Recently, the market capitalization of POSCO Group listed companies, which had been on the rise riding the 'secondary battery boom,' evaporated by more than 13 trillion won in just one day. Due to the extreme volatility caused by rapid capital inflows, there are concerns that caution is needed when investing.

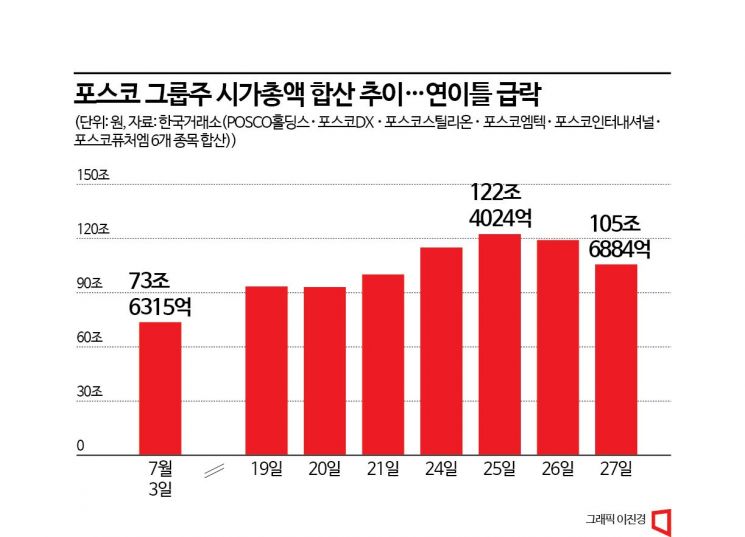

According to the Korea Exchange on the 28th, the total market capitalization of six POSCO Group listed companies (POSCO Holdings, POSCO International, POSCO Steelion, POSCO Future M, POSCO DX, POSCO M-Tech) was recorded at 105.6884 trillion won based on the previous day's closing prices. Compared to 119.1204 trillion won on the 26th, this represents a decrease of 13.432 trillion won in just one day. Compared to the all-time high of 122.4024 trillion won recorded on the 25th for these six stocks, nearly 17 trillion won flowed out over two days.

The combined market capitalization of these six stocks was in the 40 trillion won range at the beginning of the year and remained in the low 70 trillion won range as recently as early this month. However, mid-month, stock prices surged sharply, nearly doubling the market cap within half a month. This was after POSCO Group, traditionally a representative domestic steel company, announced plans to expand its business base into secondary battery materials and eco-friendly infrastructure. Following the so-called 'Ecopro brothers,' who were hot topics in the stock market in the first half of the year, POSCO Group was also identified as the next leader driving the secondary battery boom.

However, the short-term overheating of stock prices did not last long and is now undergoing correction. On the previous day, POSCO International’s stock price dropped by 21.7% in one day, while POSCO DX (-19.9%), POSCO Steelion (-17.4%), POSCO M-Tech (-16.4%), and POSCO Future M (-13.2%) all suffered double-digit declines. The holding company POSCO Holdings also saw its stock price soar to 764,000 won during trading on the 26th but closed at 594,000 won on the previous day, down about 22.3% from the peak.

The domestic stock market is already experiencing significant fatigue from excessive supply and demand concentration in the secondary battery sector, including Ecopro. Moreover, there are warnings to be cautious about stocks with rapid investment overheating that show volatility in the trillions of won range within a short period, regardless of quantitative indicators such as corporate earnings. Additionally, since secondary battery-related stocks have already risen substantially, there is analysis that full-scale profit-taking is underway.

Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "While secondary battery-related stocks fell sharply for two consecutive days, rebounds in pharmaceuticals and bio sectors stood out, and the semiconductor sector’s market leadership strengthened." He added, "As individual investors realize profits in secondary battery stocks, the supply-demand distortion is easing, and the stock market is expected to find balance in terms of supply-demand and price." He further stated, "With earnings becoming a major variable, expectations for turnaround industries are higher, and it is judged that the stock market’s center of gravity is shifting toward semiconductors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.