Operating Loss Forecast for Exchanges Except Upbit This Year

"Foreigners and Corporations Provide Liquidity Through Virtual Asset Investments" Claim

In the domestic virtual asset market, Upbit is solidifying its dominance by holding the number one market share. While other exchanges are attempting to narrow the gap through aggressive marketing, they are only feeling the height of the barrier. The virtual asset industry argues that the domestic virtual asset market itself should be expanded by opening its doors not only to individuals but also to foreign and corporate investors.

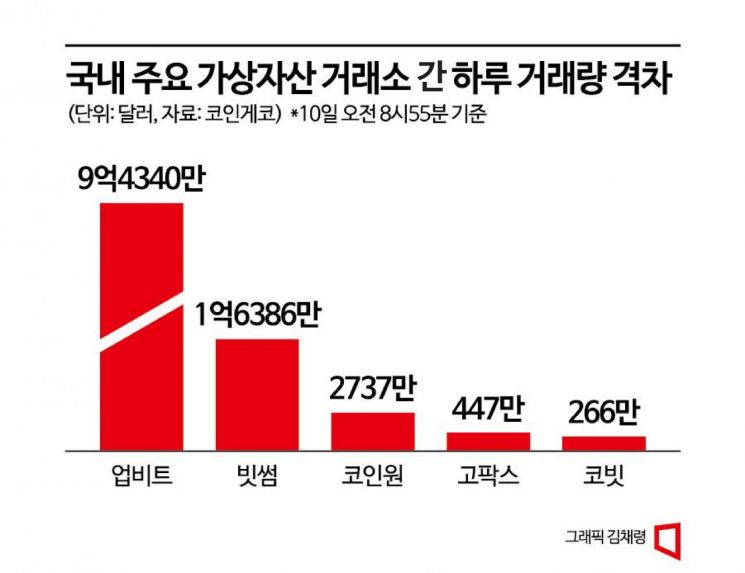

According to CoinGecko, a virtual asset market data relay site, as of 8:55 a.m. on the 10th, Upbit's 24-hour trading volume was $943.4 million (approximately 1.2406 trillion KRW). This is 5.76 times higher than Bithumb, the second-largest domestic exchange, which recorded a 24-hour trading volume of $163.86 million (approximately 215.5 billion KRW). The gap widens even more when compared to other KRW market exchanges. Upbit's 24-hour trading volume is 34.47 times that of Coinone, 211.05 times that of Gopax, and 354.66 times that of Korbit.

Recently, domestic KRW market exchanges such as Bithumb have been trying to reduce the market share gap by offering events like zero fees. Bithumb is implementing a zero-fee policy on a total of 20 virtual assets and plans to add 10 more zero-fee virtual assets every week. They are also running a zero-fee policy for trading in the Bitcoin market where transactions are made using Bitcoin. A Bithumb representative explained, "After implementing the zero-fee policy on some virtual assets, the average total usage time and average usage time per person on the Bithumb application increased by nearly 20% each," adding, "The number of new app installations also increased by 10% compared to the previous week."

Coinone is conducting events such as giving department store gift certificates for KRW deposits to attract new users. Gopax is marketing by offering rewards for inviting new members. Korbit also provides cash rewards for signing up or making the first trade.

Additionally, listing Worldcoin, developed by Sam Altman, CEO of OpenAI who created ChatGPT, by Bithumb, Coinone, and Korbit is interpreted as a strategy to increase market share.

Despite these efforts, Upbit's influence in the domestic market remains absolute. According to data from virtual asset data provider CCDATA, Upbit's trading volume in July surged 42.3% from the previous month to $29.8 billion (approximately 38.74 trillion KRW). Upbit recorded a higher trading volume than global exchanges Coinbase and OKX. It ranked second in trading volume after Binance, which holds over 40% of the global market share. Although the trading volumes of other exchanges such as Bithumb and Coinone also increased compared to the previous month, they did not match Upbit's growth rate.

Some predict that exchanges other than Upbit will record operating losses this year. Therefore, there are calls to expand the base of the domestic coin market for the survival of other exchanges besides Upbit. The industry argues that if foreign and corporate virtual asset investments through domestic exchanges become fully possible, liquidity will be supplied, which could lead to growth in market share or revenue for other exchanges.

An industry insider said, "Efforts are being made to secure market share through coin listings and zero-fee events, but users continue to flock to exchanges with high liquidity," adding, "Domestic individual investors are the target, but if overseas investors are accepted and the pie is expanded, the performance of other exchanges is also expected to improve."

Another insider stated, "With the clear limitations of the domestic coin market, if corporations participate as investors, additional liquidity supply will become possible," adding, "Since corporations will also conduct due diligence on the virtual assets they invest in and the exchanges they use, there is also an expectation that the soundness of the domestic coin market will naturally improve."

Under the current Act on Reporting and Using Specified Financial Transaction Information, there are no regulations preventing foreign or corporate investors from trading virtual assets domestically. Exchanges operating KRW markets must enter into contracts with banks to issue real-name accounts, but financial institutions must refuse transactions if "customers refuse to provide information for identity verification or if customer verification is not possible." To this end, exchanges must implement Anti-Money Laundering (AML) and Know Your Customer (KYC) systems, but in the process, they restrict usage by foreigners or domestic non-residents whose identity verification is relatively difficult. Furthermore, financial institutions do not issue real-name accounts for corporations to use KRW market exchanges, and with strengthened KYC, exchanges also restrict corporate usage, making direct corporate investment in virtual assets practically difficult.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.