To Resolve 'Loss with Every Sale' Reverse Margin,

Market Banks Raise Mortgage Loan Rates, Reducing Pressure to Cut

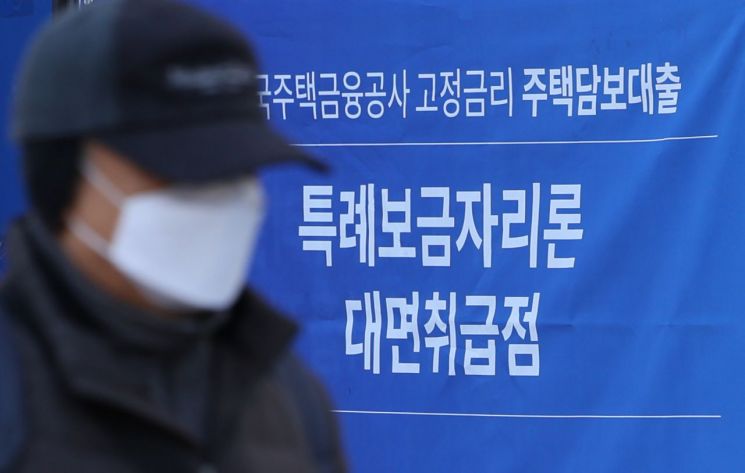

The fixed-rate policy mortgage product of Korea Housing Finance Corporation (KHFC), the Special Bogeumjari Loan, will see an interest rate increase for the first time in six months. This measure is to resolve the negative spread caused by rising funding costs. It is also interpreted that the reduced pressure to lower rates, due to the upward trend in mortgage loan rates at commercial banks, influenced this decision.

According to KHFC on the 30th, starting from the 11th of next month, the interest rate for the Special Bogeumjari Loan General Type (for housing prices exceeding 600 million KRW or income exceeding 100 million KRW) will increase by 0.25 percentage points. The existing rates of 4.15% (10-year maturity) to 4.45% (50-year maturity) per annum will rise to 4.40% (10-year) to 4.70% (50-year). However, to support vulnerable groups and ease interest burdens, the preferential type rate (for housing prices up to 600 million KRW and income up to 100 million KRW) will remain unchanged.

This is the first time KHFC has raised the Special Bogeumjari Loan General Type rate since its launch at the end of January. KHFC initially set the Special Bogeumjari Loan rate 0.5 percentage points lower than planned and had kept it frozen until this month.

The reason for the rate hike is the increase in funding costs, which has deepened the negative spread for KHFC as the supplier. KHFC raises funds for the Special Bogeumjari Loan by issuing Mortgage-Backed Securities (MBS), and the MBS issuance rate rose from 3.925% per annum on February 10 to 4.428% on the 25th of this month, an increase of 0.503 percentage points. Earlier last month, it even surged to 4.653%. As the MBS issuance rate rises, the interest expenses KHFC must bear increase. Moreover, since the issuance rate is higher than the Special Bogeumjari Loan rate, selling more loans results in losses.

The surge in applicants over the five months since launch was also considered. As of the 30th of last month, loans amounting to 28.2 trillion KRW (effective applications), which is 71.2% of the supply target, were disbursed. A KHFC official explained the background of the rate hike as “an unavoidable decision considering the rising funding costs during the six months of rate freeze and the higher-than-planned effective application amount.”

It also appears that the recent upward trend in mortgage loan rates at commercial banks has freed KHFC from pressure to lower rates. Earlier this year, as mortgage loan rates at commercial banks continued to decline, there were criticisms that the Special Bogeumjari Loan rates had lost their appeal. As of the 28th of this month, the variable mortgage loan rates at Korea’s five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?are between 4.33% and 6.93% per annum, rising more than 0.3 percentage points compared to May.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.