Resolution to Increase Capital for Raw Material Purchase Costs and Debt Repayment

Rising Demand for Laser Notching Equipment Amid LG Energy Solution's Large-Scale Expansion

DENT, a manufacturer of laser notching equipment for secondary battery cathodes, is raising funds by issuing new shares to shareholders to meet increased orders. With the recent rise in stock prices, it is expected to secure more funds than initially planned at the board resolution.

According to the Financial Supervisory Service's electronic disclosure system, DENT will issue 6 million new shares through a rights offering followed by a general public offering of forfeited shares. The planned issue price is 19,790 KRW per share, raising a total of 118.7 billion KRW.

On June 21, DENT held a board meeting and resolved to proceed with a paid-in capital increase. At that time, the planned issue price was 14,480 KRW, but last month, as secondary battery-related stocks surged in the domestic market, the initial issue price also increased. The final issue price will be confirmed on the 30th, and subscription for existing shareholders will take place over two days from the 4th to the 5th of next month.

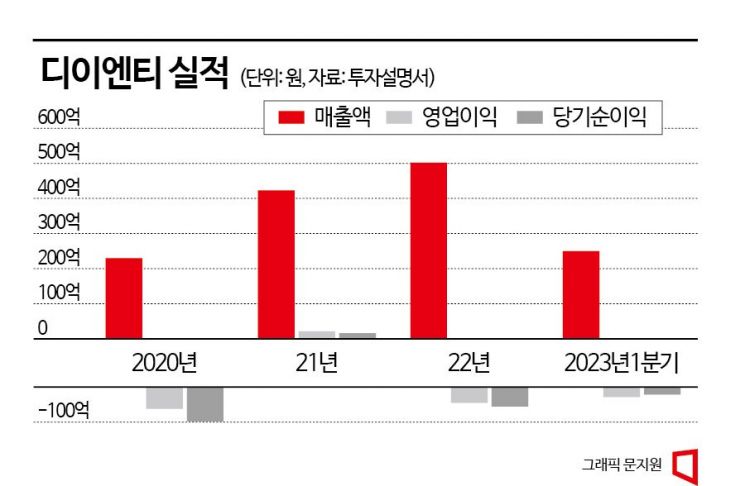

Founded in 2001, DENT initially produced display inspection process equipment but entered the secondary battery market in 2019 by developing laser notching equipment. Sales from the secondary battery division account for 80-90% of total revenue.

The notching process is one of the assembly steps in secondary battery manufacturing. Laser notching equipment cuts roll-shaped cathodes and anodes completed in the electrode process. It offers advantages over conventional press equipment in terms of speed, yield, and maintenance costs. As a technically challenging device, DENT is the only company in Korea mass-producing laser notching equipment. DENT supplies laser notching equipment to LG Energy Solution.

Kim Jaeyoon, a researcher at the Korea IR Association, explained, "The notching process directly affects the yield of the entire secondary battery process," adding, "Laser notching is in the early stage of mass production application, so there are not many competitors." He further noted, "Considering the material differences between cathodes and anodes, cathodes are more difficult to apply in mass production because the aluminum foil used in cathodes has a higher reflectivity than the copper foil used in anodes."

To supply laser notching equipment, manufacturers must pass performance and operational evaluations by secondary battery makers. It takes about three years to obtain major certifications and meet quality conditions. Until new companies enter the market, DENT is likely to see increased orders. Secondary battery companies are actively considering adopting laser notching equipment to manage yield. DENT exclusively supplies pouch-type cathode laser notching equipment to LG Energy Solution, which is planning large-scale expansion in the North American region.

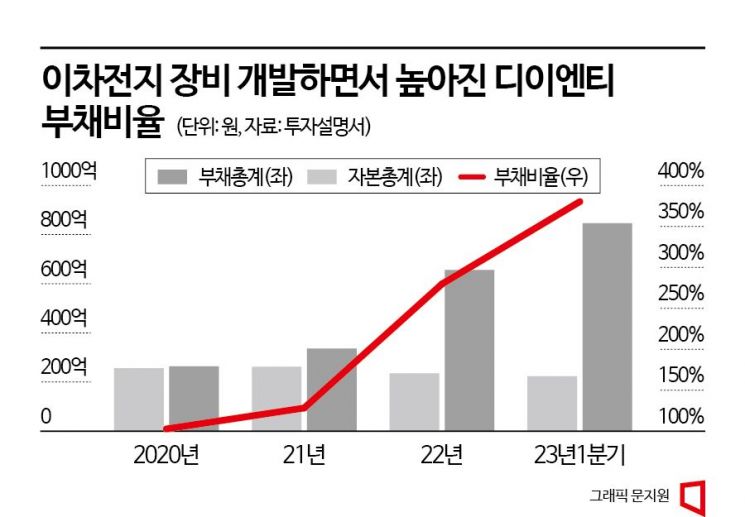

Although the business growth potential is significant, DENT's financial condition is poor. On a consolidated basis, total liabilities increased from about 26.4 billion KRW in 2020 to approximately 84.6 billion KRW in the first quarter of this year. Due to prolonged net losses, total equity decreased from 25.6 billion KRW to about 22.3 billion KRW during the same period. The consolidated debt ratio rose by 277.4 percentage points from 102.8% at the end of 2020 to 380.2% at the end of the first quarter this year.

The scale of short- and long-term borrowings increased from 19.2 billion KRW to 40 billion KRW. This was due to borrowing to cover facility funds for developing secondary battery laser notching equipment and securing production plants. As borrowings increased and interest rates rose, interest expenses grew. Interest payments amounted to 1.16 billion KRW last year and 540 million KRW in the first quarter of this year.

DENT plans to use 27.7 billion KRW of the funds raised through the capital increase to repay debt. By repaying about 70% of borrowings, it expects to improve its financial structure and reduce interest expenses.

Of the remaining funds, 76.8 billion KRW will be spent on raw material purchases. Due to a surge in orders from large-scale supply contracts for cathode laser notching equipment with LG Energy Solution and others, substantial working capital is required. Separately from raw material purchase costs, 14.3 billion KRW is allocated for research and development. Various research projects are underway to develop high-performance notching equipment.

An investment banking (IB) industry official said, "As the secondary battery manufacturing market grows, orders for laser notching equipment, a core device in the electrode process, are expected to maintain a solid trend," adding, "This could positively impact DENT's sales growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.