The Bank of Korea forecasted that Japan's economy will continue a moderate recovery in the second half of this year, with domestic demand such as private consumption and facility investment growing by about 0.3% each quarter. It also expected that Japan's consumer prices in the second half will gradually slow down due to declining import prices and the base effect from last year's price increases.

In a report titled "Second Half Outlook for the Japanese Economy and Key Issues," published in the Overseas Economic Focus on the 13th, the Bank of Korea stated, "Private consumption will continue to improve mainly in the service sector, and facility investment will also increase, but exports are expected to remain sluggish, especially for goods."

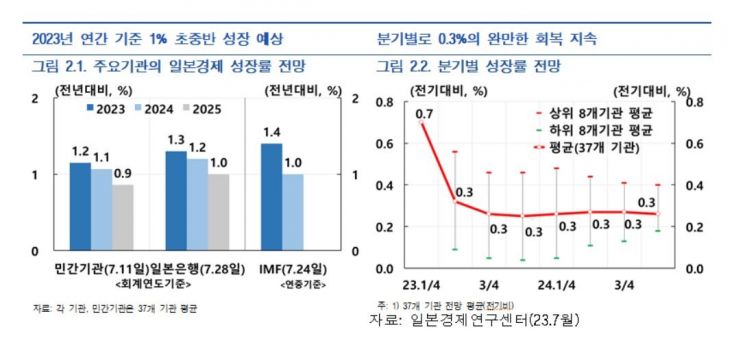

Major forecasting institutions anticipate that Japan's economic growth rate will be in the low to mid-1% range during this year, and around the low 1% range for the fiscal year (April 2023 to March 2024). However, they assessed that downside risks such as a weakening global economic growth trend and reduced purchasing power due to rising prices are latent in the future growth path.

According to the report, private consumption is expected to continue improving due to sustained pent-up demand in the service sector and rising wages. Facility investment is projected to maintain its upward trend, supported by the execution of previously postponed investment plans and increased demand for decarbonization and digitalization investments. Exports of services are expected to continue growing, driven by the recovery in the number of foreign tourists and increased tourism consumption, but goods exports are likely to continue the sluggish trend seen in the first half due to the weakening global economic growth.

The employment situation is expected to remain favorable, supported by the economic recovery. Nominal wages will continue to rise as wage pressures from labor shortages are reflected in the high wage increase rate agreed upon in the spring labor negotiations, and real wages are expected to turn to an increase after next year as the rise in nominal wages expands, reducing the decline caused by inflation. The wage increase rate agreed upon in this year's spring labor negotiations was 3.58%, the highest since 1993, with the basic wage increase rate also reaching 2.12%. In May, the nominal wage increase rate was 2.9%, significantly higher than the 1.3% recorded in March, and the regular wage increase rate, which accounts for about 76% of total nominal wages, was 1.7%, the highest since June 1997 (1.7%). Considering the strong correlation between the regular wage increase rate and the spring labor negotiation basic wage increase rate, this year's wage increase rate is likely to expand compared to last year. In the medium to long term, the report analyzed that as the population continues to decline, labor shortages will intensify, leading to increased wage pressure.

Japan's consumer prices in the second half are expected to gradually slow down due to declining import prices and the base effect from last year's price increases. Major private institutions forecast the quarterly consumer price (excluding fresh food) increase rates in the second half to be 2.8% in Q3 and 2.3% in Q4. The Bank of Korea stated, "Recently, Japan's consumer prices have been slowing in their rise due to falling energy prices, but the pace has been slower than expected earlier this year," adding, "Going forward, Japan's consumer prices are expected to slow in their rise mainly for goods prices due to declining import prices, but service prices, which have a high labor cost component, will see an expanded rise due to wage increases."

Regarding monetary policy, the Bank of Korea's report anticipated that the Bank of Japan will maintain a dovish stance, emphasizing the side effects of a hasty policy shift, making it likely that the current accommodative monetary policy will continue for a considerable period. The Bank of Japan is maintaining a cautious approach to policy shifts based on past experiences of failing to escape deflation after tightening monetary policy. Market participants generally expect that the Bank of Japan's full policy shift will likely occur after 2025, considering the cautious inflation outlook and mitigation of side effects from accommodative policies.

The Bank of Korea added, "The Bank of Japan is likely to confirm the establishment of inflation accompanied by wage increases through next year's wage negotiation results and complete its review of accommodative policies before shifting its policy stance. However, it is possible that some policies, such as expanding the fluctuation range of yield curve control (YCC) and shortening the target maturity, may be adjusted while maintaining the current negative interest rate policy under the continued accommodative monetary stance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)