64 Domestic Listed Companies Changed Names in First Half of This Year...Stock Price Analysis of 60 Companies Excluding SPAC Mergers

Stock Prices Rose on Expectations, Converging with Performance...Name Changes Declining Since First Half of Last Year

Every year, 50 to 60 companies change their company names for purposes such as improving corporate image. The effects varied by market. In the case of KOSDAQ-listed companies, there were many cases where the company name was changed when pursuing new businesses due to poor performance in existing businesses. They changed their names believing that the existing image would not help when promoting new businesses, but there was a time lag until performance improved through the new business. Stock prices that rose on expectations sometimes converged with actual performance, or initially rose due to expectations and then fell as profit-taking selling emerged. For KOSPI-listed companies, name changes were more often due to reasons such as enhancing the group-level corporate image or incorporating subsidiaries rather than poor performance in existing businesses. HD Hyundai Group is a representative example.

According to an analysis by Asia Economy on the stock price trends of 60 listed companies that changed their names in the first half of this year, excluding SPAC mergers, the average stock price increase rate was 2.0%. The increase/decrease rate was calculated by comparing the closing price on the date of the name change with the closing price on the 18th. When divided by market, the effect of name changes was greater among KOSPI-listed companies. Among KOSPI-listed companies, 20 changed their names in the first half of this year, with an average stock price increase rate of 9.7%. Among KOSDAQ-listed companies, 40 changed their names, with an average stock price change rate of -1.8%. Since March, when many companies changed their names, the KOSPI and KOSDAQ indices fell by 7.2% and 0.4%, respectively.

Among the 20 KOSPI-listed companies that changed their names, stock prices rose for 12 companies. Among the 40 KOSDAQ-listed companies, only 12 saw stock price increases. The probability of stock price increase after a name change was also higher for KOSPI-listed companies.

The listed company whose stock price rose the most after changing its name this year in the domestic stock market was POSCO DX. On March 20, it held an annual general meeting of shareholders and approved the agenda to change its name from POSCO ICT to POSCO DX. It explained that the name was changed to POSCO DX (Digital Transformation) to reflect business expansion potential and future value. The name embodies the meaning of being a leading company in the innovative digital transformation across industries. The stock price, which had been below 7,000 won, rose more than 330% in about four months.

POSCO DX supplies smart factory systems applying automation equipment, control systems, integrated production management systems, warehouse automation, and industrial robots to factories producing secondary battery materials such as lithium, nickel, cathode materials, and anode materials within the POSCO Group. It recorded sales of 775.8 billion won and operating profit of 64.3 billion won in the first half of this year, up 65% and 98% respectively compared to the same period last year.

The stock price of K-ENSOL, which changed its name from Wonbang Tech, also rose 170%. The company explained the reason for the name change as emphasizing global market entry in its external image and reflecting a modern and futuristic vision. On May 26, it held an extraordinary general meeting of shareholders and decided to change its name. The name K-ENSOL contains the meaning of becoming a company that provides solutions in the fields of environment, energy, and engineering. Along with the name change, it set goals to achieve sales of 1.5 trillion won and a corporate value of 1 trillion won by 2030.

Founded in 1989, K-ENSOL is a cleanroom design and construction company for various industries such as semiconductors and displays. Its major clients include Samsung Electronics, Samsung Display, SK Hynix, SK On, and LG Energy Solution. It recorded sales of 74.6 billion won and operating profit of 1.8 billion won in the first quarter, down 28.2% and 76.7% respectively from the same period last year. Although the first quarter performance was sluggish, it secured growth momentum by supplying dry rooms to secondary battery material factories. Moisture present in production equipment processes can react with lithium ions or electrolytes, reducing product yield. This is why demand for dry rooms is increasing. A K-ENSOL official said, "We are ending the Wonbang Tech era of over 30 years and preparing for a new leap."

In the KOSPI market, POSCO Future M's stock price rose the most after the name change, increasing by 60%. Expectations for the secondary battery business drove the stock price up. Following were Korea Movex (48.0%) and HD Korea Shipbuilding & Offshore Engineering (44.5%) with significant stock price increases.

At the beginning of this year, HD Group affiliates that included HD in their names, meaning 'Human Dynamics' for the dynamic energy of humans and 'Human Dreams' to realize humanity's dreams, generally saw stock price increases. HD Korea Shipbuilding & Offshore Engineering, HD Hyundai Electric, and HD Hyundai Construction Equipment were among the top gainers.

Among listed companies with sluggish stock price trends after changing their names were Suseong Salbasion and Georit Energy, whose stock prices halved. Suseong Salbasion is a manufacturer of industrial trucks and loaders. As a new business, it distributes the nasal spray product 'Kobixil,' which has been verified for neutralizing respiratory viruses. It recorded sales of 18.5 billion won, operating loss of 1.5 billion won, and net loss of 15.5 billion won in the first half of this year.

Georit Energy's stock price fell 51% after changing its name from GN One Energy. Georit Energy supplies geothermal heating and cooling systems that use the earth's heat to provide heating and cooling for facilities and buildings. It is pursuing lithium business, a core material for secondary batteries, as a new business.

Georit Energy's stock price surged between March and April this year. The stock price, which had been below 5,000 won, surpassed 20,000 won in about a month. This was a period of high interest in lithium-related companies in the domestic stock market. News that it would develop a U.S. salt lake together with Israeli company Xtralit, which possesses lithium extraction technology, led the stock price rise. As the stock price surged rapidly in a short period, profit-taking desires increased, and the stock price has been declining for the past four months. Georit Energy recently announced progress in its new business, stating it is securing geothermal water capable of extracting 2,800 tons of lithium annually.

APS, the effective holding company of the APS Group, removed 'Holdings' from its name at the regular shareholders' meeting in March. It explained the change was for business expansion and corporate image enhancement. Among its affiliates, AP System, DNT, Nextin, and Konic Automation are listed on the domestic stock market. APS recorded sales of 5 billion won and operating loss of 7 billion won in the first quarter on a consolidated basis. Sales decreased by 17% compared to last year, and the loss size slightly decreased. APS's stock price has been continuously falling this year. Despite efforts to improve its image, the stock price seems to be declining due to lack of performance improvement.

Lithium Force changed its name twice in the past year. It changed from W.I. to Urban Lithium in November last year, then reverted to Lithium Force after six months. The company explained the name changes were to enhance future value. After reaching an all-time high of 35,500 won on April 14, the stock price fell below 16,000 won within four months. The downward trend continued even after the name change on May 26.

A financial investment industry official said, "The procedure for a listed company to change its name is complicated," adding, "Often, expectations are already reflected during the period when the name change is announced and the shareholders' meeting is held to approve the agenda." He continued, "Once the name is actually changed, investors expect substantial changes, and as the psychology to confirm improved performance spreads, stock prices may remain sluggish."

Listed companies that changed their major shareholders or discontinued underperforming existing businesses to pursue new businesses started by changing their names. Since changing a company name requires amending the articles of incorporation, a shareholders' meeting must be held. Although the procedure is cumbersome and shareholder consent is required, a considerable number of listed companies adopt new names every year.

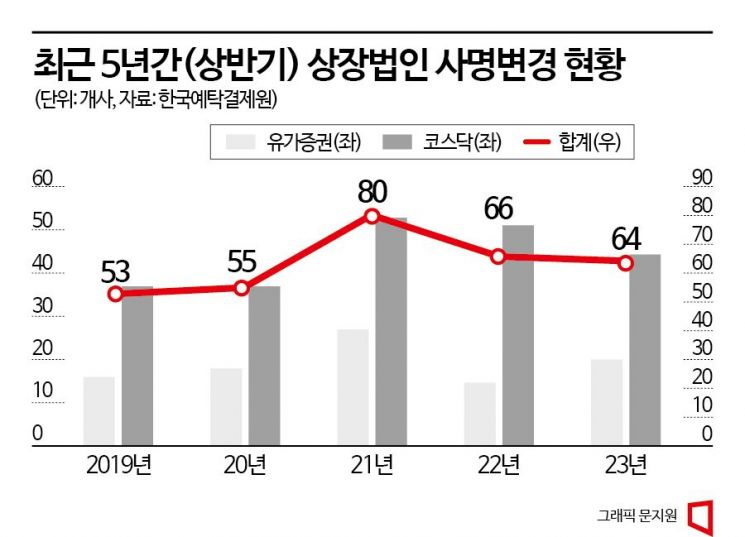

According to the Korea Securities Depository, 64 listed companies in the domestic stock market changed their names in the first half of this year. This is two fewer than the 66 companies in the first half of last year. Among KOSPI-listed companies, 20 changed their names, an increase of five compared to the same period last year. During the same period, 44 KOSDAQ-listed companies changed their names, seven fewer than the previous year.

As of the first half of the year, the number of companies changing their names increased steadily from 2019 to 2021. There were 53 companies in the first half of 2019, 55 in 2020, and 80 in 2021. Last year recorded 66 companies.

The main reasons for name changes in the first half of this year were 'enhancement of management objectives and strategies' with 32 companies (41.0%), followed by 'image improvement' with 19 companies (24.4%). Other reasons included business diversification (13 companies) and spin-offs/mergers (8 companies).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.