LG Group, which concluded its first-half earnings announcements with LG Corporation, is expected to hold a CEO meeting next month to review the second-half management situation and future portfolio. As demand for home appliances has slowed, the group plans to strengthen its automotive parts and battery businesses and grow future industries such as ABC (Artificial Intelligence, Bio, Cleantech) according to its 'selection and concentration' strategy. Consequently, the second half will likely involve follow-up work such as reviewing execution status, portfolio assessment, and strategy supplementation.

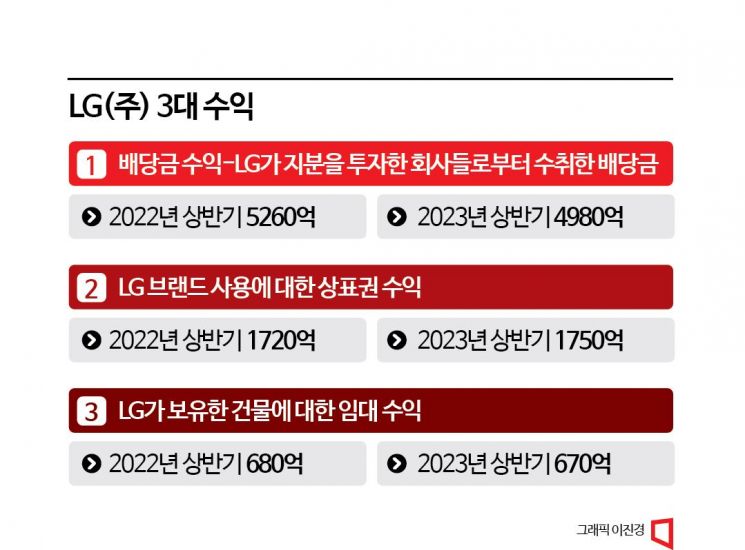

LG Corporation, led by Chairman Koo Kwang-mo, recorded first-half sales of KRW 3.5484 trillion and operating profit of KRW 959.6 billion, mainly from dividends and trademark rights. Although it performed better than other companies whose first-half results plummeted due to uncertain business environments, profitability has deteriorated compared to the past, increasing Chairman Koo’s concerns about improving profitability through business restructuring.

It is highly likely that the management focus for the second half will be on strengthening profitability and expanding future business areas. LG Group can be broadly divided into three categories: electronics affiliates such as LG Electronics, LG Display, LG Innotek, and Robostar; chemical affiliates including LG Chem, LG Energy Solution, and LG Household & Health Care; and telecommunications and service affiliates like LG Uplus and LG HelloVision. Although these fields are very different, LG has found a business that can simultaneously boost the performance of all these affiliates: future automobiles. Electronics handle automotive parts, chemicals focus on batteries, and telecommunications work on autonomous driving assistance businesses. Expanding the share of automotive parts and battery businesses means improving the overall profitability of the group’s affiliates.

LG Electronics is transforming its corporate DNA from hardware (HW)-centered to software (SW)-centered, expanding 'customer experience' to increase its sales from about KRW 65 trillion last year (excluding LG Innotek) to KRW 100 trillion by 2030. In the automotive parts business, it is actively seeking new opportunities in future mobility areas such as autonomous driving, software solutions, and content, aiming to evolve into a global top 10 player with KRW 20 trillion in sales by 2030.

Its decision to participate for the first time in the 'IAA Mobility 2023' motor show held next month in Munich, Germany, is also to accelerate its automotive parts business in the second half. LG Chem, which is experiencing a downturn in the petrochemical sector, is expected to focus on business restructuring in the second half. It will reduce its petrochemical share and accelerate the development of new secondary battery businesses. With the global battery market expected to grow by more than 33% compared to last year, LG Energy Solution will expand production capacity and accelerate market dominance, especially in the North American market in the second half.

The AI, Bio, and Cleantech sectors, which Chairman Koo has identified as future growth engines for LG beyond the next decade, also require increased investment and strategic refinement in the second half. As these are new businesses, investment currently outweighs returns, making precise portfolio direction more critical. Chairman Koo is expected to convene the CEOs and business division heads of each affiliate next month to discuss management issues based on these topics.

Instead of the regular quarterly CEO meetings held at the LG Twin Towers, this meeting is likely to take the form of a separate workshop. Chairman Koo emphasized at the September meeting last year the need for the CEO group to think from the perspective of future customers. Accordingly, this meeting is expected to focus intensively on reviewing the group-level future portfolio and execution strategies. Additionally, with business reporting meetings scheduled in October and November for each affiliate to discuss annual business performance and next year’s plans, the CEO workshop will likely determine the direction for those reporting meetings.

Meanwhile, LG CNS’s KOSPI listing is another major event anticipated in the second half for LG Group. LG CNS initially selected KB Securities, Bank of America (BOA), and Morgan Stanley as lead underwriters and prepared for an IPO application in the first half. However, due to the recent unfavorable stock market conditions, the timing of the listing is currently being adjusted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)