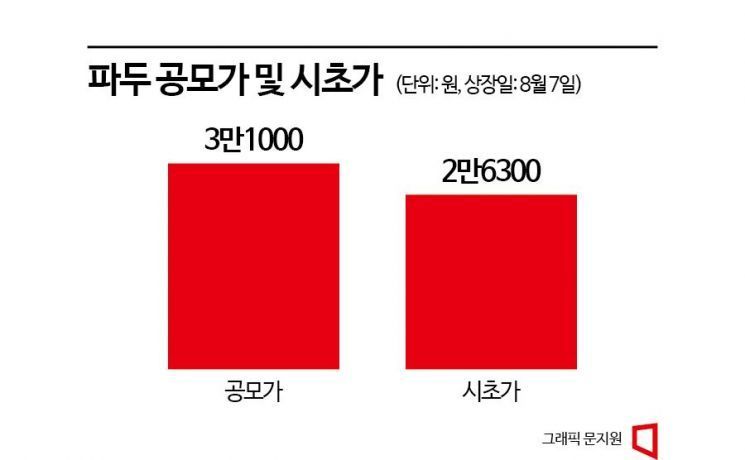

Pado was listed on the KOSDAQ market on the 7th. It was a highly anticipated promising stock this year as a major listing, but the stock price was sluggish. On the day of listing, the opening price was 26,300 won, more than 15% below the public offering price of 31,000 won, and the closing price plunged 10.97% to 27,600 won. The high public offering price and executives' stock options were obstacles to the stock price.

However, the stock price rebounded from the day after the listing. Since the listing, individual and foreign investors have net purchased 189.01 billion won and 5.928 billion won respectively, driving the stock price up. Institutions alone net sold 179.675 billion won worth of shares. The institutional selling is interpreted as profit-taking after buying shares before the public offering and selling after listing.

Pado produces controllers for solid-state drives (SSDs) specialized for data centers. NAND flash (NAND) is essential for data centers that store large-scale information. NAND is a non-volatile memory semiconductor capable of storage. It is cheaper than DRAM and is used as a chip in supercomputers. When dozens of NAND chips are assembled in parallel, they form an SSD. However, NAND is slow and vulnerable to heat, so a controller is essential. Connecting dozens of SSDs with controllers creates a server. Equipping multiple servers transforms it into a data center.

With the popularization of AI services represented by Chat GPT, demand for data SSDs is rapidly increasing. The six major global data center companies are Google, Meta (Facebook), Apple, Amazon, Microsoft (MS), and Alibaba.

However, data SSDs have high entry barriers because each client company has different technical standards. Until now, Samsung Electronics has virtually monopolized the supply of products to global data centers. However, the emergence of Pado has broken this monopoly. Since 2021, Pado has secured Meta as a client. In February this year, after raising investment funds, its corporate value exceeded 1 trillion won. This is why it is regarded as Korea's first semiconductor fabless unicorn company.

Pado also supplies controllers to NAND manufacturers. When NAND manufacturers have controllers, they can sell their NAND to global data center clients. SK Hynix is a representative example. One reason for Pado's stock price decline on the first day of listing was concerns that if SK Hynix focuses on controller development, Pado's performance could be shaken. However, this was unfounded. A representative from the listing underwriter explained, "Even if SK Hynix completes development immediately, sales will only start 2 to 3 years later. Moreover, data centers select at least three or more vendors, so there will be no significant impact."

However, poor profitability is a hurdle Pado must overcome. As a technology-specialized listing company, Pado's sales last year were 56.4 billion won, with an operating profit of only 1.5 billion won. While general companies must meet financial requirements for listing, technology-specialized listings are evaluated mainly on qualitative criteria such as growth potential through multiple professional evaluation agencies or growth assessments by listing sponsors (securities firms). An industry insider said, "Pado is steadily investing in other fields such as power semiconductors besides controllers. Some of these have progressed enough to generate sales within a few years, so long-term growth potential is expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)