Average Base Interest Rate in 9 Countries Up 3.38%P

Fastest Rise in 43 Years

Base Interest Rate Surpasses CPI After 3 Years 8 Months

Major Countries Nearing End of Tightening Policies

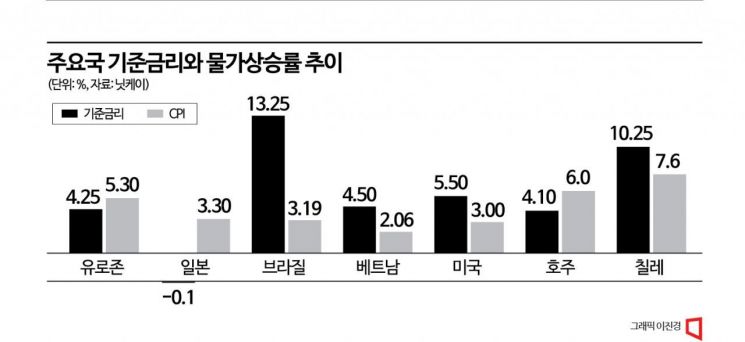

Global inflation triggered by the 'money printing' policies of various countries after COVID-19 is showing signs of gradually being controlled due to high-intensity monetary tightening by major countries that began in earnest last year. As the benchmark interest rates of major countries have surpassed inflation rates for the first time in 3 years and 8 months, it is analyzed that the inflation suppression effect of the high-intensity tightening is becoming visible.

On the 7th, the Nihon Keizai Shimbun cited statistics from the Bank for International Settlements (BIS), reporting that the benchmark interest rates of nine major countries including the UK, the US, and the Eurozone have risen by 3.38 percentage points in one and a half years. This is the fastest pace in 43 years since 1980. In 1980, the US aggressively raised interest rates to curb inflation, which had surged to a record high of 14.8%.

Due to aggressive tightening policies by various countries, benchmark interest rates have also outpaced inflation rates. According to SMBC Nikko Securities, a major Japanese securities firm, last month the difference between the benchmark interest rates of central banks worldwide and each country's Consumer Price Index (CPI) turned positive for the first time in 3 years and 8 months. Nihon Keizai explained, "Interest rates exceeding the inflation rate means that the overheated economy is beginning to cool down."

As signs of inflation being controlled appear, tightening policies worldwide are also approaching their final stages.

The US and Europe have left open the possibility of holding interest rates steady at their September monetary policy meetings. In the US, the June CPI inflation rate was 3.0%, the lowest since March 2021, strengthening expectations that the Federal Reserve's rate hike last month may be the final increase. The European Central Bank (ECB) also announced that due to indicators showing a sharp decline in Eurozone corporate loan demand and economic contraction caused by strong tightening policies, not only rate hikes but also the option of holding rates steady will be considered.

Some emerging countries are even lowering interest rates. On the 2nd, the Central Bank of Brazil unexpectedly cut rates by 0.5 percentage points for the first time in 3 years, far exceeding market expectations of a 0.25 percentage point cut. This decision was made as inflation, which had surged to around 12% early last year, fell to the 3% range.

Stabilization of food and resource prices this year has also contributed to the slowdown in inflation. Although international oil prices and global food prices have recently turned upward, oil prices have fallen from over $130 in March last year to the low $80 range currently.

However, there are also forecasts that even if central banks stop tightening policies, it will be difficult for the economy to achieve a soft landing. It is expected that the financial markets, shocked by prolonged high interest rates, and the weakened economy will not easily improve. The International Monetary Fund (IMF) stated last month that due to the long-term effects of tightening policies, the global economic growth rate is expected to be 3.0% this year and next, which is below the 20-year average growth rate of 3.8% from 2000 to 2019.

Nihon Keizai analyzed, "In the 1980s, the US also experienced two severe recessions before inflation was controlled," adding, "While there is a strong view that a soft landing of the US economy is possible, concerns about a recession will continue to remain."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.