Citing Lack of Personal Pension Management and Investment Study

Also Regretting Not Planning and Preparing for Jobs After Retirement

Retirees aged 50 and above most regretted "not managing personal pensions and studying investments" before retirement.

Regarding assets outside of pensions, they most regretted not having accumulated sufficient investment experience in stocks, funds, and other areas in advance.

A job seeker is looking at the job information bulletin board at the Seobu Employment Welfare Plus Center in Mapo-gu, Seoul.

A job seeker is looking at the job information bulletin board at the Seobu Employment Welfare Plus Center in Mapo-gu, Seoul. [Photo by Yonhap News]

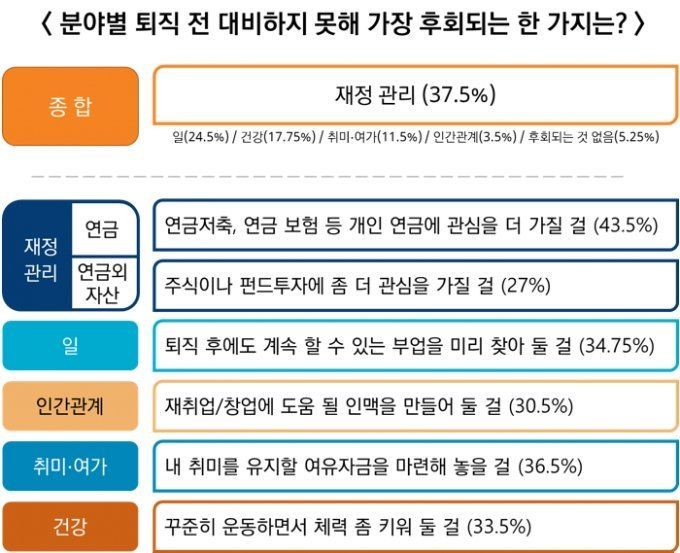

According to Mirae Asset Investment and Pension Center (hereinafter the Center), a survey was conducted from the 13th to the 15th of last month targeting 400 men and women aged 50 and above who had retired. They were asked, "What do you regret the most for not preparing in advance before retirement?" As a result, 37.5% of all respondents answered that they regretted insufficient preparation for financial management the most.

In a more detailed survey related to pensions and assets outside of pensions, the most common response, at 43.5% (174 people), was "not sufficiently managing personal pensions such as pension savings and pension insurance" among retirees.

They expressed regret over missing the opportunity to actively manage and grow their assets long-term through retirement asset investments. This is interpreted as recognizing investment as an essential means of asset growth and acknowledging the need for investment in asset management after retirement due to aging.

The Center added, "It seems that the perception has firmly taken root that relying solely on the National Pension is insufficient to maintain post-retirement life, and now individuals must prepare for their own retirement through personal pensions."

Following "financial management," retirees most regretted "planning and preparing for jobs after retirement," accounting for 24.5% (98 people). This was followed by "health management" at 17.75% (71 people), "hobby and leisure planning and preparation" at 11.5% (46 people), and "family and human relationship management" at 3.5% (14 people). Twenty-one respondents (5.25%) said they had no regrets.

Retirees regretted not having prepared jobs they could continue after retirement. When asked how they spent the income gap period and how to prepare for it, retirees responded that enduring the period without income through jobs was the most realistic method.

Regarding human relationships, financial factors had a greater impact than personal satisfaction or internal achievement. Specifically, in relation to human relationships, they regretted "not having sufficiently built networks that could help with reemployment or entrepreneurship." They also regretted not having set aside discretionary funds to enjoy leisure activities.

Finally, retirees most regretted not exercising regularly in relation to health.

Previously, after the introduction of the "60-year retirement age system," the age at which workers retire from their jobs has been advancing. According to the February report by the National Assembly Future Institute titled "Retirement Age System and Improvement Tasks," the age at which workers retire from their main jobs was 53 years in 2012 but advanced by 3.7 years to 49.3 years in 2022. However, the actual retirement age in the labor market was found to be 72.3 years as of 2022.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)