China's BOE Faces iPhone 15 Panel Production Disruptions Due to Technical Issues

OLED Technology Race for Smartphones Slows Down

Expanding into Car OLED Displays and Other Areas Poses Threat

It appears that domestic companies will supply all the organic light-emitting diode (OLED) panels for Apple's 'iPhone 15,' scheduled for release in the second half of the year. This is because BOE, China's largest panel manufacturer, is reportedly facing technical process issues that make the approval of their panel production uncertain. As a result, China's pursuit in the smartphone OLED market is expected to slow down for the time being. However, there is a tense atmosphere as China is expanding its presence into the automotive display market.

On the 9th, securities analysts analyzed that BOE's attempt to supply low-temperature polycrystalline silicon (LTPS) thin-film transistor (TFT) OLED panels for the basic and Plus models of the iPhone 15 has been halted. It is interpreted that BOE has effectively failed to supply panels for the iPhone 15 this year due to technical problems.

Dongwon Kim, a researcher at KB Securities, stated, "It is highly likely that Samsung Display and LG Display will supply 100% of the iPhone 15 OLED panels," adding, "Chinese BOE faces not only technical issues such as dynamic island hole display processing but also OLED technology patent lawsuits with Samsung, which will further reduce the possibility of supplying iPhone 15 OLED panels until the end of this year."

The dynamic island is a feature Apple introduced with the iPhone 14 last year, applying a UI to the punch-hole display that allows users to check alerts, notifications, music playback, Face ID, and more. Apple applied the dynamic island only to the Pro lineup in the iPhone 14 series, but this year, it will be applied to the lower lineup as well in the iPhone 15 series. BOE is reportedly struggling with the hole display processing required to implement this dynamic island.

The iPhone 15 series is expected to be released in four models. Samsung Display will supply OLED panels for all four new iPhone models (basic, Plus, Pro, Pro Max), while LG Display will supply OLED panels for the two higher-end 'Pro' models. Domestic display companies, which had felt threatened as China rapidly closed the technology gap in smartphone OLEDs, can now breathe a sigh of relief.

China's pursuit in the small- and medium-sized OLED market, used in mobile devices and PCs, is fierce. Market research firm Omdia reported that Samsung Display's sales in the small- and medium-sized OLED market in the first quarter of this year decreased by 6.7% compared to the same period last year and dropped 35.5% from the fourth quarter of last year to $4.67685 billion (approximately 6 trillion KRW). Its market share also fell from 80.9% in the first quarter of 2020 to 54.7% in the first quarter of this year. Meanwhile, BOE's market share rose from 6.1% in the first quarter of 2020 to 19.2% in the first quarter of this year, securing second place worldwide.

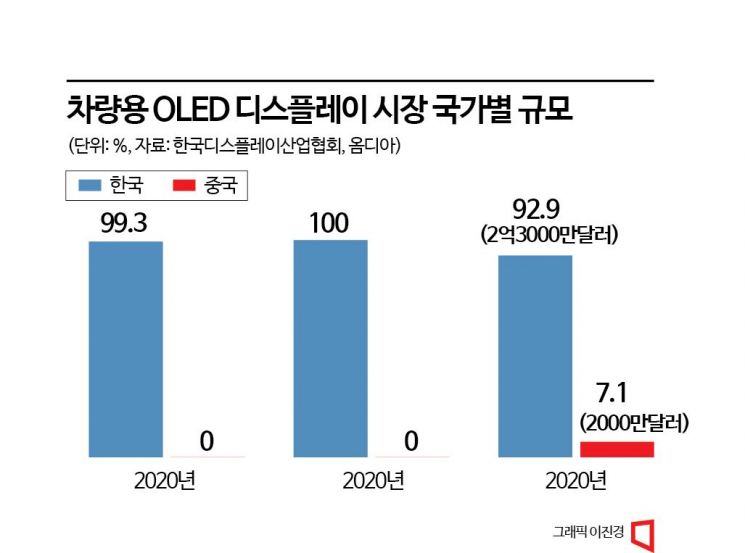

Chinese companies are aggressively increasing their market share in various OLED markets, including automotive displays, so the threat of market encroachment remains.

According to the 'Automotive Display Value Chain Analysis Report' published by the Korea Display Industry Association, the automotive OLED market was worth $250 million last year, with Korea holding a 92.9% share ($230 million). China's share of the automotive OLED market last year was 7.1% ($20 million). However, considering that its share was 0% the previous year, it can be seen that China achieved significant results immediately after entering the market. In fact, Chinese companies such as BOE and Tianma are chasing Korean companies with the support of government subsidies.

The Korea Display Industry Association pointed out, "Considering that Korean companies, which once led the liquid crystal display (LCD) industry, lost their dominance due to the low-price offensive from latecomer Chinese companies, competition with China in the OLED market is likely to intensify," adding, "It is important to pay attention to whether a similar intensification of competition will appear in the automotive OLED market in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.