Theme Stock Day Trading Hits 27 Trillion Won in Trading Volume After 2 Years

Domestic Stock Market Turnover Also Soars to Highest Level This Year

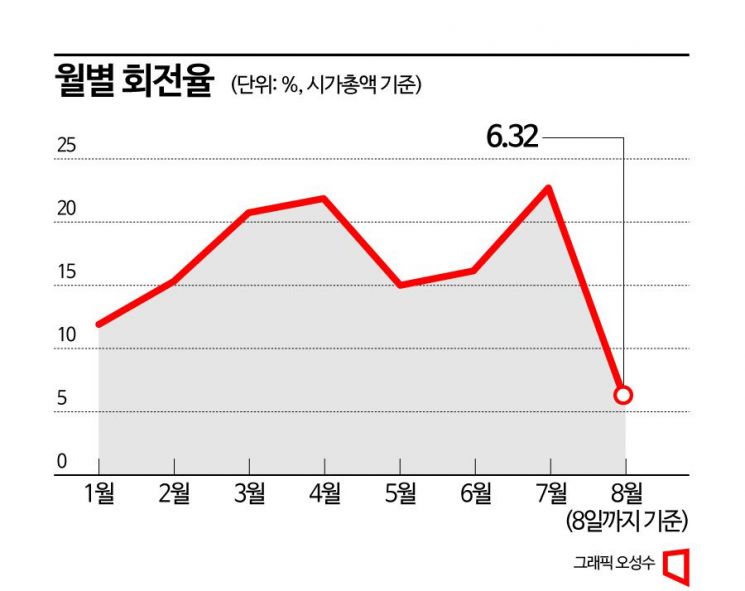

As the investment frenzy in theme stocks such as secondary batteries and superconductors intensifies, trading volume and turnover rates have soared to their highest levels this year. A high turnover rate means frequent changes in ownership, indicating an increase in short-term trading. Experts are concerned that such movements could increase market volatility. Regulatory authorities have also issued warnings about the overheating trend.

Investment Frenzy in Secondary Batteries and Superconductors

According to the Korea Exchange, the average daily trading value of the KOSPI and KOSDAQ last month was 27.043 trillion won, about 40% higher than June's 19.127 trillion won. On a monthly basis, the average daily trading value in July exceeded 27 trillion won for the first time in two years since August 2021 (27.461 trillion won). This surge is driven by the investment frenzy in secondary batteries. The KOSDAQ market, in particular, was lively. On the 26th of last month, the KOSDAQ trading value reached a record high of 26.481 trillion won. On that day, EcoPro's stock price soared intraday to 1,539,000 won before closing at 1,228,000 won, about 20% lower than the peak.

Trading value related to secondary battery stocks also increased sharply. In July, the combined average daily trading value of POSCO Holdings and POSCO Future M (2.6539 trillion won) accounted for 18% of the KOSPI's average daily trading value (14.19 trillion won). The combined trading value of EcoPro (1.5599 trillion won) and EcoPro BM (1.2991 trillion won) reached 20% of the KOSDAQ's average daily trading value (14.19 trillion won).

In particular, trading appeared to be heavily short-term. On the 26th of last month, the overall market turnover rate (based on market capitalization) was 2.52%, the highest since January 11, 2021 (2.53%). This is the highest level this year. The turnover rate, which had generally remained below 1% this year, mostly exceeded 2% since April. The turnover rate is the ratio of trading value to market capitalization; a higher figure means more frequent trading among investors.

Accordingly, the turnover rate of the domestic stock market reached 22.7% last month, the highest in 26 months since April 2021 (23.62%). The turnover rate had fallen to the 10% range last year due to the market downturn but rose back to the 20% range this year as investor sentiment recovered. The turnover rate was especially higher in the KOSDAQ market, indicating concentrated short-term trading. The KOSPI turnover rate in July was 14.46%, the highest this year. The KOSDAQ market soared to 61.8%, significantly up from 45.31% the previous month.

This high turnover rate appears to be driven by individual investors. According to an analysis by a major domestic securities firm, the turnover rate of investors in their 20s, which was 27% in January, more than doubled to 62.1% in July. For those in their 50s, it surged from 11% to 25%. For investors in their 30s, it increased from 27.6% to 35.7%. Those in their 40s and 60s and older saw slight increases from 21.7% to 23.7% and from 10.9% to 16.6%, respectively.

IPO Short-Term Trading Also Surges... Lee Bok-hyun Warns of Overheating

Recently, trading that had been concentrated on secondary battery stocks shifted to superconductor-related stocks. From the beginning of August to the 7th, trading values of superconductor-related stocks such as Seonam (92 billion won → 2.693 trillion won), Mobis (1 billion won → 1.65 trillion won), and Shinseong Delta Tech (17.2 billion won → 1.557 trillion won) increased dramatically.

There is also abundant standby capital in the stock market. Currently, investor deposits in the domestic stock market are at their highest level in a year. Investor deposits reached 58.199 trillion won on July 27, the highest since July 1 of last year (58.73 trillion won), and increased by more than 6 trillion won compared to the end of June (51.8 trillion won). The average has remained in the 55 trillion won range since the beginning of August. This large pool of funds is ready to flow into the market at any time.

Short-term trading has also surged in the IPO market due to price limit fluctuations on the listing day of new stocks. Contrary to the intention of enhancing price discovery, the influx of short-term trading is raising concerns about increased volatility. Since the so-called 'ttattabl' (a 400% increase over the public offering price) became possible on July 26, the average turnover rate on the listing day (based on listed shares) of newly listed stocks on the KOSPI and KOSDAQ reached 610%. The turnover rate of listed shares is the ratio of trading volume to the number of tradable shares; a higher turnover rate means more frequent ownership changes. Some stocks even exceeded a turnover rate of 1,500%. For example, OpenNol, a recruitment and job training platform listed on July 30, had a trading volume of 38,796,620 shares on the listing day, which is 15 times the number of tradable shares (2,584,710 shares) on that day.

As concerns about market volatility grow, regulatory authorities have issued warnings. Lee Bok-hyun, Governor of the Financial Supervisory Service (FSS), instructed thorough inspections and strict responses regarding false rumors circulating amid the theme stock fever involving secondary battery and superconductor stocks. At the FSS executive meeting on the 8th, Governor Lee expressed concern over the recent rapid fluctuations in theme stock markets, citing "excessive investor concentration, increased leverage (borrowed investment), and short-term trading" as signs of overheating. He also warned about the expansion of margin loans related to theme stock trading, which is increasingly driven by leveraged investments. In response, securities firms have implemented measures such as raising margin and loan collateral ratios and restricting credit extensions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)