The stagnant real estate market appears to be showing signs of recovery, particularly in some areas such as Seoul, but supply indicators in the housing market have yet to improve. The number of housing starts in the first half of this year (January to June) has been cut in half compared to the same period last year, and the number of permits issued has also decreased by more than 27%. As a result, the construction and housing industries are forecasting a supply shortage in 2 to 3 years and are concerned about a sharp rise in housing prices due to the lack of supply.

Housing Starts Halved and Permits Down 27% in the First Half

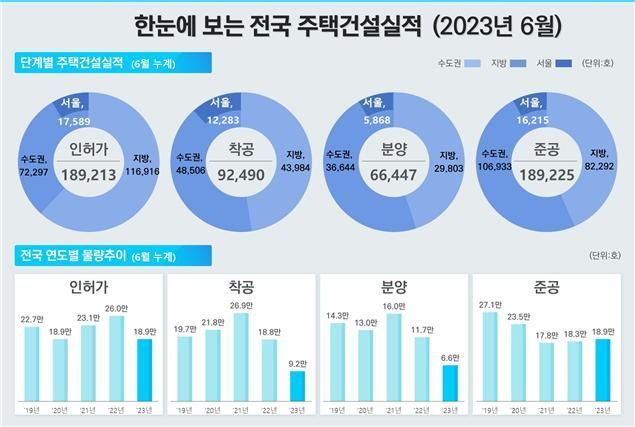

According to data released by the Ministry of Land, Infrastructure and Transport on the 31st, nationwide housing starts this year totaled 92,490 units, a dramatic 50.9% decrease compared to 188,449 units in the same period last year. Nationwide, apartments accounted for 69,361 units and non-apartment housing for 23,129 units, down 50.4% and 52.5% respectively from the previous year.

The number of housing permits issued in the first half was 189,213 units, down 27.2% from 259,759 units in the same period last year. By region, the Seoul metropolitan area recorded 72,297 units, down 24.8% year-on-year, while other regions saw 116,916 units, down 28.5% year-on-year.

Considering that apartment move-ins typically occur 3 to 5 years after permits are issued and 2 to 3 years after construction starts, the sharp decline in permits and housing starts is likely to directly lead to a shortage of housing supply in the future. Real estate big data company Asil estimates that the number of move-ins in 2025 will be 190,353 units, a 46% decrease compared to 2024, followed by 43,594 units in 2026 and 4,770 units in 2027, indicating a severe supply drought.

The increase in the number of demolished houses is also a factor that raises concerns about housing supply shortages. Demolished houses refer to existing homes that have disappeared due to reasons such as demolition. An increase in demolished houses means a reduction in the total number of houses.

The number of demolished houses reached 146,396 units in 2021, more than double the 4.2% increase in 2020, and is expected to continue rising. According to the 2022 Population and Housing Census by Statistics Korea, the number of aging houses over 30 years old in the Seoul metropolitan area surged from 317,000 units in 2010 to 1,248,000 units in 2020, and further increased to 14,818,000 units in 2021.

Supply and Demand Imbalance Raises Concerns Over Future Housing Price Surge

Meanwhile, the housing order amount for private construction companies is decreasing. According to the Korea Construction Association, construction orders recorded 20.5652 trillion won in January, then sharply dropped for four consecutive months to 13.4494 trillion won in February, 13.5427 trillion won in March, and 10.9126 trillion won in April. The total cumulative construction order amount was 58.4699 trillion won, a 44% decrease compared to the same period last year.

The shortage of housing supply is also predicted to trigger a sharp rise in real estate prices in the future. In fact, during the global financial crisis in 2012-2013, the real estate market fell into a slump, and as supply became insufficient, housing prices rose 1 to 2 years later.

According to Real Estate R114 data, a total of 187,342 apartment units were occupied nationwide in 2012, the lowest since records began in 1990. In 2013, 199,490 units were occupied. This was about 40% less than the average annual occupancy of 319,923 units from 2002 to 2011.

Supply began to recover in 2014 with 274,921 units, but housing prices also started to rise. After falling by 4.77% in 2012 and 0.29% in 2013, housing prices surged by 3.48% in 2014 and 6.88% in 2015.

Kwon Il, head of the research team at Real Estate Info, said, "As the real estate market contracted, the number of permits and housing starts decreased, and considering that construction usually takes 2 to 3 years, a supply shortage could occur around 3 years from now. Ultimately, due to the imbalance between supply and demand, housing prices could rise higher than they are currently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.