Ant, EcoPro, and Others Invest Over 4 Trillion Won in POSCO After Profit-Taking

Foreign Buying Likely Driven by EcoPro Short Covering and MSCI Korea Index Inclusion Boost

Individual and foreign investors have been focusing on buying secondary battery stocks over the past month. However, individuals mainly purchased POSCO Holdings on the KOSPI, while foreigners primarily bought EcoPro on the KOSDAQ, showing a divergence in stock preferences. Individuals who realized profits from EcoPro and others switched to POSCO, while foreigners appeared to be betting on EcoPro due to its potential inclusion in the MSCI Korea Index.

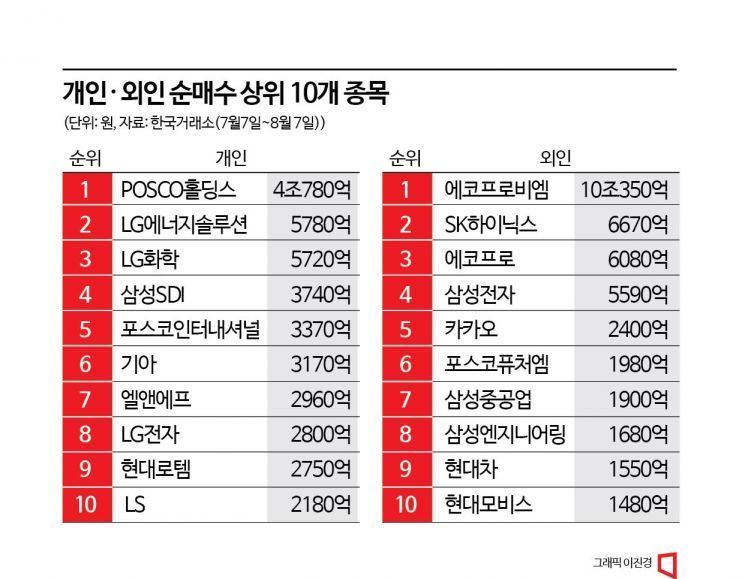

According to the Korea Exchange, the top 10 stocks with the highest net purchases by individuals over the past month (July 7 to August 7) were POSCO Holdings, LG Energy Solution, LG Chem, Samsung SDI, POSCO International, Kia, L&F, LG Electronics, Hyundai Rotem, and LS, in that order. The top four stocks are all secondary battery-related stocks listed on the KOSPI. Notably, individuals poured as much as 4 trillion won into POSCO. This seems to reflect attention to POSCO’s potential to emerge as a leading secondary battery stock following EcoPro and others. A market insider said, "The concentration on secondary battery stocks has intensified, increasing overall market volatility, but it appears that investors found no better stocks or sectors to outperform the secondary battery theme stocks."

The concentration on secondary battery stocks has eased somewhat, but enthusiasm remains strong. EcoPro’s stock price, which was 110,000 won at the beginning of the year, surpassed 1,118,000 won on the closing price basis on July 18, becoming a dominant stock. EcoPro BM’s stock price also peaked at 462,000 won on July 25, up from 93,400 won. Despite high valuation concerns and attacks from short sellers, EcoPro group stocks had been soaring but showed signs of hesitation since the end of last month.

As a result, the investment frenzy for secondary battery stocks shifted to POSCO and POSCO Future M. POSCO’s stock price hovered around the 300,000 won range from 272,000 won at the start of the year but began to heat up in mid to late July, closing at 658,000 won on July 25.

In particular, its market capitalization surpassed 50 trillion won within a month, jumping from 10th to 5th place. Although it has since undergone some correction, securities firms have been raising POSCO’s target price consecutively, positively evaluating the growth potential of its secondary battery materials business. This explains why more than 4 trillion won of individual investor money flowed into a single POSCO stock.

During the same period, the stock prices of LG Energy Solution, LG Chem, and Samsung SDI declined somewhat. LG Energy Solution fell 8.5% (from 562,000 won to 514,000 won), LG Chem dropped 6.2% (from 656,000 won to 615,000 won), and Samsung SDI decreased 11.4% (from 697,000 won to 617,000 won). All three stocks saw individuals buying while foreigners and institutions were selling.

The top 10 stocks with the highest net purchases by foreigners were EcoPro BM, SK Hynix, EcoPro, Samsung Electronics, Kakao, POSCO Future M, Samsung Heavy Industries, Samsung Engineering, Hyundai Motor, and Hyundai Mobis. Over the month, EcoPro BM rose 21.4% (from 280,000 won to 340,000 won), and EcoPro increased 8.0% (from 980,000 won to 1,066,000 won). Hwang Kyu-won, a researcher at Yuanta Securities, explained, "Foreigners seem to be buying EcoPro due to its potential inclusion in the MSCI Korea Index. If included, passive funds such as ETFs will be required to purchase the stock regardless of price, which is expected to drive the stock price up." Of course, short-covering due to short selling also appears to have significantly influenced foreign buying.

Meanwhile, it is notable that semiconductor stocks, which individuals have turned to selling, ranked high in foreigners’ net purchases. Samsung Electronics slightly declined (from 69,900 won to 68,500 won), but SK Hynix rose modestly (from 110,800 won to 121,900 won). Ryu Hyung-geun, a researcher at Samsung Securities, said, "SK Hynix is leading the supply of high-bandwidth memory (HBM3) to Nvidia, making it a beneficiary stock of HBM. SK Hynix is ahead in market launch timing, while Samsung Electronics is expected to start selling HBM3 in the fourth quarter of this year." He added, "We still consider Samsung Electronics and SK Hynix to be in an active buying phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.