POSCO Holdings Ranks 4th, Surpassing Samsung Biologics, LG Chem, and Samsung SDI

EcoPro Brothers Rank 1st and 2nd in KOSDAQ Market Cap

This year, the market capitalization rankings of KOSPI-listed companies have been changing dynamically. Related stocks have defied the charts due to the 'secondary battery boom.' Battery material and manufacturing companies have pushed out finished car manufacturers to enter the top ranks, while the so-called 'Nakao (Naver and Kakao),' once synonymous with Korea's leading IT companies, have suffered the humiliation of falling outside the top 10.

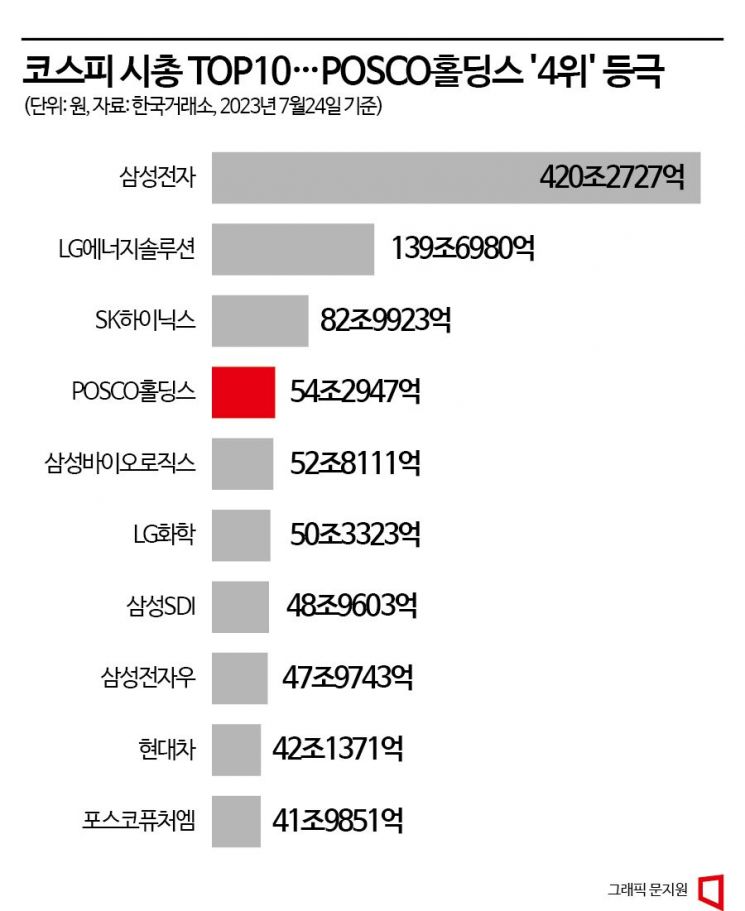

According to the Korea Exchange on the 25th, POSCO Holdings surpassed Samsung Biologics, LG Chem, and Samsung SDI to rank 4th in market capitalization on the KOSPI market (based on closing price on July 24). POSCO Holdings closed at 642,000 KRW, up 16.52% in a single day. Just a year ago, its market capitalization was about 20.4 trillion KRW (as of July 25, 2022), but it recorded approximately 54.3 trillion KRW the day before, more than doubling in just half a year. Its market cap ranking also surged from 15th to 4th.

POSCO Holdings is the holding company of POSCO, Korea's leading steel company. The recent stock price rise is driven not by steel but by the secondary battery materials business. POSCO Holdings has declared its management goal to achieve 62 trillion KRW in sales in the related sector by 2030 under the title of 'secondary battery materials specialist.' POSCO Holdings' stock price has surged 132.19% this year alone, and its affiliates such as POSCO Steelion (167.4%), POSCO International (192%), and POSCO Future M (201.1%) have also skyrocketed. POSCO Future M has secured a spot within the top 10 in market capitalization thanks to its rising stock price. POSCO Future M's market cap is 41.9851 trillion KRW, ranking 9th excluding preferred shares, closely trailing 8th-ranked Hyundai Motor (41.1371 trillion KRW).

Due to POSCO Holdings' rapid rise, all other listed companies except Samsung Electronics, LG Energy Solution, and SK Hynix have fallen in market cap rankings. Finished car manufacturers Hyundai Motor and Kia (33.5707 trillion KRW) barely remain within the top 10. The two major portal companies, Naver and Kakao, once called 'national stocks,' have been pushed out of the rankings entirely. As of the previous day, Naver ranked 11th (33.302 trillion KRW), and Kakao ranked 13th (22.1465 trillion KRW).

In the KOSDAQ market, secondary battery-related companies are also holding the top positions. The 'EcoPro brothers,' EcoPro BM (39.5606 trillion KRW) and EcoPro (30.9147 trillion KRW), are competing for first and second place. EcoPro BM has already surpassed Kia and Naver in market capitalization, ranking 10th in the combined KOSPI and KOSDAQ rankings.

However, there is advice to approach the recent capital concentration in domestic secondary battery companies with a more long-term perspective, as the background includes beneficiary factors from the US-China conflict. Jeong Yong-jin, a researcher at Shinhan Investment Corp., said, "Korea's secondary battery industry was previously fiercely competing with Chinese rivals, but after the US Inflation Reduction Act (IRA) policy, excluding China from key value chains allows for purely reflective benefits." He added, "However, it is hard to believe that the reflective benefits from deglobalization will last forever."

He further explained, "(The US government) is thoroughly fostering finished car manufacturing domestically while providing full support to the secondary battery industry, which requires supply chain alliances, but this is also a debt to be repaid in the future," adding, "The winner will be the company that secures the supply chain of the downstream industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.