9 Consecutive Quarters of Losses... Below Market Expectations

Fee Expenses and Subsidiary Performance Weigh Down

Profitability Since 1Q 2022 on Separate Basis

"Improved H2 Performance Driven by Securities and Non-Life Insurance Growth"

Kakao Pay has once again failed to return to profitability. Although sales and transaction volumes steadily increased, rising costs and poor performance of subsidiaries are believed to have held it back.

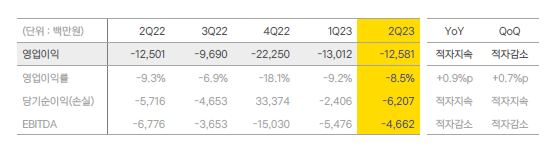

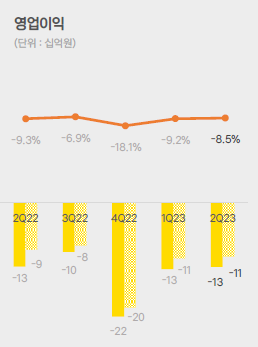

According to the Financial Supervisory Service's electronic disclosure system on the 2nd, Kakao Pay recorded consolidated sales of 148.9 billion KRW and an operating loss of 12.6 billion KRW in the second quarter of this year. Sales increased by 11.0% compared to the same period last year, but the deficit also grew by 0.6%. Net loss for the period was 6.2 billion KRW, up 8.6% during the same period. This marks Kakao Pay’s ninth consecutive quarter of consolidated losses.

The results also fell significantly short of market expectations (consensus). According to financial information provider FnGuide, Kakao Pay’s second-quarter earnings forecast was an operating loss of 8.2 billion KRW and net profit of 3.1 billion KRW. The actual operating loss was more than 50% larger than the consensus.

While transaction volume and sales steadily increased, rising costs and poor subsidiary performance are believed to have been the main obstacles. In fact, Kakao Pay has consistently posted profits on a separate basis since the first quarter of 2022. In the second quarter of this year, it recorded an operating profit of 10.1 billion KRW and net profit of 16.2 billion KRW on a separate basis. Transaction volume also showed an upward trend, reaching 34.2 trillion KRW in the second quarter, an 18% increase compared to the same period last year. Transaction volume contributing to sales also rose 19% during the same period, reaching 9.9 trillion KRW.

However, as sales grew, operating expenses also increased. Operating expenses in the second quarter were 161.4 billion KRW, up 10.1% year-on-year and 4.5% quarter-on-quarter. This is the reason for the widening deficit. Kakao Pay explained that the increase in fees paid to card companies and others related to simple payment services was the cause of the expanded losses. In the second quarter, Kakao Pay’s payment fees rose 19.2% year-on-year to 77.2 billion KRW, accounting for nearly half of total operating expenses.

Going forward, the performance of subsidiaries such as Kakao Pay Securities and Kakao Pay Insurance is expected to be key to improving Kakao Pay’s overall results. Kakao Pay stated, "If stock trading volume increases in the second half of the year and subsidiaries improve their performance through the launch of travel insurance and self-designed insurance products, results will improve. Through collaboration with financial subsidiaries, Kakao Pay will move one step closer to becoming a lifestyle financial platform for the entire nation."

Jung Ho-yoon, a researcher at Korea Investment & Securities, said, "Kakao Pay’s operating profit margin has remained around -10% since 2021 without improvement, because the financial business division’s sales have not grown significantly compared to 2021," adding, "From the second half of the year, as the mobile trading system (MTS) fees from Kakao Pay Securities contribute more to sales, profitability is expected to gradually improve."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.