Sales Start This Month... Utilizing Facilities with Reduced Operation

Existing Companies Bewildered by the Emergence of Strong Latecomers

An unexpected 'rebar war' has begun in the steel industry. POSCO is making a big splash by entering the rebar market for the first time since its founding. Although a latecomer, it is expected to quickly establish itself in the market with price and quality competitiveness based on its powerful production capacity.

Steel companies that have been producing rebar until now feel uncomfortable with POSCO's entry into the rebar market. Even though POSCO's supply volume is not large at the moment, they are concerned that POSCO will expand its rebar business in the future once it has set foot in the market. The construction industry, which is the demand sector, is sluggish, and the number of competitors is increasing.

Starting this month, POSCO began producing rebar using one wire rod (rod-shaped steel mainly used as raw material for wire) facility at the Pohang Steelworks and has started sales. The scale can produce 700,000 tons annually. To this end, POSCO obtained KS certification from the Korean Standards Association in May and subsequently held a product briefing session.

The coil rebar produced by POSCO is rebar rolled into a coil shape, which can be cut to the desired length unlike bar-shaped rebar, and is relatively convenient to load, resulting in logistics cost reduction. Also, POSCO uses the blast furnace method, which is evaluated to have price competitiveness compared to other companies using electric furnaces.

The wire rod facilities at Pohang Steelworks consist of four units, which were damaged by the Hinamno Road disaster last year but have all been restored. However, as cheap Chinese products entered the domestic wire rod market, the operating rate has been gradually declining. The annual domestic wire rod production volume decreased by 40%, from 3.7 million tons in 2021 to 2.66 million tons in 2022. This is interpreted as the reason POSCO focused on rebar as a new market.

It is also evaluated that the fact that rebar prices are higher than usual influenced POSCO's market entry. The distribution price of rebar soared to 1.2 million KRW per ton in May 2021 due to the COVID-19 pandemic. Although the price fell below 1 million KRW per ton this year, it remains at a higher level compared to previous years when it was below 800,000 KRW per ton.

However, the outlook does not seem easy. Domestic rebar production capacity is 12 million tons, but only about 10 million tons are produced annually, indicating an oversupply. Last year, domestic rebar sales amounted to only 9.666 million tons.

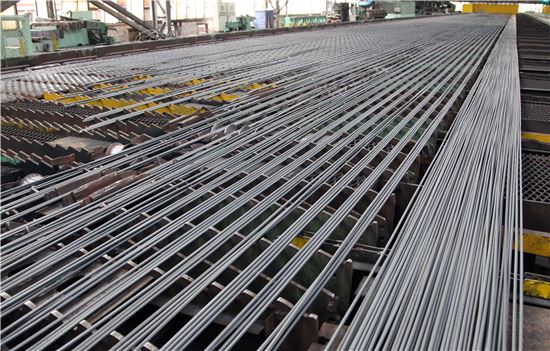

Rebar reference photo

Rebar reference photo

The problem is that the construction industry shows little sign of improvement. Last year, construction orders amounted to 229 trillion KRW, an 8.4% increase from the previous year, showing resilience, but cumulative construction orders from January to April this year were 58 trillion KRW, a 18.5% decrease compared to the same period last year. There is also a forecast that this year's annual construction orders will be around 201 trillion KRW, a 12.3% decrease from last year.

Existing rebar producers are facing a double blow as POSCO, a strong competitor, enters the market while the construction industry, the main demand sector for rebar, has not improved. Dongkuk Steel and Daehan Steel are major rebar producers.

An industry insider said, "POSCO would not have entered the rebar market just to sell 700,000 tons, and the other three wire rod facilities can start producing rebar at any time," adding, "In an oversupply situation, POSCO's entry will exacerbate difficulties."

Hyundai Steel, which produces straight rebar, is also closely watching POSCO's entry into the rebar market. Lee Sung-soo, head of Hyundai Steel's electric furnace business division, explained at the first half earnings announcement last month, "Although it is the rainy season, many companies are reducing production and cutting sales volume through maintenance, and all existing companies are quite concerned about POSCO entering the market."

Dongkuk Steel Coil Rebar

Dongkuk Steel Coil Rebar

A POSCO official said, "POSCO is participating in the domestic rebar market at a very small scale overall, and sales will be conducted mainly through bidding centered on group affiliates such as POSCO E&C," adding, "Using coil rebar improves work safety, reduces loss rate, and shortens construction time, so the construction industry welcomes POSCO's market entry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)