Craft Beer Popularity Declines, Performance Worsens

Dependent on Convenience Store Channels, Losing Identity and Consumer Interest

Must Restore Originality and Character, Improve Beer Quality Again

Once filling convenience store shelves, craft beer is now being pushed out by Japanese beer and highballs, facing the risk of losing its place. Convenience stores played an effective role in introducing craft beer to the public and served as a highway for the industry's growth. However, this also led to dependency on sales channels, causing craft beer to lose its unique identity and ultimately resulting in a loss of competitiveness and a crisis. For craft beer at a crossroads to take flight once again, it seems necessary to draw a clear line from convenience store beers that have lost their identity and to slowly persuade consumers one by one with original and distinctive products.

Flat Craft Beer... Performance Plummets in One Year

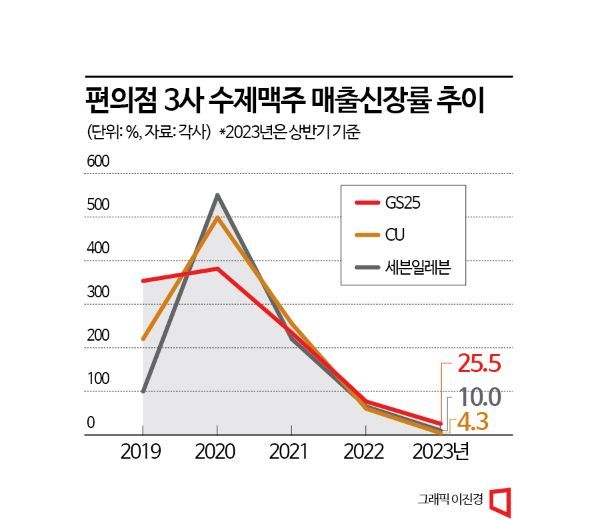

According to the convenience store industry on the 23rd, domestic craft beer sales this year have sharply declined compared to recent years. In the case of CU, craft beer sales in 2019 grew by 220.4% compared to the previous year, gaining momentum, and in 2020, the growth rate peaked at 498.4%. In 2021, high growth continued at 255.2%, but last year growth slowed to 60.1%, and this year, as of the first half, the growth rate plunged to just 4.3%.

The sluggishness of craft beer is even more pronounced compared to other types of alcoholic beverages. CU's craft beer sales growth rate of 4.3% in the first half ranks lowest not only among beverage categories but also within the beer category. Whiskey sales increased by 30.7% year-on-year in the first half, and traditional liquor also grew by 17.5%, showing strong performance. Meanwhile, beer sales only increased by 7.8%, and considering imported beer's high growth rate of 11.6%, the poor performance of craft beer appears to have negatively affected the overall beer sales results.

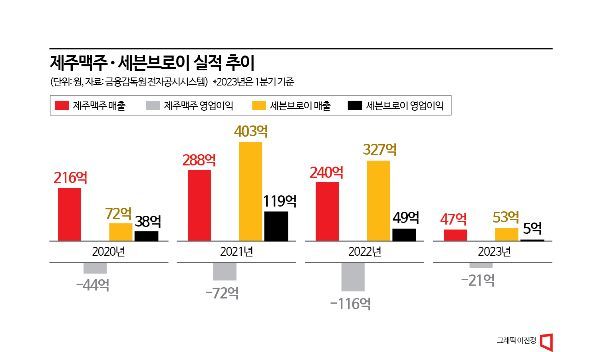

As craft beer's popularity wanes, the performance of leading companies in the industry is also poor. Jeju Beer, the first craft beer company to be listed on the KOSDAQ market in 2021, has seen its operating losses increase since listing. Jeju Beer's operating loss last year was 11.6 billion KRW, up 60.2% from 7.2 billion KRW in 2021, while sales dropped 16.9% to 24 billion KRW. This year is no different. First-quarter sales shrank 25.4% year-on-year to 4.7 billion KRW, and operating losses increased 39.3% to 2.1 billion KRW.

As performance worsens, the company recently undertook a rigorous workforce restructuring. On the 12th, Jeju Beer notified employees of a management reform plan including voluntary retirement procedures for 40% of all employees. The company plans to provide severance pay based on years of service to applicants and operate employment support programs, while the CEO has decided to forgo his entire salary. If Jeju Beer continues its poor performance, it could face delisting. The Korea Exchange applies delisting if a KOSDAQ-listed company posts losses for five consecutive years.

The situation at Sevenbrau is not much different. Sevenbrau's first-quarter sales dropped by half to 5.3 billion KRW compared to 10.1 billion KRW a year earlier, and operating profit fell 83.3% to 500 million KRW. After signing a trademark contract with Daehan Flour Mills in 2020, Sevenbrau launched 'Gompyo Wheat Beer,' selling over 58 million cans and leading the craft beer boom. However, the trademark contract expired in March, souring relations between the two companies. Sevenbrau filed complaints with the Fair Trade Commission and sought injunctions to ban sales, entering litigation, but with Gompyo Wheat Beer, which accounted for 90% of sales, gone, the damage seems inevitable.

Loss of Identity Due to Convenience Store Concentration... Need to Strengthen Standards and Improve Quality

The fundamental reason craft beer has fallen into its current crisis is the loss of its identity. Craft beer refers to beer produced in small-scale breweries operated with independent capital, using original and distinctive methods. Unlike pale or light lagers produced by large liquor companies, craft beer's identity lies in using basic ingredients such as malt, hops, and yeast, as well as various fruits and herbs, to create unique styles by each brewery. Consumers initially cheered for craft beer because of its spirit prioritizing diversity and originality, and the high-quality beer produced based on this.

However, everything changed during the COVID-19 pandemic. Craft beer, which was mainly consumed through specialized craft beer bars and pubs, had its industry roots shaken by business restrictions. With alcohol distribution effectively limited to home channels, breweries sought survival by opening sales channels in marts and convenience stores. Fortunately, this coincided with a boycott of Japanese beer, making it easier to fill the gap, and with the success of products like Gompyo Wheat Beer, it seemed to settle into new channels.

But now, a few years later, the convenience store channel, once thought to be a lifeline, has limited craft beer's growth and, above all, caused it to lose its identity. Due to the convenience store channel's marketing policy of '4 cans for 11,000 to 12,000 KRW,' the upper limit of supply prices was set, making it difficult to produce high-quality beers that could showcase each company's characteristics. Instead, only low-flavor 'collaboration beers' that could meet the supply price appeared in abundance. By abandoning strengths and focusing only on bland diversity, the distinction from mainstream beer blurred, and competitiveness against other alcoholic beverages was lost. Both convenience stores and consumers began to turn away, but some companies dependent on these sales channels, under the pretext of following trends, have shifted production from beer to highballs.

Ultimately, opinions suggest that craft beer needs to recover its identity to avoid collapse and achieve a rebound. Since craft beer's identity lies in diverse and rich tastes and aromas that differentiate it from mainstream beer, many voices call for focusing on producing high-quality beer. An industry insider said, "Low-quality craft beer dependent on convenience store channels cannot overcome the situation, so returning to basics and making high-quality beer is the top priority. Even if marketing is intensified or laws are changed to provide support without solid products, the effect on industry development will be limited."

There is also a movement to redefine craft beer. Beer manufacturers hold either small-scale manufacturing licenses or general manufacturing licenses depending on the scale of their production facilities. Generally, companies supplying mainly to home channels like convenience stores hold general licenses, while those with a high proportion of sales in entertainment channels hold small-scale licenses. It is suggested that the criteria for craft beer be more strictly defined by small-scale license holders to serve as a foundation for identity recovery. Discussions are underway at the Korea Craft Beer Association level, and there is a strong consensus within the industry on the need to reorganize craft beer standards.

Lee In-gi, chairman of the Korea Craft Beer Association, emphasized, "Early consumers of craft beer were attracted by quality that differentiated it from mainstream commercial beer, but as it became dependent on convenience store channels and started making and selling beer in the same way as commercial beer, its value declined." He also expressed intentions to strengthen solidarity among companies centered on the association. "We have organized technical, export, and promotion divisions within the association to support brewing technology and jointly explore export channels, working to restore the value of craft beer," he said. "Through various supports at the association level, we will strive to create a solid ecosystem where members help each other and coexist."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)