In the first half of this year, the semiconductor and electronics industries did not fully benefit from the anticipated China reopening (resumption of economic activities). As expectations for China's economic growth have diminished, Korean companies that relied on the recovery of the Chinese market now face the need to find breakthroughs by reducing their dependence on China.

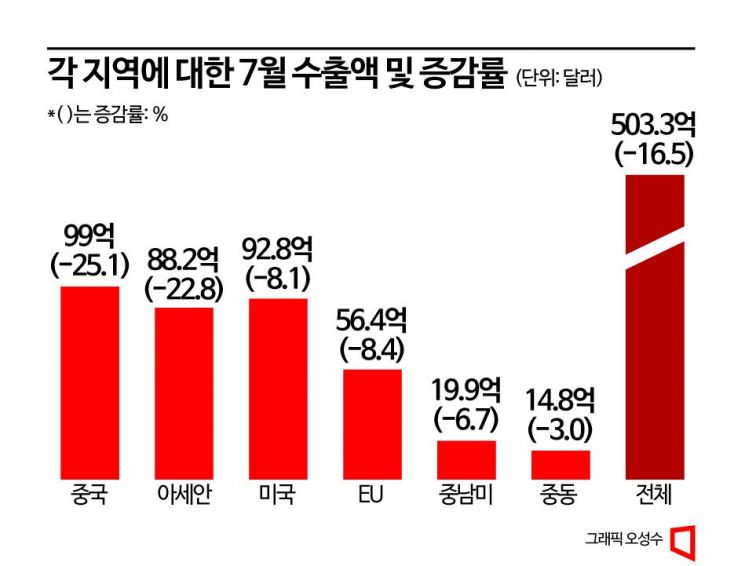

According to export statistics released by the Ministry of Trade, Industry and Energy on the 1st, South Korea's exports to China in the first half of this year (January to June) amounted to $60.2 billion, a 26% decrease compared to the same period last year, followed by a 25.1% drop to $9.9 billion in July. The decline in exports to China was more pronounced compared to other regions such as the United States (-8.1%), the EU (-8.4%), and the Middle East (-3%). The sluggishness in South Korea's exports to China was largely influenced by a decrease in semiconductor exports.

In July, South Korea's semiconductor exports totaled $7.44 billion, down $3.8 billion (33.6%) from the same period last year. Display exports also fell by 4.6% to $1.69 billion, while computers and communications dropped by 33.4% and 15.3%, respectively. This was due to weak IT demand in China. Song Myung-seop, an analyst at Hi Investment & Securities, commented on the weak IT demand in China, stating, "Chinese smartphone manufacturers increased memory semiconductor orders starting in March, but due to sluggish sales, smartphone customers' inventories appear to have increased again from the second quarter," adding, "A full recovery in actual demand is necessary for sustained growth in semiconductor orders."

In fact, the domestic semiconductor and electronics industries expressed disappointment over the expected China reopening effect in their first-half performance. SK Hynix, which reported losses for three consecutive quarters, stated during its second-quarter earnings conference call that "a large-scale promotion was conducted in the second quarter to increase memory semiconductor sales, but the demand improvement from the China reopening (for IT devices, etc.) was weak, resulting in little effect."

Warnings are growing that the China reopening effect should no longer be expected. China's manufacturing Purchasing Managers' Index (PMI) was 49.2 in April, 48.8 in May, 49.0 in June, and 49.3 in July, remaining below the baseline of 50 for four consecutive months, indicating an economic contraction. The Ministry of Economy and Finance recently pointed out in its 'July Economic Trends' report that "the China reopening effect is appearing much more limited than initially expected," highlighting the reality where expectations and concerns about constraints regarding the China reopening effect coexist. The Bank of Korea also noted in its report 'Characteristics and Implications of Our Exports' that exports of IT items, centered on semiconductors, are declining, explaining that the China reopening effect is weaker than anticipated.

Rather than benefiting from the China reopening effect, Korean companies now have to worry about the impact of various Chinese export restrictions. The Chinese Ministry of Commerce has started controlling exports of gallium and germanium, which are used in semiconductor and display manufacturing, from this month citing national security reasons. Accordingly, on the first day of the implementation of China's export control measures, the Ministry of Trade, Industry and Energy held an 'Industrial Supply Chain Inspection Meeting' to assess the supply and demand impact and prepare countermeasures. Although there are alternative sources to replace Chinese imports, the fact that China, the largest supplier of gallium and germanium, has imposed export controls means issues such as price increases and customs clearance difficulties may arise, prompting the public and private sectors to jointly seek new import sources.

Voices are also emerging that strategies for entering the Chinese market need to be restructured to reflect changing trends. KOTRA evaluated that, unlike the rapidly recovering service sector following the transition to normalcy after COVID-19 in China, manufacturing recovery has been relatively insufficient due to global tightening policies and sluggish domestic and external demand. Lee Ji-hyung, head of KOTRA's Economic and Trade Cooperation Headquarters, explained, "It is time to review from the ground up what changes the Chinese domestic market is undergoing and which trends are gaining attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.