Sharp Decline in Local Tax Revenue Due to Semiconductor Performance Drop

Accounts for 20-30% of City Finances... Tightening Unavoidable

The semiconductor downturn has dealt a direct blow to the finances of frontline local governments. As the performance of Samsung Electronics and SK Hynix deteriorates, the so-called southern Seoul metropolitan area semiconductor belt?comprising Suwon, Hwaseong, Icheon, and Pyeongtaek?where these companies contribute 30% of the annual tax revenue, is moving toward fiscal tightening. In particular, the decrease in tax revenue is feared to lead to a contraction in investment in social overhead capital (SOC) such as roads and railways.

Samsung and Hynix Performance Shock Spreads to Local Governments

"After COVID-19 ended, the semiconductor shock has arrived." This is a lament from a tax department official in a local government in the Seoul metropolitan area where Samsung Electronics' semiconductor factories are located.

So, how much has the semiconductor shock affected the finances of frontline local governments? Let's look at Suwon City, where Samsung Electronics' headquarters is located. Samsung Electronics pays two types of taxes to Suwon: corporate local income tax and property tax. Property tax, levied on real estate, fluctuates with official property prices but not significantly. The biggest hit from the performance downturn is on income tax.

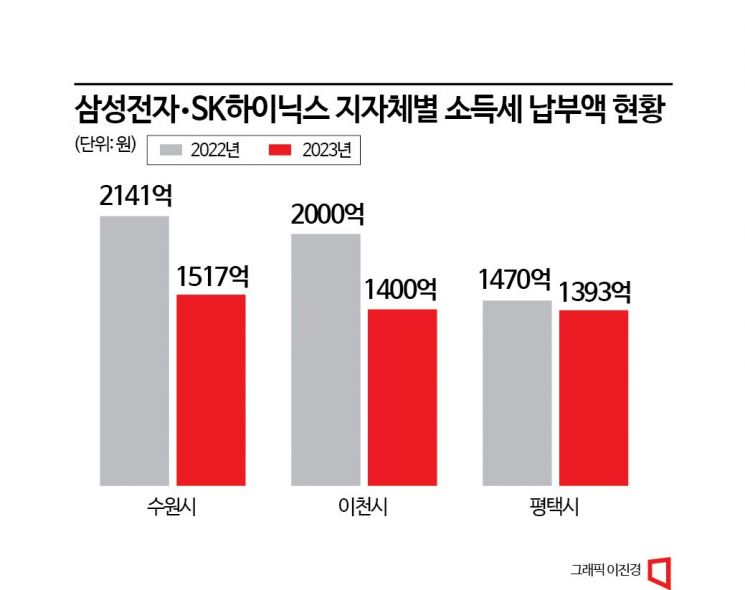

Samsung Electronics paid 214.1 billion KRW in income tax to Suwon last year. This amount shrank to 151.7 billion KRW this year, a 29.1% decrease. According to a Suwon city official, the situation was somewhat manageable until the first half of last year because the semiconductor market was still good then.

The problem is next year. A Suwon city official predicted, "If the current trend continues, we should expect almost no income tax from Samsung Electronics next year." Samsung Electronics accounts for about 27% of Suwon's total tax revenue.

Icheon City, where SK Hynix's headquarters is located, is also on high alert. Although not exact, last year Icheon collected about 200 billion KRW in income tax from SK Hynix. This year, the amount has plunged to around 140 billion KRW. Icheon also fears that SK Hynix will pay almost no income tax next year. SK Hynix accounts for about 25-30% of Icheon's tax revenue.

Pyeongtaek and Hwaseong, home to Samsung Electronics campuses, are experiencing similar hardships. Pyeongtaek's Samsung Electronics income tax dropped from 147 billion KRW last year to 139.3 billion KRW this year, and it is feared to plummet further to around 50-60 billion KRW next year. Hwaseong has not disclosed specific figures but also expects a decline in tax revenue due to Samsung Electronics' worsening performance.

How Bad Are Samsung and Hynix's Performances?

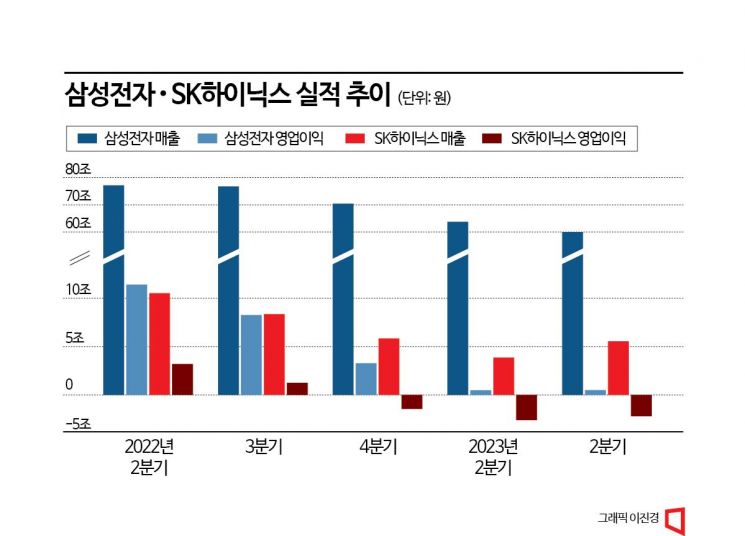

Samsung Electronics, which recorded sales of around 77 trillion KRW and operating profit of around 14 trillion KRW in the first and second quarters of last year, began to show a sharp downward trend starting from the third quarter. Sales were 76.7817 trillion KRW, down about 0.5% from the previous quarter, but operating profit barely stayed above 10 trillion KRW at 10.852 trillion KRW.

In the fourth quarter, conditions worsened sharply with sales of 70.4646 trillion KRW and operating profit of 4.3061 trillion KRW. This year, even sales in the 60 trillion KRW range are under threat. Operating profits for the first and second quarters were 640.2 billion KRW and 668.5 billion KRW, respectively, down 95% year-on-year.

SK Hynix's performance shock is even more severe. In the second quarter of last year, sales were 13.811 trillion KRW and operating profit was 4.1972 trillion KRW, but in the third quarter, sales dropped to 10.9826 trillion KRW and operating profit to 1.6556 trillion KRW. Moreover, in the fourth quarter of last year, SK Hynix recorded an operating loss of 1.8984 trillion KRW, which expanded to a loss of 3.4203 trillion KRW in the first quarter of this year. The second quarter saw a slight reduction in losses to 2.8821 trillion KRW (provisional), which is somewhat consoling.

Local Governments Squeeze Dry Towels but Fear Direct Hit to SOC

The worsening performance of these two companies, which account for 20-30% of total local government tax revenue, has put next year's budgets for each local government at a standstill.

Although specific budget plans have not yet been prepared, budget departments in local governments feel they will have to draft budgets as if squeezing dry towels. A Pyeongtaek City planning and budget official said, "We are preparing countermeasures such as reducing fixed expenses due to decreased tax revenue, but it is not an easy problem."

As tax revenue decreases, local governments have no choice but to reduce expenditures. This effectively signals a high-intensity fiscal tightening across local government finances.

In particular, SOC investment is feared to take a direct hit from the tax revenue decline. Even if tax revenue decreases, it is difficult to hastily cut cash expenditures such as welfare, which are directly related to residents' lives. Therefore, reducing SOC budgets for roads, railways, and other projects that require multi-year funding is the most realistic alternative, according to frontline local governments.

A local government planning and budget official said, "For ongoing projects such as roads and railways, we will have to allocate only the minimum budget necessary for construction maintenance." This means delays in project schedules, postponement of groundbreaking, or downsizing of SOC projects are inevitable.

However, there is no sharp solution. Ultimately, the situation depends on a rapid recovery of the semiconductor market.

An Icheon city official said, "At one time, during the semiconductor boom, income tax revenue from Hynix alone reached 400 billion KRW," adding, "Local governments are realizing that for them to survive, the companies must survive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.