Foreigners' Net Buying Volume Halved Compared to Last Month

Brokerages Raise Target Prices One After Another... Earnings Expected to Improve from Q1 Low

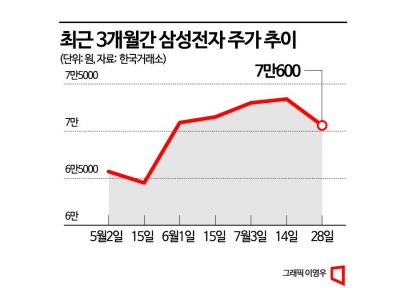

Samsung Electronics' stock price is showing a sluggish trend. Despite announcing an additional production cut, the stock price has failed to gain upward momentum and is fluctuating around the 70,000 won mark. However, contrary to this movement, the securities industry has been raising target prices one after another, reflecting expectations of Samsung Electronics' performance improvement in the second half of the year.

According to the Korea Exchange, Samsung Electronics' stock price fell 2.22% from the beginning of this month through the 28th. It rose 2.72% on the 27th following the announcement of second-quarter earnings and additional production cut plans, but dropped 1.53% on the 28th, failing to maintain the upward trend.

The main reason Samsung Electronics' stock price is showing a frustrating pattern appears to be supply and demand. The foreign buying spree focused on Samsung Electronics last month weakened this month. Foreign investors net purchased 833.2 billion won worth of Samsung Electronics shares this month, compared to 1.6725 trillion won last month, roughly half the previous month's level.

Looking at the top stocks by foreign net purchases this month, the order is EcoPro (1.144 trillion won), EcoPro BM (1.1033 trillion won), Samsung Electronics (833.2 billion won), SK Hynix (643.7 billion won), and Samsung Heavy Industries (189.9 billion won). While Samsung Electronics was overwhelmingly the most purchased last month, this month EcoPro and EcoPro BM were bought more than Samsung Electronics.

There is also an analysis that being the leading stock of the Korean stock market has become a hindrance. Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "On the 28th, semiconductor stocks rose centered on SK Hynix, spreading warmth even to small and mid-cap stocks, but Samsung Electronics declined," adding, "This contrasting trend is because Samsung Electronics serves as a benchmark for the domestic stock market. While investors are betting on a semiconductor industry recovery, they are likely using Samsung Electronics as a means to avoid systematic risks such as domestic monetary policy and slow manufacturing recovery."

The securities industry's outlook on Samsung Electronics is positive. After the confirmed second-quarter earnings announcement, securities firms have successively raised their target prices for Samsung Electronics. Hana Securities raised the target price from 78,000 won to 95,000 won, Kyobo Securities from 85,000 won to 95,000 won, Hanwha Investment & Securities from 82,000 won to 94,000 won, and Meritz Securities from 87,000 won to 94,000 won.

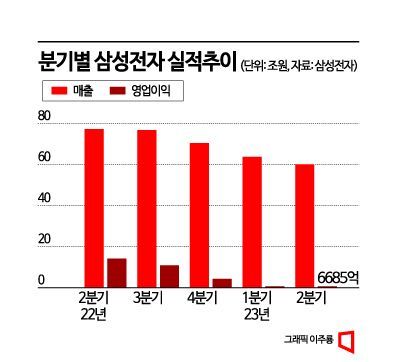

Kim Rok-ho, a researcher at Hana Securities, said, "The DRAM market is passing through the bottom, and Samsung Electronics' quarterly earnings have entered an improvement trend since the first quarter of this year," adding, "The short and intense downcycle is expected to stabilize early due to production cuts by suppliers." He continued, "Since Samsung has continued next-generation investments compared to competitors, it has created an environment where earnings can be maximized after entering the upcycle," and added, "The price-to-book ratio (PBR) of 1.34 times based on 2024 is an attractive range considering it is the early stage of the market turnaround."

There is also an opinion that attention should be paid to competitiveness in the artificial intelligence (AI) server market. Kim Kwang-jin, a researcher at Hanwha Investment & Securities, said, "In the mid to long term, competitiveness in the AI server market will be highlighted," and predicted, "Samsung Electronics' strength lies in being the only company that can supply everything from high-bandwidth memory (HBM), a core component of AI accelerators, to 2.5D heterogeneous chip packaging (foundry)." He added, "It is necessary to focus on the direction of the market bottoming out due to improved memory supply and demand conditions and the competitiveness Samsung will have in the AI server market.".

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.