Announcement of Ministry of Economy and Finance Tax Reform Plan on the 27th

Tax Credit Rate for Video Content Production Costs More Than Doubled

Economic Effect Over 2 Trillion Won, Support Measures Needed for 'Blind Spots'

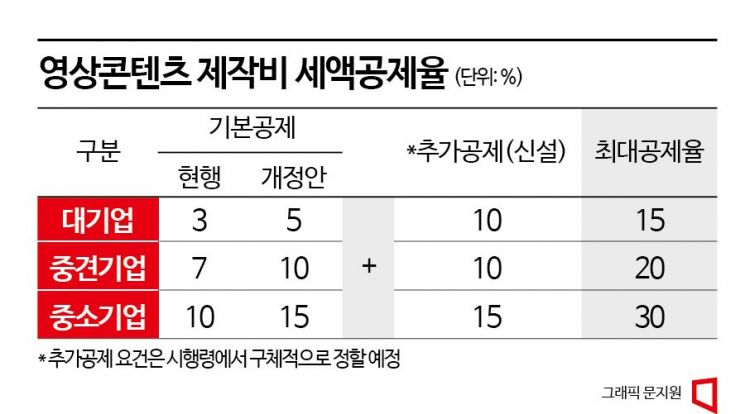

The tax reform plan announced by the Ministry of Economy and Finance on the 27th included an expansion of the production cost tax credit, a long-standing wish of the video industry. This is the first increase in the tax credit rate in six years since the related system was introduced in 2017. The tax credit rates, which were previously applied at 3%, 7%, and 10% for video content production costs by large corporations, medium-sized enterprises, and small businesses respectively, have been raised to 5%, 10%, and 15%.

A new "additional credit" that did not exist before has also been introduced. Video content with significant domestic industrial ripple effects will receive an additional credit of 10% (for large and medium-sized enterprises) to 15% (for small businesses). In the case of small businesses, applying the basic credit (15%) plus the additional credit (15%) can save up to 30% in taxes. This is similar to the credit rates for investments in national strategic technology facilities such as semiconductors and batteries (15% for large corporations, 20% for medium-sized enterprises, and 25% for small businesses). The criteria for the additional credit will be separately defined by enforcement ordinances. A new tax credit of 3% has also been established for production costs invested by medium-sized and small enterprises in cultural industry specialized companies.

Due to the tax reform, the tax on drama production costs will be reduced to about half of the previous level. Photo is a still cut from The Glory (Photo by Studio Dragon).

Due to the tax reform, the tax on drama production costs will be reduced to about half of the previous level. Photo is a still cut from The Glory (Photo by Studio Dragon).

Until now, domestic production companies have been said to compete with a "sandbag" compared to foreign countries where the credit scale is up to 40%. Moreover, the industry is currently in a difficult situation due to the reduction of programming by domestic OTT (over-the-top video streaming services) and terrestrial broadcasters. Wednesday-Thursday dramas have disappeared, and Wave and TVING, which are struggling with deficits, find it difficult to increase investment in production costs. This is why the reform is being evaluated as a "rain in a drought."

Economic Effect Exceeds 2 Trillion Won

What is the economic effect of the tax credit? According to an input-output analysis presented by Kim Yong-hee, a research fellow at Open Route, at a National Assembly forum last year, the economic ripple effect over four years due to the expansion of the tax credit was 2.617 trillion won. This analysis was based on credit rates of 7% for large corporations, 13% for medium-sized enterprises, and 18% for small businesses. The production inducement effect was 1.871 trillion won, the value-added inducement effect was 746 billion won, and the employment inducement effect was 9,922 jobs. Although there is a slight difference from the credit rates in the current reform plan, it can be estimated that the effect will be significant.

Governments around the world are supporting the content industry comprehensively. In the United States, the credit varies by state but can be up to 35%, and the United Kingdom provides a 25% tax credit. For example, the movie "Guardians of the Galaxy Vol. 3," produced in the UK, had a production cost of $250 million (approximately 320 billion won). Applying the 25% credit results in a credit amount of $62.5 million (80 billion won). This is equivalent to producing six films like "The Outlaws 3," which had a production cost of 13.5 billion won. In these countries, the credit benefits lead to a "virtuous cycle of investment" through reinvestment.

Remaining 'Sandbags'

The scale of the production cost tax credit was only 9.9 billion won in 2020, 17 billion won in 2021, and 29.7 billion won last year. The estimated production cost for domestic dramas and films was 2.5 trillion won last year. Across the industry, the credit rate is barely over 1%. Considering that the previous credit rates were 3% for large corporations, 7% for medium-sized enterprises, and 10% for small businesses, the actual credit benefits are extremely insufficient.

Many production companies fall into a "credit blind spot." There are many small or deficit-producing companies that cannot even pay corporate tax. According to the 2022 Video Industry White Paper published by the Korea Creative Content Agency, among 732 independent broadcasting and video production companies, 659 (90%) had sales of less than 10 billion won. Promotion is also lacking. According to a 2022 report by KDI (Korea Development Institute), 80% of 215 production companies were unaware of the system's existence. It is necessary to actively promote the system while also providing support measures for production companies that cannot receive credit benefits. In the UK, a system is operated that directly compensates losses in cash if losses occur. Other countries are also beginning to introduce systems that return part of the production costs in cash.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)