Bloomberg "The 3rd Largest Tech Company IPO in U.S. Stock Market History"

Bloomberg reported on the 2nd (local time) that the initial public offering (IPO) size of ARM, a UK-based subsidiary of Japan's SoftBank planning to list on the US stock market this September, is expected to reach 13 trillion won.

The report, citing sources, stated that ARM plans to raise $10 billion (approximately 13 trillion won) through this listing. If the IPO succeeds, ARM's corporate value is expected to reach $60 billion to $70 billion (approximately 77.8 trillion to 90.8 trillion won).

If the IPO proceeds as planned, ARM will become the third-largest technology company IPO in US stock market history, following Alibaba, which went public in 2014 with $25 billion, and Meta, which went public in 2012 with $16 billion, according to the report.

The investor roadshow will begin in the first week of next month. The final public offering price is expected to be confirmed around the second week of next month, when the roadshow for institutional investors concludes.

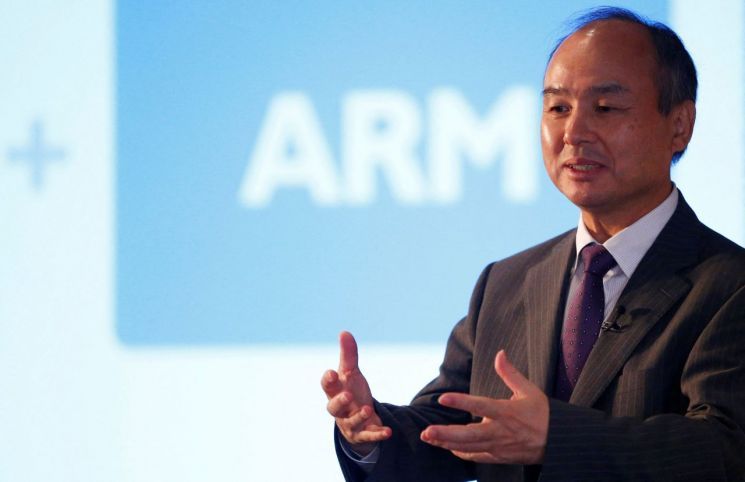

The ARM listing process is being led by SoftBank Chairman Masayoshi Son. It is reported that Chairman Son is personally involved in attracting Nvidia as an anchor investor to promote ARM's listing success by leveraging artificial intelligence (AI), the hottest theme on the New York Stock Exchange this year.

Nvidia, listed on the US Nasdaq market, has seen its stock price surge more than 218% (as of the closing price on the 1st) this year alone, fueled by the AI boom, increasing its market capitalization to nearly $1.15 trillion, becoming the first semiconductor company to surpass a $1 trillion market cap.

Headquartered in Cambridge, UK, ARM holds core technologies in semiconductor design that serve as the "brain" of IT devices such as PC central processing units (CPUs) and smartphone application processors (APs). SoftBank acquired ARM in 2016 for $32 billion.

Originally, SoftBank planned to sell ARM to Nvidia for up to $40 billion in 2020, but the deal was canceled due to opposition from regulatory authorities in various countries. Instead of selling, SoftBank shifted its strategy to recover funds by listing ARM on the US stock market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.