Q2 Major Battery Companies Performance Analysis

Record High Earnings but Profit Margins Up to 10%

High Cost Ratio + Supply Price Constraints Impact

High Value-Added Like Semiconductors Difficult

Global Competition Intensifies

On June 27, 2023, automotive lithium-ion batteries were exhibited at the '2023 World Battery & Charging Infrastructure Expo - 2023 World Solar Energy Expo' held at KINTEX in Goyang, Gyeonggi Province. Photo by Jin-Hyung Kang aymsdream@

On June 27, 2023, automotive lithium-ion batteries were exhibited at the '2023 World Battery & Charging Infrastructure Expo - 2023 World Solar Energy Expo' held at KINTEX in Goyang, Gyeonggi Province. Photo by Jin-Hyung Kang aymsdream@

Despite high expectations for K-battery companies, the profitability of secondary battery companies remains capped at around 10%. Although sales and operating profits of secondary battery companies are soaring due to the expansion of the electric vehicle market, structural challenges make it difficult to improve profit margins, analysts say.

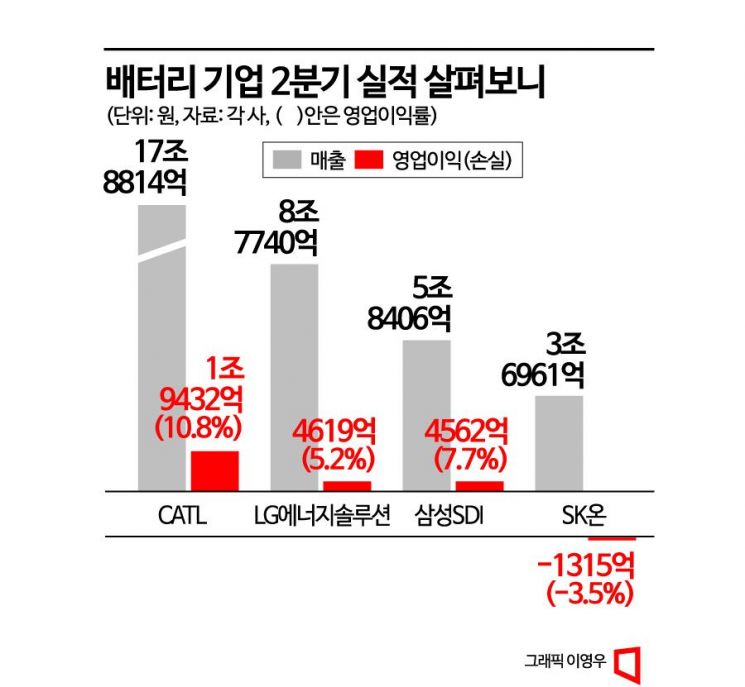

As the second-quarter earnings announcements of major global secondary battery companies concluded on the 1st, the company with the highest operating profit margin was CATL, the world's largest battery cell company. According to Bloomberg's data, CATL recorded revenue of 100.21 billion yuan (approximately 17.8814 trillion KRW) and operating profit of 10.89 billion yuan (approximately 1.9432 trillion KRW) in Q2. Compared to the same period last year, revenue increased by 56% and operating profit by 63%. The operating profit margin was 10.8%.

Bloomberg stated, "These results exceeded market consensus," attributing the performance to increased global electric vehicle sales and the stabilization of prices for key minerals such as lithium.

◆Battery Companies’ Operating Profit Margins Hardly Exceed 10%

Korean battery cell companies competing with China in the global market also recorded record-high sales last quarter. LG Energy Solution, Korea's top battery cell company, posted sales of 8.774 trillion KRW and an operating profit of 461.9 billion KRW in Q2. Sales increased by a remarkable 73% year-on-year due to increased sales in the North American market. Operating profit rose 135% year-on-year, but the operating profit margin remained at 5.2%. Excluding the effect of U.S. tax credits, the operating profit margin falls to 4.0%.

Samsung SDI recorded sales of 5.8406 trillion KRW in Q2, up 23.2% year-on-year, and operating profit of 450.2 billion KRW, a 4.9% increase. Its operating profit margin was the best among the three major domestic battery cell companies at 7.7%.

SK On posted sales of 3.6961 trillion KRW and an operating loss of 131.5 billion KRW in Q2. Sales increased by 186.9% year-on-year, marking a record high. The operating loss narrowed by 213.2 billion KRW. The company expects to turn profitable as early as the second half of this year.

Despite the rapid expansion of the secondary battery market, the general view is that battery cell companies at the forefront of the value chain will find it difficult to exceed operating profit margins in the low teens.

Hana Securities forecasts CATL’s annual operating profit margin to be 10.4% this year. The company’s operating profit margin was 9.6% last year and 13.8% the year before. Domestic battery cell companies are also unlikely to surpass CATL’s operating profit margin.

Within the secondary battery industry, many believe it will be difficult for electric vehicle batteries to establish themselves as a high value-added industry like semiconductors due to the business structure. This is because battery cells are supplied to automakers linked to the cost of key minerals.

A representative from a domestic battery cell company explained, "The high proportion of key minerals in costs and automakers diversifying battery cell suppliers to reduce risks make it structurally difficult to expect high profit margins in the long term."

Battery material companies such as EcoPro and POSCO Future M face similar situations. They are under dual pressure from costs and supply prices, making it difficult to generate high margins.

According to EcoPro’s consolidated financial statements released last month, its provisional Q2 sales were 2.013226 trillion KRW, with a provisional operating profit of 166.423 billion KRW. Sales increased by 63.4% year-on-year, but operating profit decreased by 2.1%. The operating profit margin was 8.2%. EcoPro will disclose detailed results on the 3rd.

In contrast, semiconductors, often compared to batteries, can show operating profit margins of 30-40% depending on market conditions. Taiwan’s TSMC, the world’s number one foundry (semiconductor contract manufacturer), recorded a 42% operating profit margin in Q2 despite a sluggish market.

◆Competition Intensifies

Although the global electric vehicle market is expanding, signs of growth slowdown are emerging in Europe and China, excluding North America. LG Energy Solution stated in its earnings announcement on the 27th of last month, "Some major customers in Europe with somewhat high inventory levels may adjust their product purchase timing to the fourth quarter," and "Q3 sales are expected to slightly decrease compared to Q2." Hana Securities analyst Sujin Han explained, "The Chinese electric vehicle battery market, which has sustained high growth for nearly three years, is expected to slow down from next year, even more so than the global market."

Major battery cell companies are fiercely competing to expand in the high-growth North American market. CATL is already focusing more on overseas markets than the domestic market. According to SNE Research, as of May this year, CATL held a 36% market share in the global battery cell market, up 2.2 percentage points from the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.