Plan to raise 30 billion won during capital increase resolution → 24.1 billion won raised

Last year's borrowings 462.7 billion won · average interest rate 4.93%

Among raised funds, 6.1 billion won used to repay high-interest loans

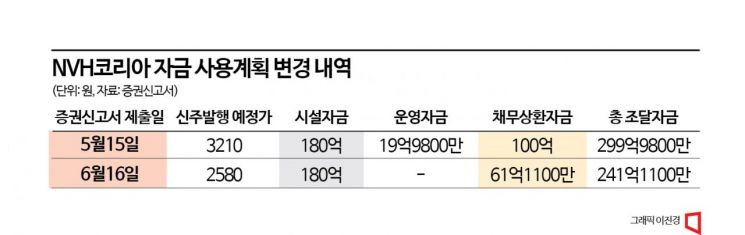

The issuance price of new shares by NVH Korea was lower than expected, causing disruptions to the debt repayment plan. NVH Korea intended to use the funds raised through the rights offering to purchase land for local production in the U.S. and to repay debt. Due to the reduced fundraising scale, the facility fund plan will be maintained, but the repayment amount will be reduced.

According to the Financial Supervisory Service's electronic disclosure system, NVH Korea will raise 24.1 billion KRW through a rights offering to shareholders. This is about 20% less than the initially planned 30 billion KRW when the board resolved the capital increase agenda. The new share issuance price dropped from 3,210 KRW to 2,580 KRW. Subscription for existing shareholders will proceed over two trading days until the 24th. If there are unsubscribed shares, they will be offered through a public offering. In case of final undersubscription, the lead manager BNK Investment & Securities will underwrite the unsubscribed shares.

As of the 20th, the closing price was 3,670 KRW, about 40% higher than the new share issuance price. Since the largest shareholder, CEO Gu Ja-gyeom, plans to subscribe to all allocated shares, the likelihood of unsubscribed shares appears low.

NVH Korea supplies automotive parts to the Hyundai Motor Group. It has secured orders for parts for new vehicles, including electric vehicles. Major customers such as Hyundai Motor and Kia account for a high proportion of sales. As of last year, 72.2% of automotive parts sales were generated from the Hyundai Motor Group. Besides automotive parts, the company also operates a cleanroom business.

Of the funds raised through the rights offering, 18 billion KRW will be invested in overseas local subsidiaries. 15 billion KRW will be invested in NVH USA to purchase land and factories in the U.S., and 3 billion KRW will be used for factory facility equipment funds for the Indian subsidiary. Previously, NVH Korea established the U.S. local subsidiary NVH USA in December last year for the battery parts business. NVH USA plans to invest 100 billion KRW in a production plant, combining 30 billion KRW in capital and 70 billion KRW in borrowings. This investment follows the domestic automakers’ decision to build electric vehicle production infrastructure locally in response to the U.S. government's implementation of the Inflation Reduction Act (IRA). Last year, NVH Korea recorded sales of 1.23 trillion KRW, a 15.1% increase from the previous year. Sales are expected to increase starting next year when deliveries through the U.S. plant begin.

The remaining 6.1 billion KRW of the raised funds will be used to repay part of the high-interest borrowings amounting to 30 billion KRW. This is related to the NVH Asset Securitization No. ABL long-term securitized loan, maturing on February 27, 2025. The interest rate is 8.3%, and partial repayment is planned to reduce interest expenses. When the board resolved the fundraising agenda, it was expected to repay 10 billion KRW, but the repayment amount was reduced due to the smaller capital increase scale.

NVH Korea’s consolidated borrowings have steadily increased from 354.6 billion KRW in 2020 to 397.2 billion KRW in 2021 and 462.7 billion KRW in 2022. As of the first quarter of this year, borrowings reached 511.8 billion KRW. Among these borrowings, short-term borrowings maturing within one year account for 66.71% of total borrowings. The average interest rate on borrowings rose by 1.2 percentage points from 3.73% last year to 4.93%. Interest expenses in the first quarter of this year were 6.3 billion KRW, a significant increase from 3.6 billion KRW in the same period last year. The interest coverage ratio, calculated by dividing operating profit by interest expenses, dropped from 3.08 times last year to 2.20 times in the first quarter of this year.

As of the first quarter of this year, the debt ratio and current ratio stand at 270.24% and 82.43%, respectively. The company explained that the current ratio is below 100%, indicating high liquidity risk, and that due to the nature of the automotive parts industry, which requires continuous facility investment, liquidity could deteriorate suddenly.

With many overseas subsidiaries, the company is affected by international conditions. The lead manager explained, "Among 33 subsidiaries, 12 are overseas subsidiaries," and "the borrowings of overseas subsidiaries amount to 161.4 billion KRW when converted to Korean won, posing foreign exchange translation loss risks related to the economic conditions and exchange rates of those countries."

Since the outbreak of the Russia-Ukraine war in February last year, the operating rate of the NVH RUS plant in Russia fell below 20%. Last year, impairment losses of 10.841 billion KRW were recognized related to production facilities in Russia. The prolonged Ukraine conflict continues to negatively impact the financial situation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)