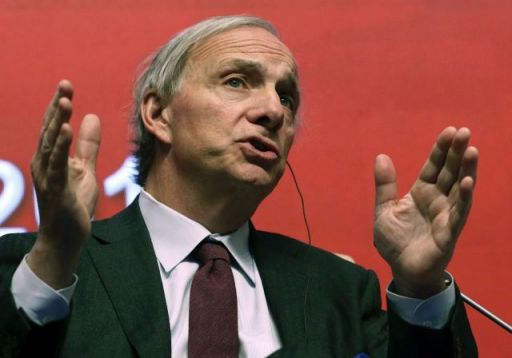

Ray Dalio "Governments Must Also Repay Debt"

"Political Intervention May Intensify"

Ray Dalio, an American billionaire and hedge fund legend who founded Bridgewater Associates, cited the "wealth transfer effect" as the reason why the U.S. economy has not contracted despite sharp interest rate hikes.

He warned that this has weakened the balance sheets of the public sector (central government + central bank) in various countries, and that a situation may arise where the government budget has to support the central bank.

On June 2 (local time), Dalio explained on the business social networking service LinkedIn why the U.S. economy is still showing high growth rates. Previously, the U.S. Gross Domestic Product (GDP) grew at an annual rate of 2.4% in the second quarter.

Dalio stated, "Wealth has moved from the government, central bank, and bondholders to the private sector (businesses and households)," adding, "This was designed by the government."

According to Dalio, during the height of the COVID-19 pandemic in 2020-2021, the U.S. government budget deficit was 10-14% of GDP. During the same period, the Federal Reserve's bond holdings nearly doubled from 18% to 35% of GDP, and the benchmark interest rate was kept at zero. This meant that businesses and households could effectively borrow money for free. It was more advantageous to borrow than to save.

Even after the pandemic ended in 2022, the public sector continued massive spending. The government deficit was around 5-6% of GDP. However, the Fed implemented quantitative tightening policies. As a result, some sectors of the U.S. economy were hit, but Dalio explained that the private sector's balance sheets have still improved compared to before COVID-19.

Now the Public Sector is at Risk... Dalio: "Bank Net Assets Could Turn Negative"

The problem lies in the fact that while the "wealth transfer" has helped the private sector recover, the public sector has weakened. Dalio said, "Is it a problem that the real economy is doing quite well but the government and central bank's balance sheets have worsened? Of course, it is a problem," emphasizing, "The government also has to pay debt repayments and principal. The only difference between the government and households is that the government confiscates wealth through taxes."

Dalio especially expressed concern about losses at central banks including the Fed. If government deficits surge, the interest (repayment costs) on government debt also increases. In this case, banks' balance sheets worsen further, which could eventually lead to bank losses. If the central bank turns to net asset losses, a paradoxical situation arises where the central government must support the banks.

Dalio explained, "In Germany, if the Bundesbank, the central bank, has a negative net asset position, it must secure capital from the government. In the UK, the Treasury is already set to cover losses of the Bank of England up to 2% of GDP in such a scenario."

He continued, "Many central banks are considering what to do in these types of scenarios," and predicted, "In the U.S., if the Fed incurs large losses and the government has to cover them, there will be political reactions."

He warned, "One can imagine the independence of central banks weakening and politics strengthening political control over central banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.