Bank Interest Income Steady

Trading Gains on Securities and Others Increase by 900 Billion Won

Non-Bank Affiliates Such as Securities, Cards, and Capital Show Weak Performance

Hana Financial Group posted a net profit exceeding 900 billion KRW in the second quarter of this year. This is attributed to an increase in trading performance of securities and derivatives, as well as asset growth centered on high-quality corporate loans, which led to a rise in non-interest income.

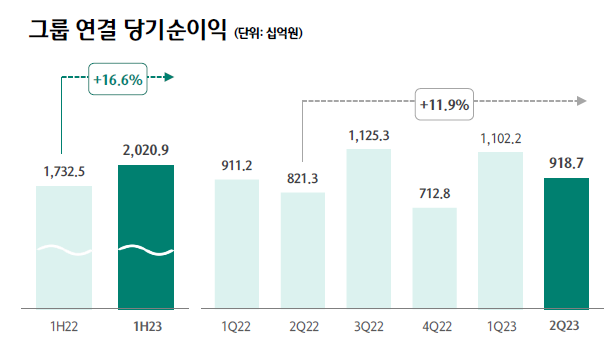

Hana Financial Group announced on the 27th that it recorded a net profit of 935.8 billion KRW in the second quarter of this year, a 10.9% increase compared to the same period last year. The net profit attributable to controlling shareholders was 918.7 billion KRW, up 11.9% year-on-year. As a result, the cumulative net profit for the second quarter reached 2.0209 trillion KRW, a 16.6% increase compared to the same period last year.

Hana Financial explained that despite increased risks due to domestic and international economic slowdown and financial market instability, factors such as ▲ increased trading gains from securities and derivatives trading ▲ healthy asset growth centered on high-quality corporate loans ▲ stable cost management were effective.

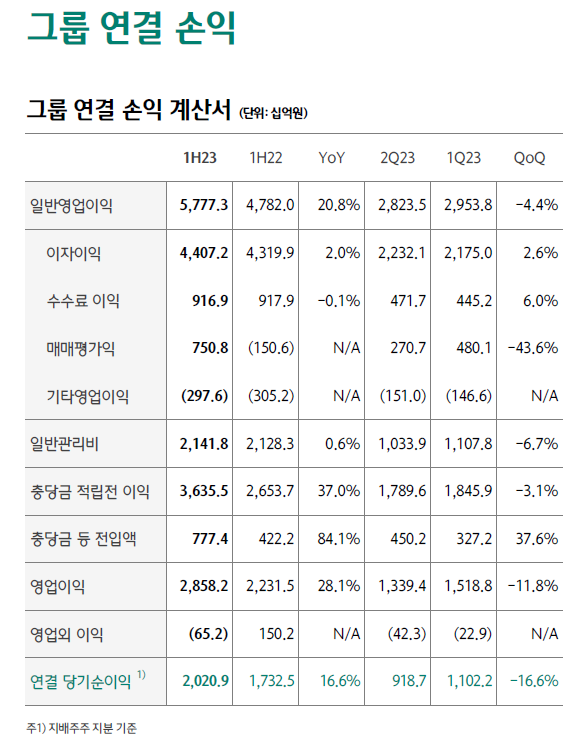

The group also significantly increased provisions to prepare for crisis situations. It added 310.4 billion KRW in the first half alone, accumulating a total of 777.4 billion KRW in provisions, an 84.1% increase compared to the same period last year.

Non-interest income was record-breaking. It reached 1.3701 trillion KRW in the first half, a 196.5% increase compared to 686.4 billion KRW in the same period last year. This is the highest half-year performance since the establishment of the holding company. Fee income was 916.9 billion KRW, a slight decrease of 0.1% year-on-year, but trading gains surged to 750.8 billion KRW. In the first half of last year, there was a valuation loss of 150.6 billion KRW. The net increase amounted to 901.4 billion KRW.

Interest income in the first half was 4.4072 trillion KRW, a 2.0% increase compared to the same period last year. Combined with fee income, the core income for the first half was 5.3241 trillion KRW, up 1.7% year-on-year. The net interest margin (NIM) for the second quarter was 1.84%, up 4 basis points (bp, 1bp=0.01%) compared to the same period last year. However, it fell 4bp compared to the previous quarter.

The group's core income for the first half, combining interest income (4.4072 trillion KRW) and fee income (916.9 billion KRW), recorded 5.3241 trillion KRW, a 1.7% (86.3 billion KRW) increase year-on-year, maintaining steady growth. The group's second-quarter net interest margin (NIM) was 1.84%, down 4bp from the previous quarter.

Operating profit before provisions for the first half was 3.6355 trillion KRW, a 37% increase compared to the same period last year. The operating expense ratio improved by 7.4 percentage points year-on-year, reaching 37.1%, the lowest level since the establishment of the holding company.

As of the end of the second quarter, the group's total assets, including trust assets of 171.2916 trillion KRW, amounted to 764.9009 trillion KRW. Return on equity (ROE) was 10.87%, and return on assets (ROA) was 0.71%.

The NPL coverage ratio was 167.4%, and the ratio of non-performing loans was 0.45%. As of the end of the second quarter, the estimated Basel III (BIS) capital adequacy ratio and common equity tier 1 ratio were 15.22% and 12.80%, respectively.

By major affiliates, Hana Bank's consolidated net profit for the second quarter was 868.3 billion KRW, a 9.0% increase year-on-year. However, it decreased by 10.6% compared to the previous quarter. For the first half, the total was 1.839 trillion KRW, up 33.9% year-on-year, attributed to a 338.6% (443.1 billion KRW) surge in non-interest income.

Interest income for the first half was 3.9732 trillion KRW, an 8.7% increase year-on-year. The NPL coverage ratio was 243.8%, the ratio of non-performing loans was 0.21%, and the delinquency rate was 0.26%. As of the end of the second quarter, the bank's total assets, including trust assets of 89.8289 trillion KRW, amounted to 589.983 trillion KRW.

In the case of Hana Securities, net profit for the first half sharply declined by 75.1% year-on-year to 34.6 billion KRW, attributed to increased provisions due to market deterioration. Hana Capital and Hana Card posted net profits of 121.1 billion KRW and 72.6 billion KRW, respectively, down 25.8% and 33.8% compared to the first half of last year. Hana Asset Trust also recorded a net profit of 47.1 billion KRW, down 6.0% year-on-year.

Meanwhile, the Hana Financial Group board resolved to continue the tradition of interim dividends for 17 years and implement an active shareholder return policy by paying a quarterly cash dividend of 600 KRW per share.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)